The 16% return this week takes Keyrus' (EPA:ALKEY) shareholders three-year gains to 174%

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. To wit, the Keyrus S.A. (EPA:ALKEY) share price has flown 174% in the last three years. That sort of return is as solid as granite. Also pleasing for shareholders was the 22% gain in the last three months.

Since the stock has added €17m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Keyrus

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

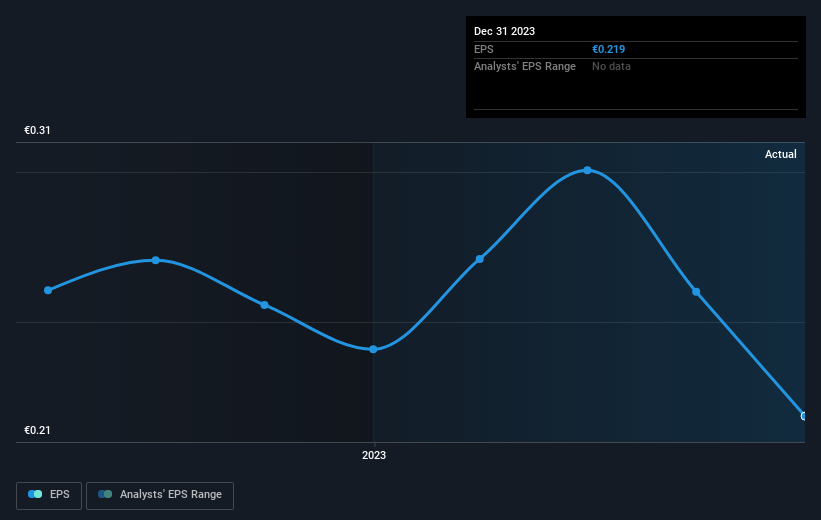

Keyrus became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Keyrus' earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Keyrus shareholders have received a total shareholder return of 86% over the last year. That's better than the annualised return of 12% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Keyrus better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Keyrus (of which 1 can't be ignored!) you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Keyrus might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALKEY

Keyrus

A consultancy company, engages in the development of data and digital solutions for performance management worldwide.

Low risk and overvalued.

Market Insights

Community Narratives