- France

- /

- Diversified Financial

- /

- ENXTPA:ALHYP

HiPay Group (EPA:ALHYP) pulls back 10% this week, but still delivers shareholders decent 22% CAGR over 3 years

Some HiPay Group SA (EPA:ALHYP) shareholders are probably rather concerned to see the share price fall 41% over the last three months. But don't let that distract from the very nice return generated over three years. To wit, the share price did better than an index fund, climbing 80% during that period.

In light of the stock dropping 10% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

View our latest analysis for HiPay Group

HiPay Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

HiPay Group's revenue trended up 22% each year over three years. That's well above most pre-profit companies. The share price rise of 22% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. So now might be the perfect time to put HiPay Group on your radar. A window of opportunity may reveal itself with time, if the business can trend to profitability.

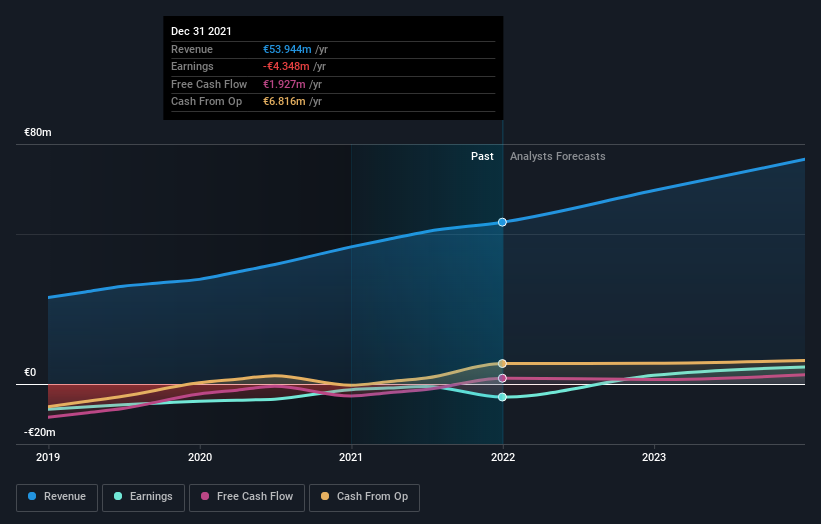

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 6.9% in the last year, HiPay Group shareholders lost 5.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.8% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand HiPay Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with HiPay Group , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HiPay Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALHYP

HiPay Group

Provides augmented payment solutions in France and rest of Europe.

Moderate with proven track record.

Market Insights

Community Narratives