- Sweden

- /

- Consumer Finance

- /

- OM:YIELD

European Penny Stocks To Watch In December 2025

Reviewed by Simply Wall St

As the European markets show signs of steady economic growth, with the pan-European STOXX Europe 600 Index rising by 1.60%, investors are keenly observing how looser monetary policies might influence stock performance. Though the term 'penny stock' might sound like a relic of past trading days, these smaller or newer companies can still present significant opportunities when built on solid financials. This article will explore three penny stocks that demonstrate balance sheet strength and potential for outsized gains, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.504 | €1.56B | ✅ 4 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.70 | €83.47M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €227.2M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.08 | €65.33M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.16 | SEK192.25M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.335 | €383.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0742 | €7.98M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 294 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Crypto Blockchain Industries (ENXTPA:ALCBI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Crypto Blockchain Industries operates in the cryptocurrency and blockchain-based application sector in France with a market cap of €51.27 million.

Operations: The company generates revenue of €5.21 million from its blockchain segment.

Market Cap: €51.27M

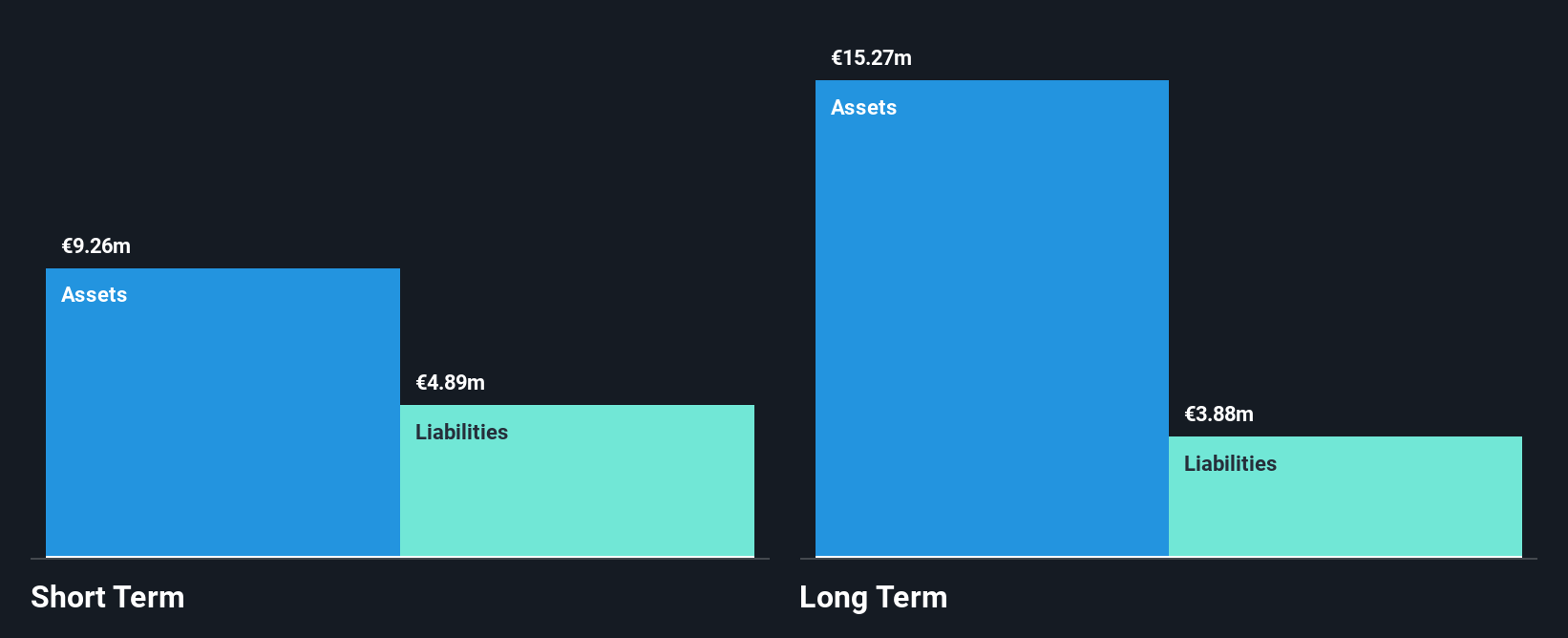

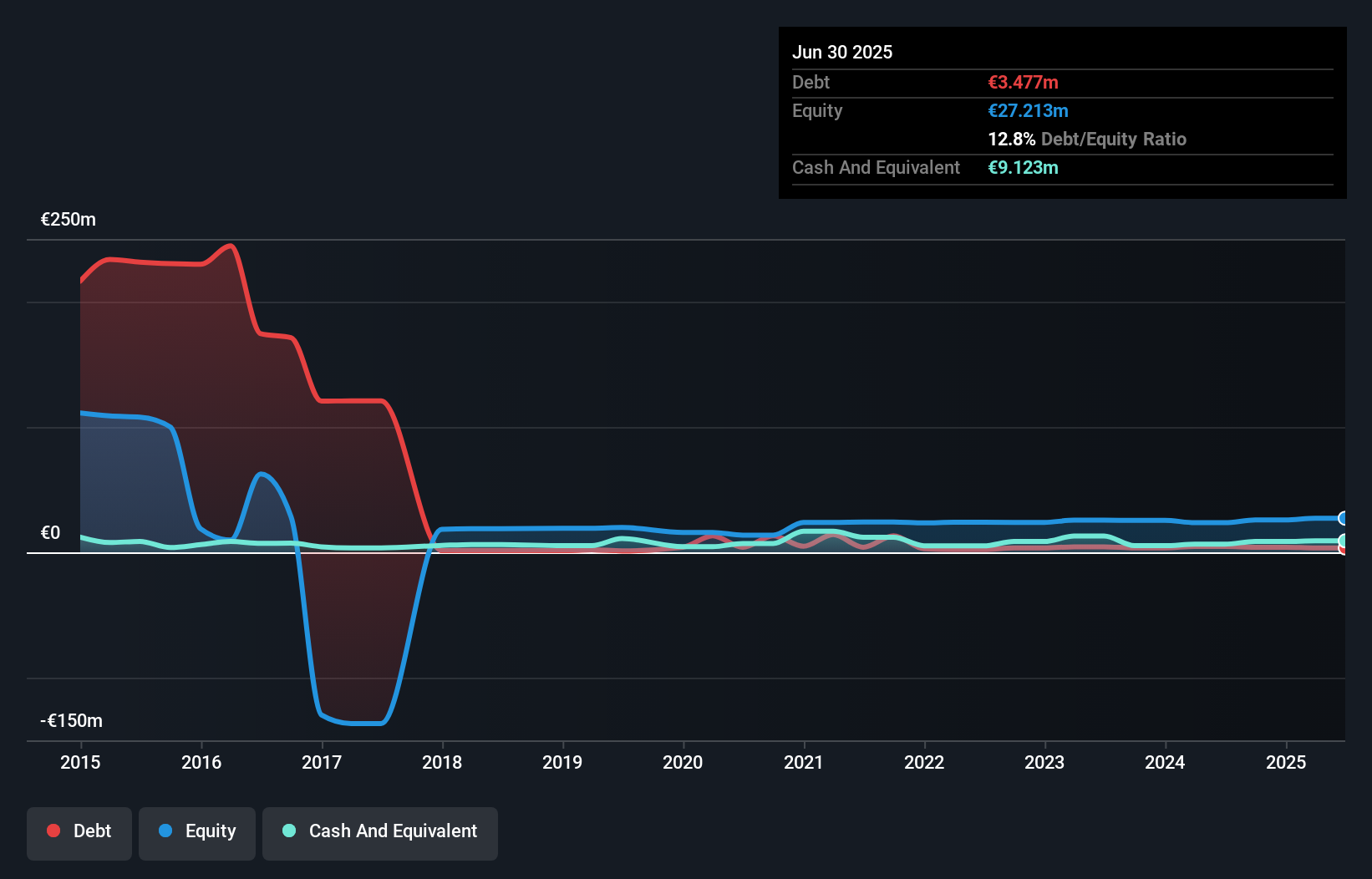

Crypto Blockchain Industries, with a market cap of €51.27 million and revenue of €5.21 million, operates in the blockchain sector and faces challenges typical for penny stocks. The company is unprofitable, with negative return on equity at -48.49%, but its short-term assets (€9.3M) exceed both short-term (€4.9M) and long-term liabilities (€3.9M), indicating strong liquidity management. Despite a reduction in debt-to-equity ratio from 33.4% to 3.9% over five years, volatility remains high compared to most French stocks, reflecting inherent risks associated with investing in this volatile sector.

- Get an in-depth perspective on Crypto Blockchain Industries' performance by reading our balance sheet health report here.

- Learn about Crypto Blockchain Industries' historical performance here.

Componenta (HLSE:CTH1V)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Componenta Corporation, with a market cap of €43.28 million, operates in Finland and specializes in providing cast iron components through its subsidiaries.

Operations: The company generates revenue from its Contract Workshop Business, amounting to €114.51 million.

Market Cap: €43.28M

Componenta Corporation, with a market cap of €43.28 million, has shown promising developments typical for penny stocks. It recently turned profitable, reporting a net income of €1.42 million for the first nine months of 2025 compared to a loss last year. The company's management and board are seasoned, enhancing operational stability. Although its interest coverage is low at 1.5x EBIT, its debt is well managed with satisfactory net debt to equity and covered by operating cash flow (72.2%). Recent financing agreements further bolster its financial position as it continues to improve sales and profitability metrics.

- Take a closer look at Componenta's potential here in our financial health report.

- Gain insights into Componenta's future direction by reviewing our growth report.

SaveLend Group (OM:YIELD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SaveLend Group AB (publ) is a fintech company operating in Sweden and Finland with a market cap of SEK117.44 million.

Operations: The company's revenue is primarily generated from its operations in Sweden, amounting to SEK105.87 million.

Market Cap: SEK117.44M

SaveLend Group AB, with a market cap of SEK117.44 million, is navigating the penny stock landscape with strategic product enhancements. The recent launch of a new user interface for its savings platform underscores its commitment to improving customer experience and transparency. Despite being unprofitable, the company maintains a stable cash runway exceeding three years and has reduced losses over five years. However, challenges remain as it faces high net debt to equity at 167.9% and an inexperienced board and management team with short tenures averaging 0.7 and 1.8 years respectively, which could impact long-term strategic execution.

- Unlock comprehensive insights into our analysis of SaveLend Group stock in this financial health report.

- Examine SaveLend Group's past performance report to understand how it has performed in prior years.

Taking Advantage

- Unlock our comprehensive list of 294 European Penny Stocks by clicking here.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 28 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YIELD

SaveLend Group

Through its subsidiaries, operates as a fintech company in Sweden and Finland.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion