Is 74Software Trading Below Its True Value After Latest Earnings Beat?

Reviewed by Bailey Pemberton

If you’re one of the many investors eyeing 74Software right now, you’re not alone. Deciding what to do with this stock isn’t just about gut feel or recent headlines, either. The company’s share price has definitely kept things interesting, with a 1.6% climb over the past week after a modest dip of 3.9% in the last month. Looking beyond the short term, 74Software’s story is quite compelling, with a 41.1% increase year-to-date, a 54.5% rise over the past twelve months, and a remarkable 147.1% gain in just three years. This is notable performance for anyone thinking strategically about their next move.

Some of this momentum appears tied to broader market developments, particularly where software and tech stocks are concerned. Shifts in demand for enterprise solutions and positive sentiment for digital-first companies have helped draw attention to names like 74Software. This reinforces a sense of opportunity and may also raise questions about future risk. But is this price justified, or are investors still getting a deal?

This is where a closer look at valuation becomes important. Based on a comprehensive six-point value score, 74Software lands at an impressive 5 out of 6. It is considered undervalued by almost every major metric tracked. Each approach to valuation will be examined in detail next, with a closer look at what these numbers could mean for you and your portfolio.

Approach 1: 74Software Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its future cash flows and discounting them back to today’s value. This method helps investors gauge whether the current market price accurately reflects the business’s true economic potential.

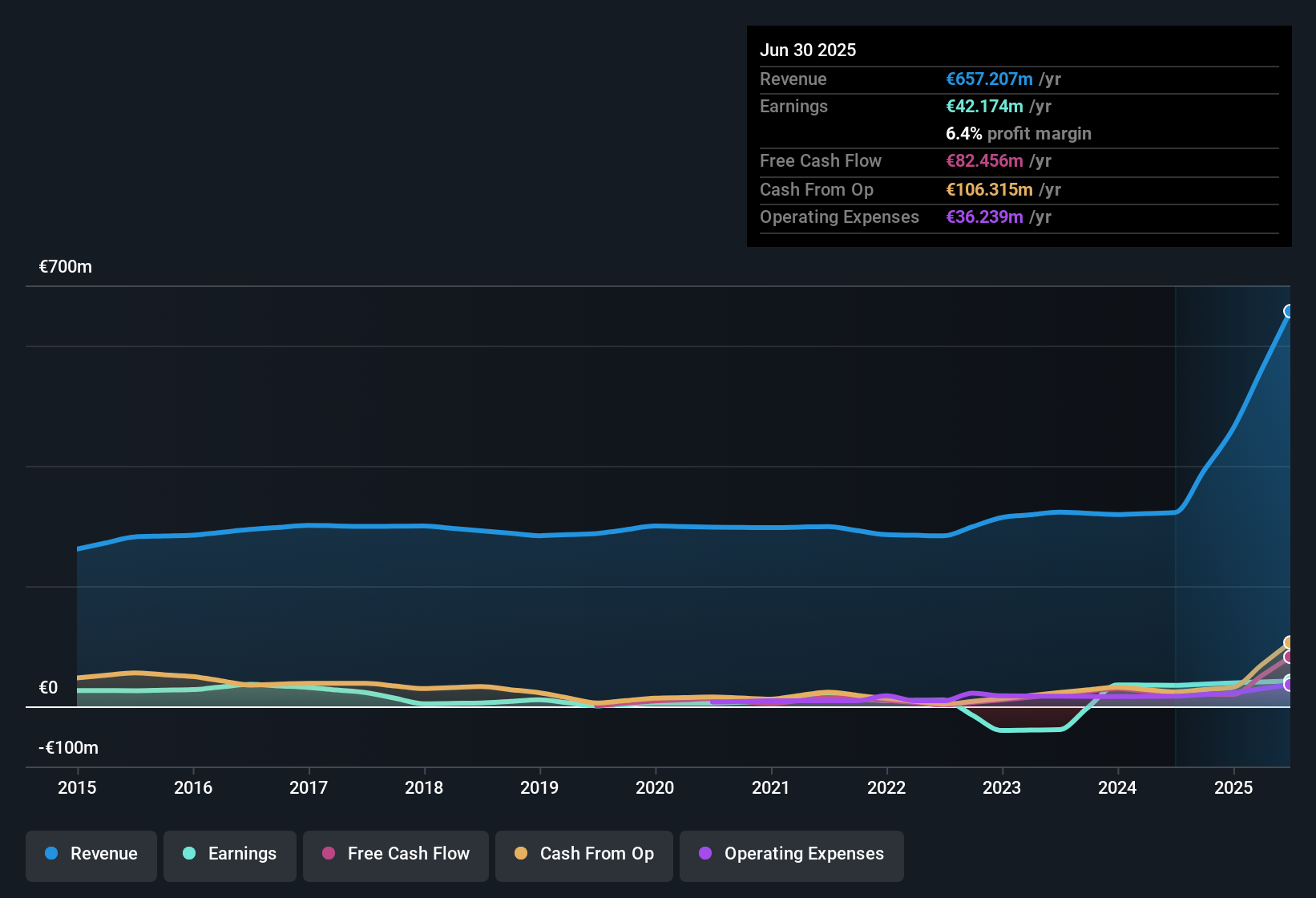

For 74Software, the DCF model uses the two-stage Free Cash Flow to Equity approach. Right now, the company’s latest twelve months’ Free Cash Flow sits at €90.8 million. Analyst forecasts extend cash flow projections over the next several years and expect continued growth. By 2028, free cash flow is anticipated to reach €120.3 million. Looking further out, extrapolated estimates project free cash flow above €220 million by 2034, though such long-term numbers carry additional uncertainty.

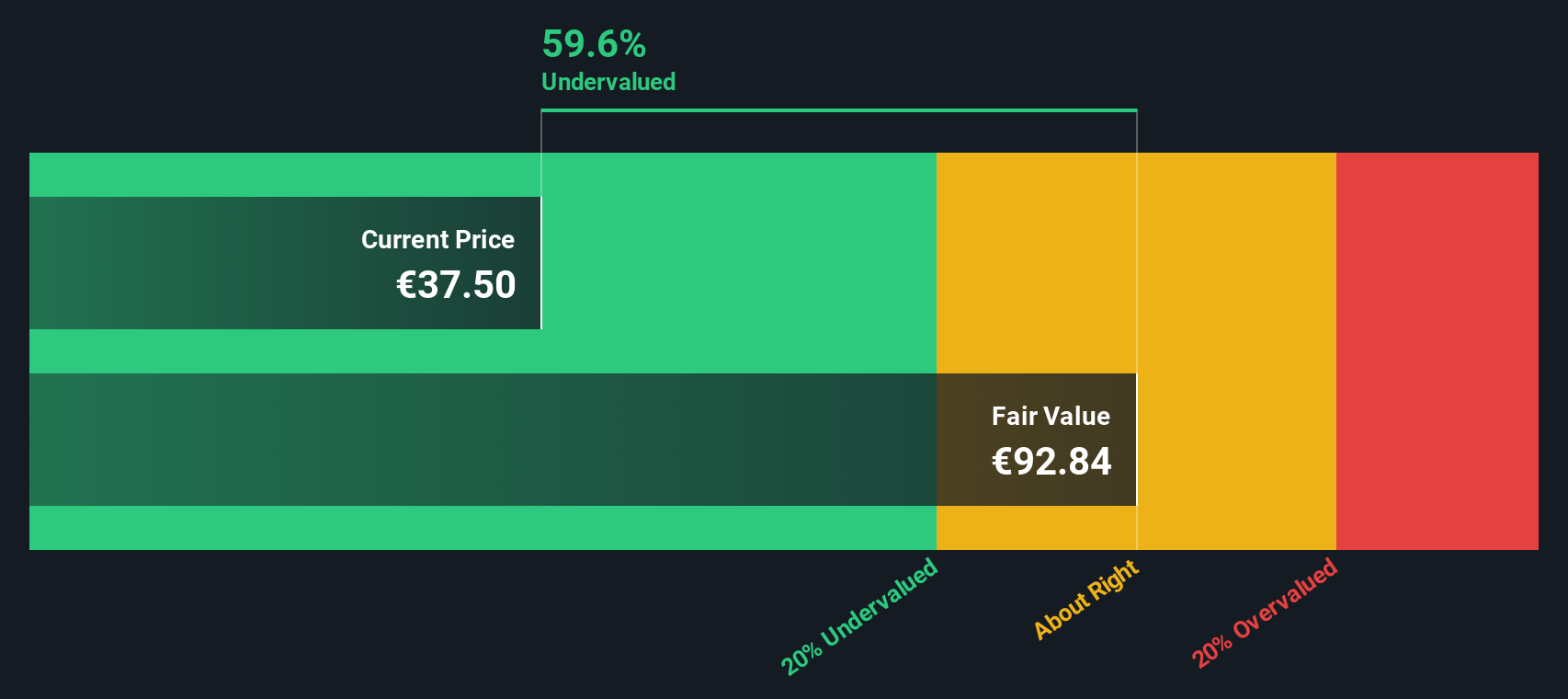

After discounting this stream of expected cash flows, the intrinsic value of 74Software comes out to approximately €92 per share. This marks a sizable 59.3% discount to where the stock currently trades, suggesting it is substantially undervalued based on future cash-flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests 74Software is undervalued by 59.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: 74Software Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation measure for profitable companies because it allows investors to see how much they are paying for each euro of current earnings. A suitable PE ratio takes into account not just a company’s profitability, but also expectations for growth, stability, and the broader risks in the business and sector. In essence, investors are typically willing to pay a higher PE for fast-growing, resilient businesses and less for slower, riskier ones.

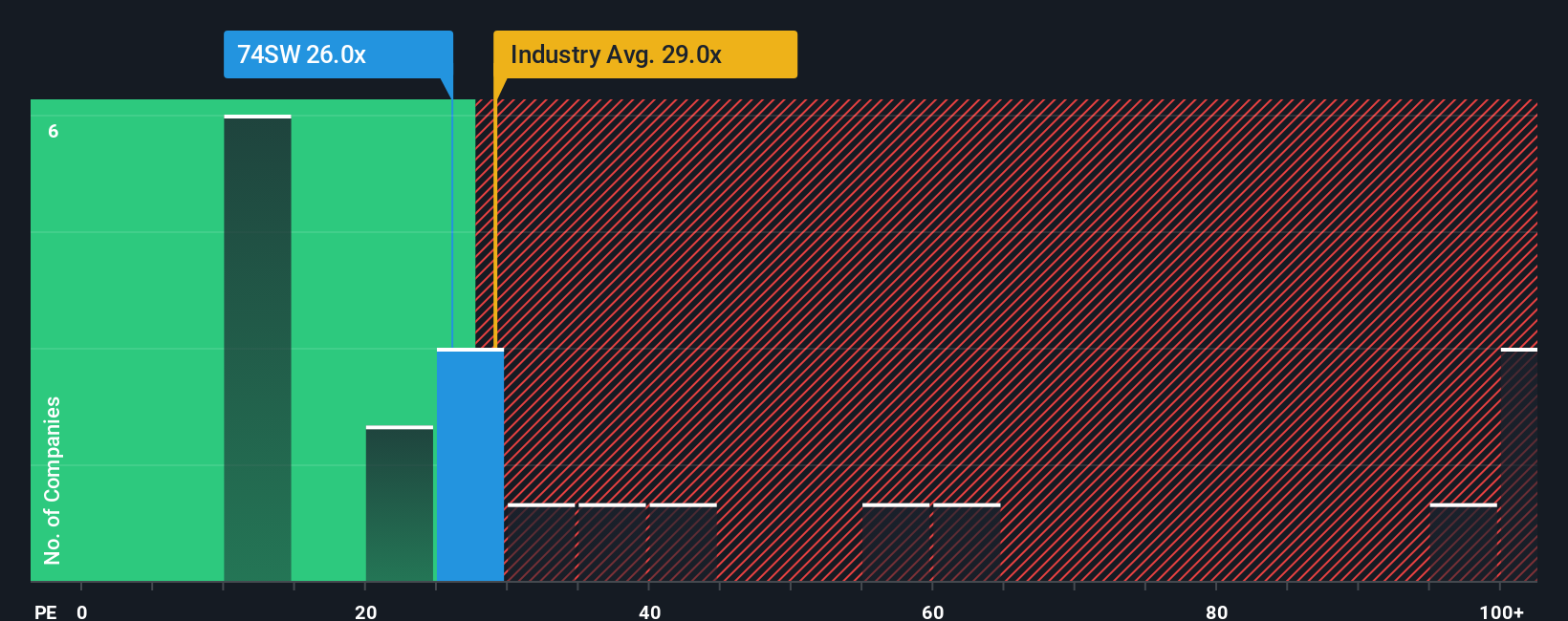

Currently, 74Software trades at a PE ratio of 26x. This is slightly lower than the average for its software industry peers, which stands at 28x. It is also below the broader industry average PE of 30x. Comparing these benchmarks helps provide context. However, making a decision based solely on these relative figures can miss important nuances.

That is where Simply Wall St’s “Fair Ratio” comes in. Unlike peer or industry comparisons, the Fair Ratio analyzes 74Software’s growth prospects, profit margins, risk profile, industry dynamics, and company size. For 74Software, the Fair Ratio is calculated at 24.9x. This is just a hair below the company’s actual PE of 26x, suggesting that the market pricing closely matches what would be considered fair after accounting for all the company’s unique attributes. The small difference between these values implies that the stock is trading at about the right level.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your 74Software Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative lets you connect a company’s story, your perspective on its prospects, risks, and growth drivers, to real financial forecasts and an estimated fair value. Instead of relying on just one static view, Narratives invite you to define your own assumptions for future revenue, profit margins, and valuation multiples. This turns raw numbers into a personal, actionable story.

Narratives are simple and accessible tools available to every investor on Simply Wall St’s Community page, used by millions worldwide. They show how different outlooks can lead to different views of a company’s fair value, helping you decide whether to buy or sell by comparing your Narrative’s fair value to the current share price. Each Narrative updates automatically as news or earnings reports arrive, so your view stays relevant.

For example, one investor might create a bullish Narrative for 74Software, believing its transition to cloud-based solutions and premium acquisitions will drive the fair value as high as €53.0. Another might focus on competitive risks and set it as low as €44.4, showing how your own analysis can shape a smarter investment decision.

Do you think there's more to the story for 74Software? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:74SW

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success