- France

- /

- Semiconductors

- /

- ENXTPA:XFAB

X-FAB (ENXTPA:XFAB) Margin Decline Challenges Growth Narrative Despite 40% Earnings Growth Forecast

Reviewed by Simply Wall St

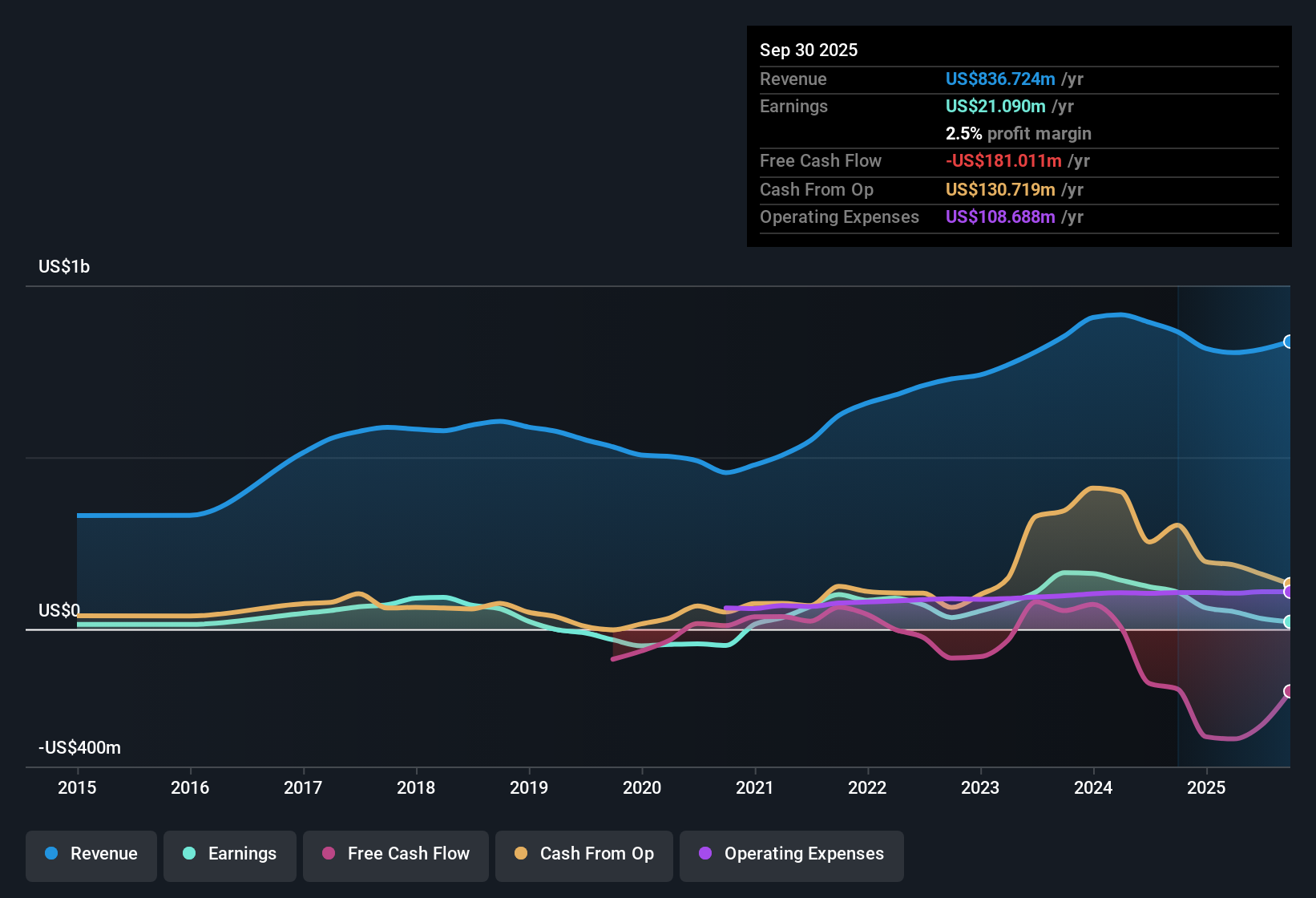

X-FAB Silicon Foundries (ENXTPA:XFAB) is forecast to grow earnings by 40.4% per year, significantly outpacing its own five-year average growth of 18.9% and the French market's projected 12.4% per year. Revenue growth is also expected to lead, with a 6.9% annual forecast compared to the French market's 5.6%. However, net profit margins have compressed sharply to 3.7%, down from 13.8% last year. This suggests profitability pressure despite strong growth expectations and an attractive valuation gap versus estimated fair value.

See our full analysis for X-FAB Silicon Foundries.Next, we will see how these figures measure up against the market's prevailing narratives and what investors are saying about X-FAB's outlook.

See what the community is saying about X-FAB Silicon Foundries

Order Volatility Puts Margin Gains at Risk

- Analysts project that net profit margins will rise from 3.7% today to 12.6% in three years, signaling a potential recovery amidst high recent margin compression.

- According to the analysts' consensus view, the company’s profitability prospects face key uncertainties:

- Rising order uncertainty and short-notice demand, driven by geopolitical factors, may disrupt revenue and utilization rates. This makes the anticipated margin expansion less predictable.

- Analysts note that while core markets like automotive and industrial are delivering record revenues, the potential for overcapacity and intense competition from Asian foundries could undermine those margin gains if demand softens unexpectedly.

Capacity Expansion Powers Growth Narrative

- Wafer production in silicon carbide is set to more than double, with first half 2025 output expected to exceed all of 2024. This is due to expanded clean rooms and new fabs, directly capturing booming demand in data center power management and electrification.

- From the analysts' consensus view, X-FAB’s ongoing investments are seen as pivotal for seizing market share:

- Proprietary technologies and high barriers to entry boost customer loyalty and ASPs. This gives the company pricing power that supports the case for superior profitability as volumes scale up.

- Consensus narrative calls out that increased prototype project wins across automotive, industrial, and medical sectors reinforce the belief that capacity investments will convert into higher future revenues and improved net margins.

Valuation Discount Versus DCF and Peers

- X-FAB trades at €5.5 per share, well below its DCF fair value of €49.57 and beneath the sector average price-to-earnings ratio of 33.8x. Its own P/E stands at 27.2x.

- Per analysts' consensus view, this valuation gap spotlights both opportunity and questions about sustainability:

- The current share price is 25% below the analyst price target of €7.30, implying potential upside if growth and margin gains materialize as forecast.

- However, consensus narrative highlights customer concentration and reliance on legacy technologies as lingering risks. This suggests that a price discount may be warranted until those execution uncertainties are resolved.

For a deeper dive into all sides of the debate on X-FAB, including what drives both optimism and caution, read the full consensus narrative. 📊 Read the full X-FAB Silicon Foundries Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for X-FAB Silicon Foundries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Look at the figures from your own angle. Share your perspective in just a few minutes and shape the conversation. Do it your way

A great starting point for your X-FAB Silicon Foundries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

X-FAB’s outlook remains clouded by volatile margins, order unpredictability, and customer concentration risks. These factors call sustainable profitability into question.

If you want to sidestep these uncertainties, now’s the time to focus on stable growth stocks screener (2101 results) offering consistent performance and steadier earnings through any market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:XFAB

X-FAB Silicon Foundries

Develops, produces, and sells analog/mixed-signal IC, micro-electro-mechanical systems, and silicon carbide products for automotive, medical, industrial, communication, and consumer sectors in the Europe, the United States, Asia, and internationally.

Very undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion