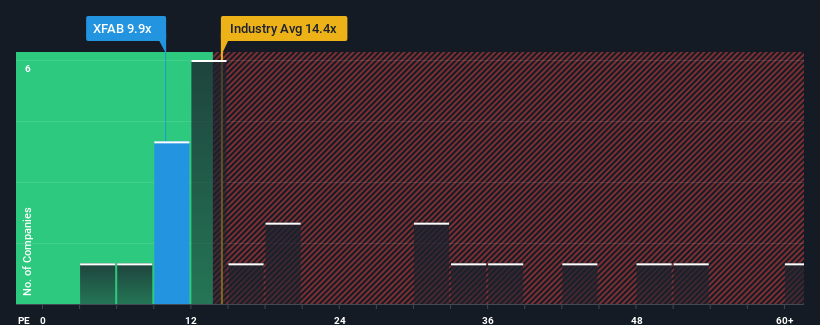

With a price-to-earnings (or "P/E") ratio of 9.9x X-FAB Silicon Foundries SE (EPA:XFAB) may be sending bullish signals at the moment, given that almost half of all companies in France have P/E ratios greater than 15x and even P/E's higher than 25x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

X-FAB Silicon Foundries has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for X-FAB Silicon Foundries

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, X-FAB Silicon Foundries would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 62% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 26% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 32% each year over the next three years. With the market only predicted to deliver 14% each year, the company is positioned for a stronger earnings result.

With this information, we find it odd that X-FAB Silicon Foundries is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that X-FAB Silicon Foundries currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for X-FAB Silicon Foundries you should be aware of, and 1 of them is potentially serious.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:XFAB

X-FAB Silicon Foundries

Develops, produces, and sells analog/mixed-signal IC, micro-electro-mechanical systems, and silicon carbide products for automotive, medical, industrial, communication, and consumer sectors in the Europe, the United States, Asia, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives