- France

- /

- Semiconductors

- /

- ENXTPA:XFAB

Could X-FAB (ENXTPA:XFAB) Navigate Leadership Change to Reinforce Its Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- X-FAB Silicon Foundries announced that CEO Rudi De Winter will step down from his role in February 2026, continuing as a board member, and provided new revenue guidance for the fourth quarter and full year 2025 alongside third-quarter earnings results.

- The combination of an upcoming leadership transition after a long tenure and updated financial expectations offers a significant update for stakeholders amid a shifting semiconductor sector.

- Next, we’ll explore how the planned CEO departure could influence X-FAB’s outlook and the previously discussed growth narrative.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

X-FAB Silicon Foundries Investment Narrative Recap

To own X-FAB Silicon Foundries shares, investors must be confident in the company’s position in specialty semiconductor manufacturing, particularly as demand for EV-related and industrial applications continues. The recent CEO succession plan is unlikely to materially affect the most immediate catalyst, capacity expansion supporting revenue growth, but it draws attention to leadership stability as a potential risk, especially given recent earnings volatility and softening net income.

The updated full-year 2025 revenue guidance (US$863 million to US$873 million) is especially relevant, as it aligns with ongoing capacity investments and expanding customer engagement in core markets. This outlook suggests management maintains a degree of demand visibility, at least in the near term, despite a backdrop of increasing order uncertainty previously noted as a key risk.

However, looking closer, investors should not overlook that customer order unpredictability remains a factor in...

Read the full narrative on X-FAB Silicon Foundries (it's free!)

X-FAB Silicon Foundries' outlook anticipates $1.1 billion in revenue and $136.0 million in earnings by 2028. Achieving this would require a 9.8% annual revenue growth and a $105.5 million increase in earnings from the current $30.5 million.

Uncover how X-FAB Silicon Foundries' forecasts yield a €7.36 fair value, a 50% upside to its current price.

Exploring Other Perspectives

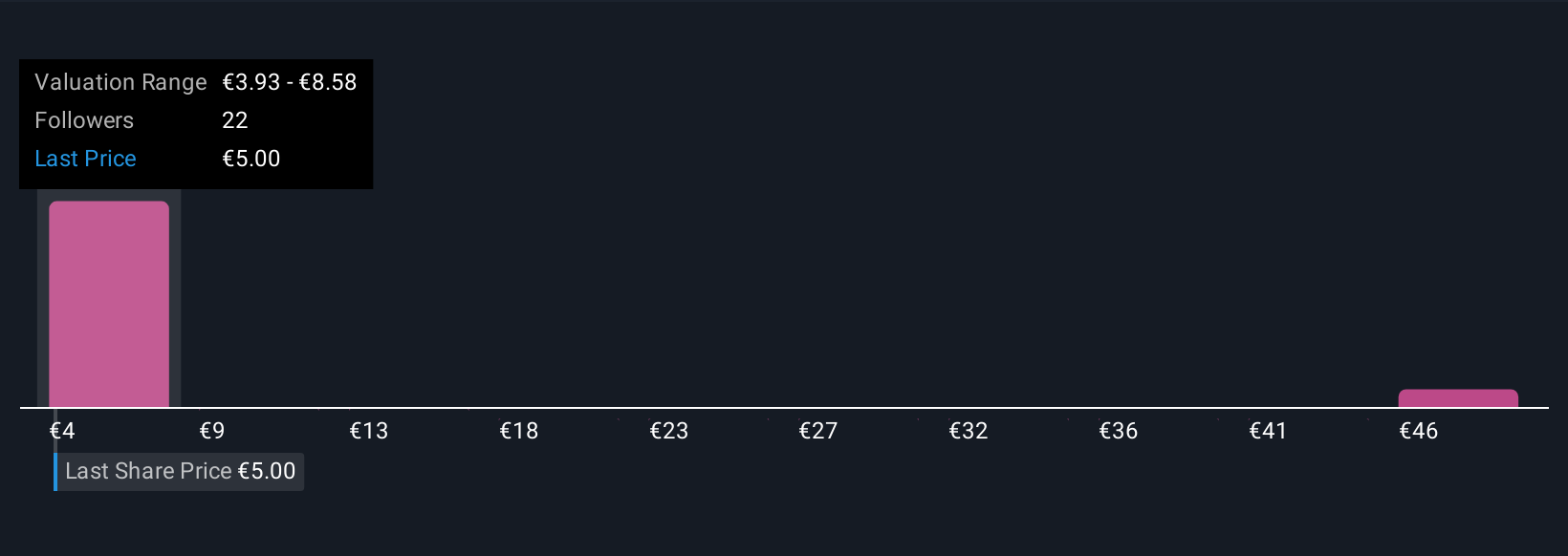

Seven Simply Wall St Community members estimate X-FAB’s fair value from €3.93 to €48.67, offering substantial variance. With order uncertainty an ongoing risk, explore these viewpoints to understand the range of future expectations.

Explore 7 other fair value estimates on X-FAB Silicon Foundries - why the stock might be worth over 9x more than the current price!

Build Your Own X-FAB Silicon Foundries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your X-FAB Silicon Foundries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free X-FAB Silicon Foundries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate X-FAB Silicon Foundries' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:XFAB

X-FAB Silicon Foundries

Develops, produces, and sells analog/mixed-signal IC, micro-electro-mechanical systems, and silicon carbide products for automotive, medical, industrial, communication, and consumer sectors in the Europe, the United States, Asia, and internationally.

Very undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion