- France

- /

- Semiconductors

- /

- ENXTPA:ALKAL

Kalray S.A.'s (EPA:ALKAL) Business Is Trailing The Industry But Its Shares Aren't

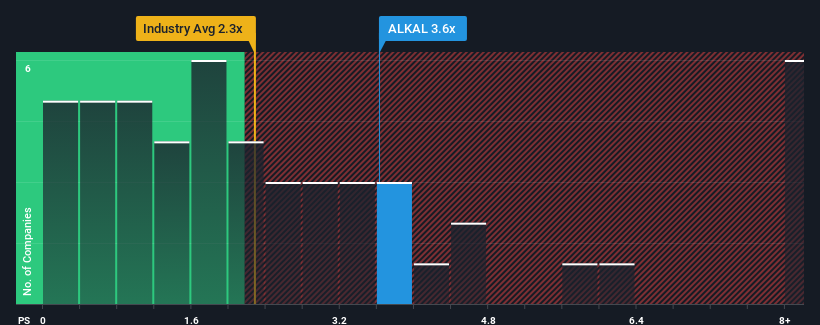

Kalray S.A.'s (EPA:ALKAL) price-to-sales (or "P/S") ratio of 3.6x may not look like an appealing investment opportunity when you consider close to half the companies in the Semiconductor industry in France have P/S ratios below 2.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Kalray

What Does Kalray's P/S Mean For Shareholders?

Recent times have been advantageous for Kalray as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Kalray's future stacks up against the industry? In that case, our free report is a great place to start.How Is Kalray's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Kalray's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 118% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to plummet, contracting by 20% during the coming year according to the three analysts following the company. The industry is also set to see revenue decline 1.3% but the stock is shaping up to perform materially worse.

With this information, it's strange that Kalray is trading at a higher P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be extremely difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Bottom Line On Kalray's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Kalray's analyst forecasts determined that its even shakier outlook against the industry isn't impacting its high P/S anywhere near as much as we would have predicted. Revenue outlooks like this don't typically support a company trading at such an elevated P/S, and if it did, it doesn't usually do it for long. In addition, we would be concerned whether the company's revenue prospects could slide further under these tough industry conditions. Unless the company's prospects improve markedly, it's going to be challenging to resist the P/S dropping to a more justifiable level.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Kalray that you need to be mindful of.

If these risks are making you reconsider your opinion on Kalray, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kalray might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALKAL

Moderate risk and fair value.

Market Insights

Community Narratives