- France

- /

- Semiconductors

- /

- ENXTPA:ALKAL

Benign Growth For Kalray S.A. (EPA:ALKAL) Underpins Stock's 32% Plummet

Kalray S.A. (EPA:ALKAL) shareholders that were waiting for something to happen have been dealt a blow with a 32% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 97% loss during that time.

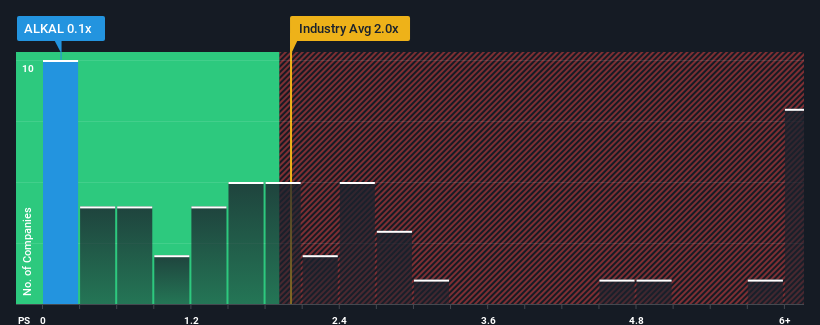

Since its price has dipped substantially, given about half the companies operating in France's Semiconductor industry have price-to-sales ratios (or "P/S") above 1.6x, you may consider Kalray as an attractive investment with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Kalray

How Kalray Has Been Performing

With only a limited decrease in revenue compared to most other companies of late, Kalray has been doing relatively well. One possibility is that the P/S ratio is low because investors think this relatively better revenue performance might be about to deteriorate significantly. You'd much rather the company continue improving its revenue if you still believe in the business. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Kalray's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Kalray?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Kalray's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 7.9% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Turning to the outlook, the next year should bring plunging returns, with revenue decreasing 45% as estimated by the three analysts watching the company. With the rest of the industry predicted to shrink by 9.2%, it's a sub-optimal result.

With this in consideration, it's clear to us why Kalray's P/S isn't quite up to scratch with its industry peers. However, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares heavily.

The Final Word

Kalray's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Kalray's P/S is about what we expect, seeing as the P/S and revenue growth forecasts are lower than that of an already struggling industry. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Typically when industry conditions are tough, there's a real risk of company revenues sliding further, which is a concern of ours in this case. In the meantime, unless the company's prospects improve they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Kalray (3 are concerning) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Kalray might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALKAL

Slight and fair value.

Market Insights

Community Narratives