- France

- /

- Specialty Stores

- /

- ENXTPA:SRP

SRP Groupe's (EPA:SRP) Stock Price Has Reduced 95% In The Past Three Years

Over the last month the SRP Groupe S.A. (EPA:SRP) has been much stronger than before, rebounding by 50%. But the last three years have seen a terrible decline. Indeed, the share price is down a whopping 95% in the last three years. So we're relieved for long term holders to see a bit of uplift. But the more important question is whether the underlying business can justify a higher price still.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for SRP Groupe

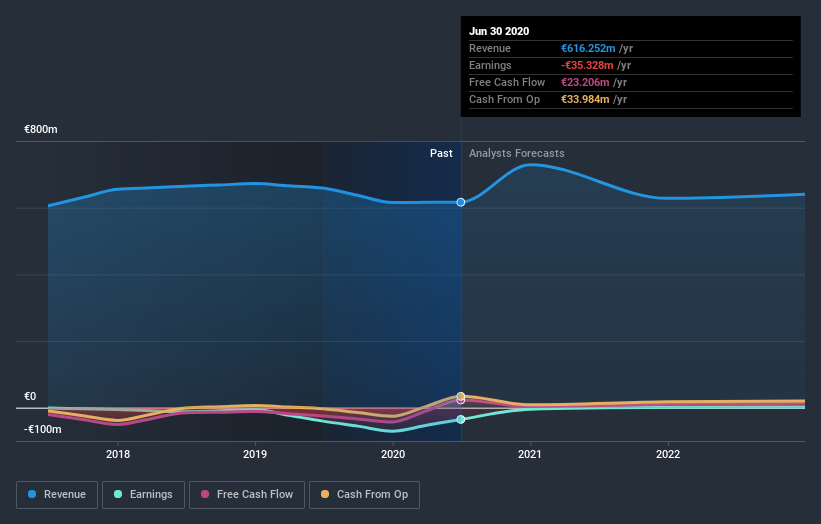

Given that SRP Groupe didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years SRP Groupe saw its revenue shrink by 0.8% per year. That's not what investors generally want to see. Having said that the 25% annualized share price decline highlights the risk of investing in unprofitable companies. This business clearly needs to grow revenues if it is to perform as investors hope. Don't let a share price decline ruin your calm. You make better decisions when you're calm.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling SRP Groupe stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered SRP Groupe's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that SRP Groupe's TSR, at -90% is higher than its share price return of -95%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Pleasingly, SRP Groupe's total shareholder return last year was 45%. This recent result is much better than the 24% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. It's always interesting to track share price performance over the longer term. But to understand SRP Groupe better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for SRP Groupe you should be aware of, and 1 of them can't be ignored.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you’re looking to trade SRP Groupe, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:SRP

SRP Groupe

Engages in the e-commerce business in France and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives