- France

- /

- Specialty Stores

- /

- ENXTPA:MDM

These 4 Measures Indicate That Maisons du Monde (EPA:MDM) Is Using Debt Extensively

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Maisons du Monde S.A. (EPA:MDM) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Maisons du Monde

What Is Maisons du Monde's Net Debt?

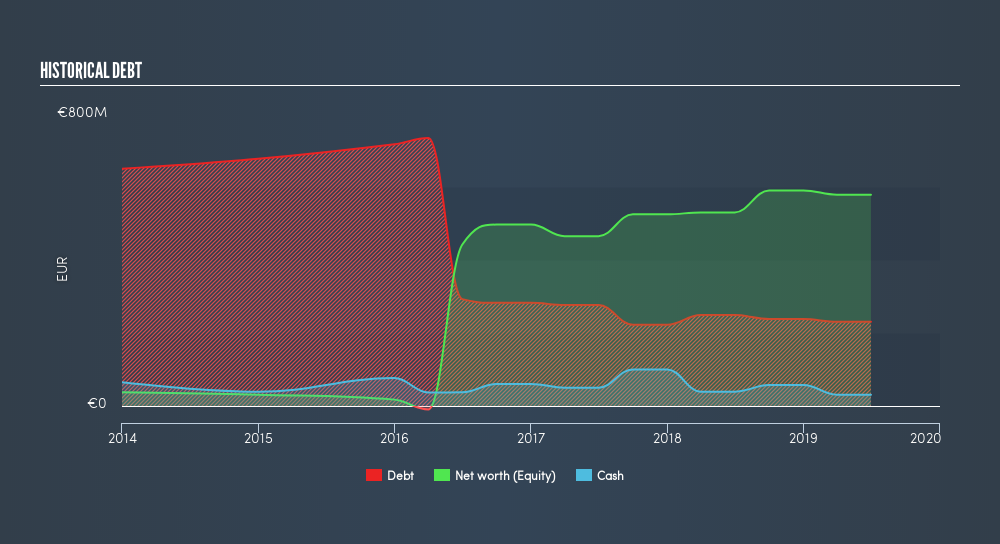

As you can see below, Maisons du Monde had €230.4m of debt at June 2019, down from €252.2m a year prior. However, it also had €30.7m in cash, and so its net debt is €199.7m.

A Look At Maisons du Monde's Liabilities

Zooming in on the latest balance sheet data, we can see that Maisons du Monde had liabilities of €373.7m due within 12 months and liabilities of €876.2m due beyond that. Offsetting this, it had €30.7m in cash and €118.1m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €1.10b.

When you consider that this deficiency exceeds the company's €760.8m market capitalization, you might well be inclined to review the balance sheet, just like one might study a new partner's social media. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Maisons du Monde has net debt of just 1.4 times EBITDA, indicating that it is certainly not a reckless borrower. And this view is supported by the solid interest coverage, with EBIT coming in at 8.5 times the interest expense over the last year. Fortunately, Maisons du Monde grew its EBIT by 4.0% in the last year, making that debt load look even more manageable. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Maisons du Monde's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, Maisons du Monde recorded free cash flow worth 61% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Maisons du Monde's struggle to handle its total liabilities had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. But on the bright side, its ability to cover its interest expense with its EBIT isn't too shabby at all. Taking the abovementioned factors together we do think Maisons du Monde's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Maisons du Monde's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:MDM

Maisons du Monde

Through its subsidiaries, provides home and living room related products in France and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives