- France

- /

- Specialty Stores

- /

- ENXTPA:MDM

Imagine Owning Maisons du Monde (EPA:MDM) And Wondering If The 35% Share Price Slide Is Justified

Maisons du Monde S.A. (EPA:MDM) shareholders should be happy to see the share price up 13% in the last quarter. But that is minimal compensation for the share price under-performance over the last year. After all, the share price is down 35% in the last year, significantly under-performing the market.

See our latest analysis for Maisons du Monde

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the Maisons du Monde share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past. It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's well worth checking out some other metrics, too.

Maisons du Monde's revenue is actually up 9.9% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

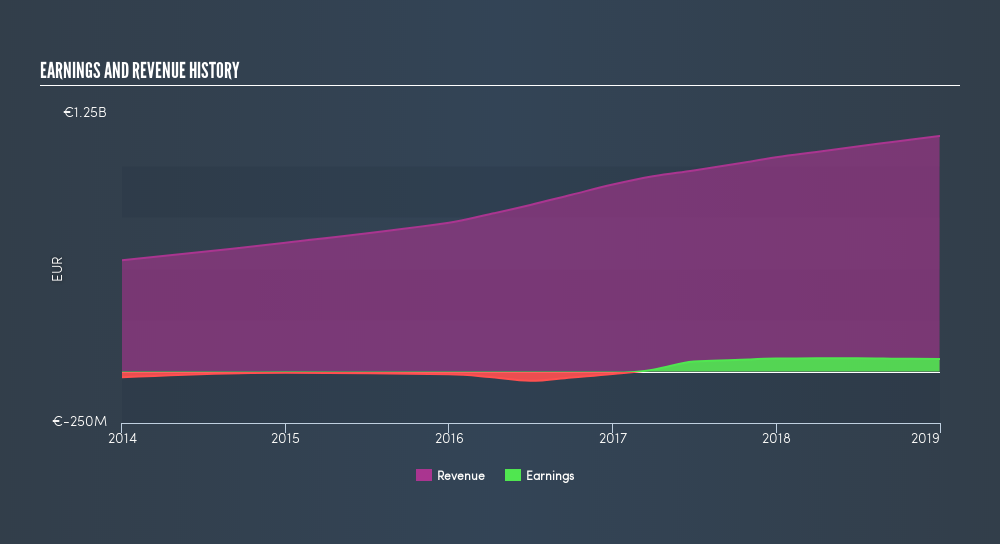

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Maisons du Monde is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. Given we have quite a good number of analyst forecasts, it might be well worth checking out this freechart depicting consensus estimates.

A Different Perspective

While Maisons du Monde shareholders are down 34% for the year (even including dividends), the market itself is up 5.8%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. It's great to see a nice little 13% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). Before deciding if you like the current share price, check how Maisons du Monde scores on these 3 valuation metrics.

We will like Maisons du Monde better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:MDM

Maisons du Monde

Through its subsidiaries, provides home and living room related products in France and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives