Every investor in Avenir Telecom S.A. (EPA:AVT) should be aware of the most powerful shareholder groups. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

Avenir Telecom is not a large company by global standards. It has a market capitalization of €2.8m, which means it wouldn't have the attention of many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutional investors have not yet purchased shares. We can zoom in on the different ownership groups, to learn more about Avenir Telecom.

Check out our latest analysis for Avenir Telecom

What Does The Lack Of Institutional Ownership Tell Us About Avenir Telecom?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

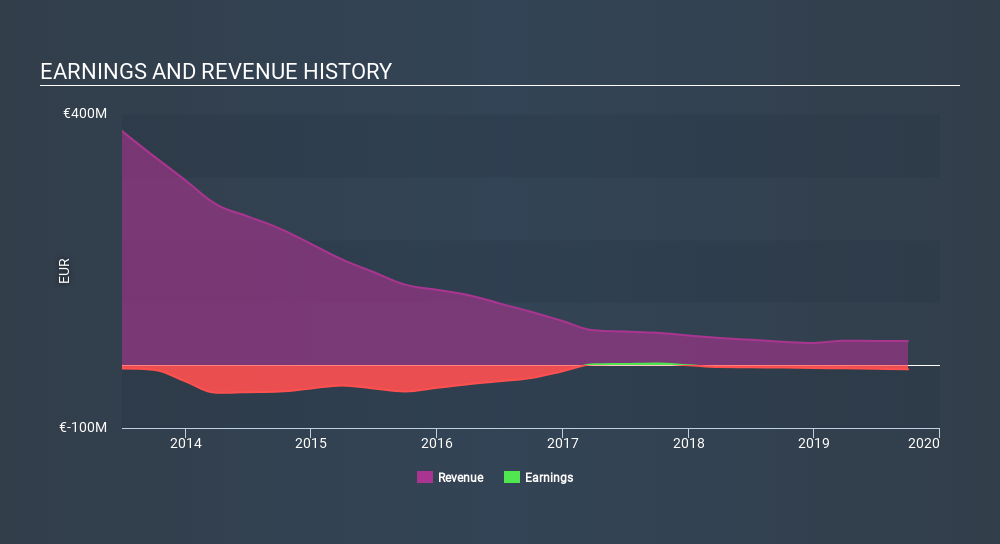

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of Avenir Telecom, for yourself, below.

Avenir Telecom is not owned by hedge funds. Our data suggests that Robert Schiano-Lamoriello, who is also the company's Top Key Executive, holds the most number of shares at 30%. When an insider holds a sizeable amount of a company's stock, investors consider it as a positive sign because it suggests that insiders are willing to have their wealth tied up in the future of the company. OXO S.A. is the second largest shareholder with 27% of common stock, followed by Jean-Daniel Beurnier, holding 7.0% of the stock. Interestingly, Jean-Daniel Beurnier is also a Chairman of the Board, again, indicating strong insider ownership amongst the company's top shareholders.

Further, we found that the top 2 shareholders have a combined ownership of 57% in the company, meaning that they are powerful enough to influence the decisions of the company.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. As far I can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Avenir Telecom

The definition of company insiders can be subjective, and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders maintain a significant holding in Avenir Telecom S.A.. Insiders own €1.0m worth of shares in the €2.8m company. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public, with a 36% stake in the company, will not easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Private Company Ownership

It seems that Private Companies own 27%, of the AVT stock. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Avenir Telecom you should be aware of, and 2 of them make us uncomfortable.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ENXTPA:AVT

Avenir Telecom

Designs and distributes mobile phones and mobility accessories in Europe, the Middle East, Africa, Asia, Oceania, and the Americas.

Flawless balance sheet low.

Market Insights

Community Narratives