Amidst a backdrop of mixed global market performances, the European markets recently saw a boost as major stock indexes rose, driven by relief over the reopening of the U.S. federal government. However, cooling sentiment around artificial intelligence investments has tempered gains in some sectors. In this environment, growth companies with high insider ownership can offer unique insights into potential opportunities, as insider confidence often signals alignment with shareholder interests and long-term commitment to business success.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 42.6% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 86.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's explore several standout options from the results in the screener.

Aramis Group SAS (ENXTPA:ARAMI)

Simply Wall St Growth Rating: ★★★★☆☆

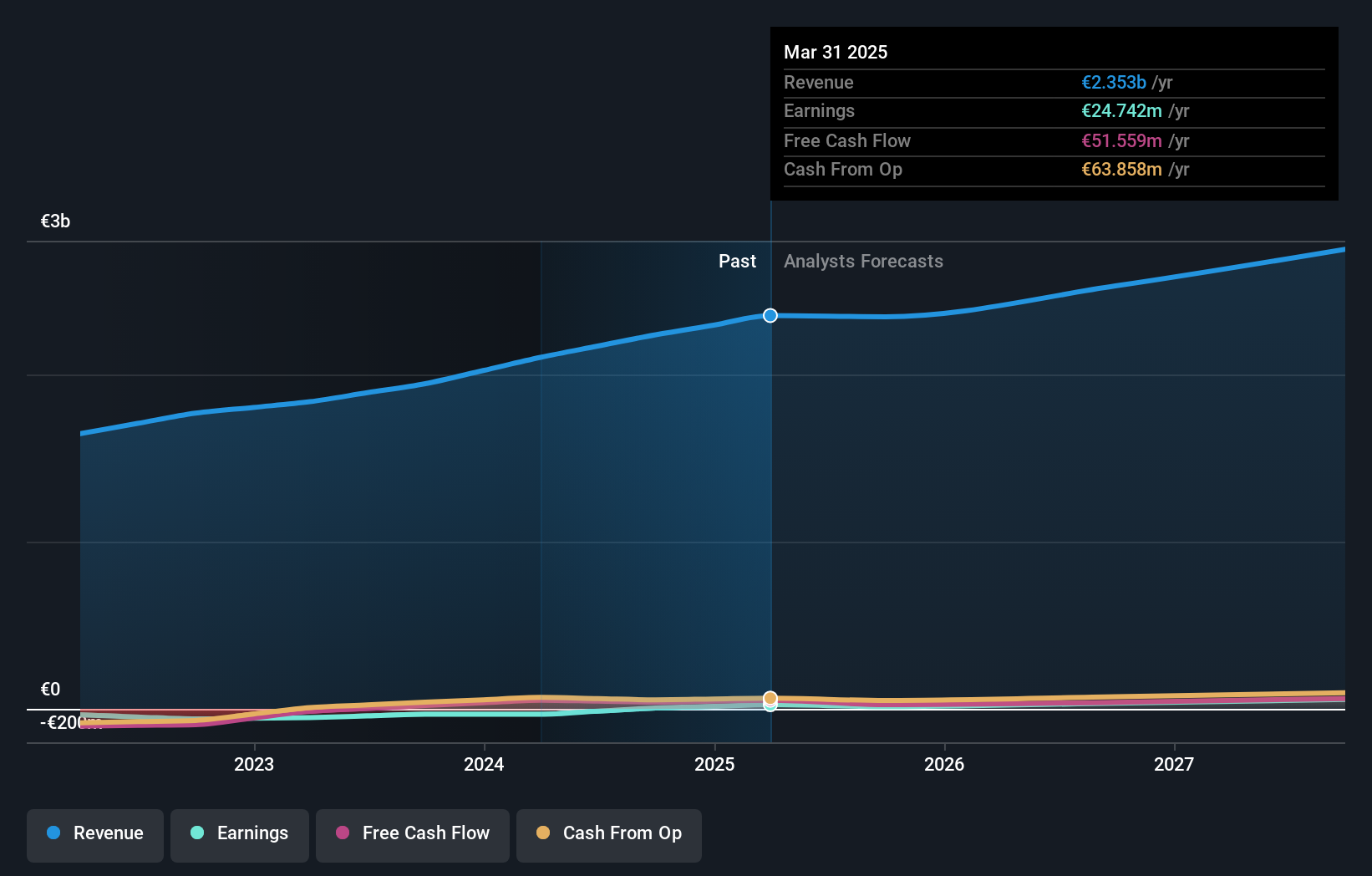

Overview: Aramis Group SAS operates in the online sale of used vehicles across France, Belgium, the United Kingdom, Austria, Italy, and Spain with a market cap of €484.08 million.

Operations: The company's revenue is primarily derived from Refurbished Cars (€1.59 billion), followed by Pre-Registered Cars (€497.56 million), B2B (€147.98 million), and Services (€120 million).

Insider Ownership: 18%

Earnings Growth Forecast: 44.9% p.a.

Aramis Group SAS, recently added to the S&P Global BMI Index, is experiencing notable growth with earnings forecasted to increase significantly at 44.9% annually over the next three years. Despite revenue growth being slower at 6.7%, it still outpaces the French market's average. Trading at a substantial discount of 55.4% below its estimated fair value, Aramis presents an intriguing opportunity for investors interested in companies with high insider ownership and robust profit growth potential.

- Click to explore a detailed breakdown of our findings in Aramis Group SAS' earnings growth report.

- According our valuation report, there's an indication that Aramis Group SAS' share price might be on the cheaper side.

Surgical Science Sweden (OM:SUS)

Simply Wall St Growth Rating: ★★★★☆☆

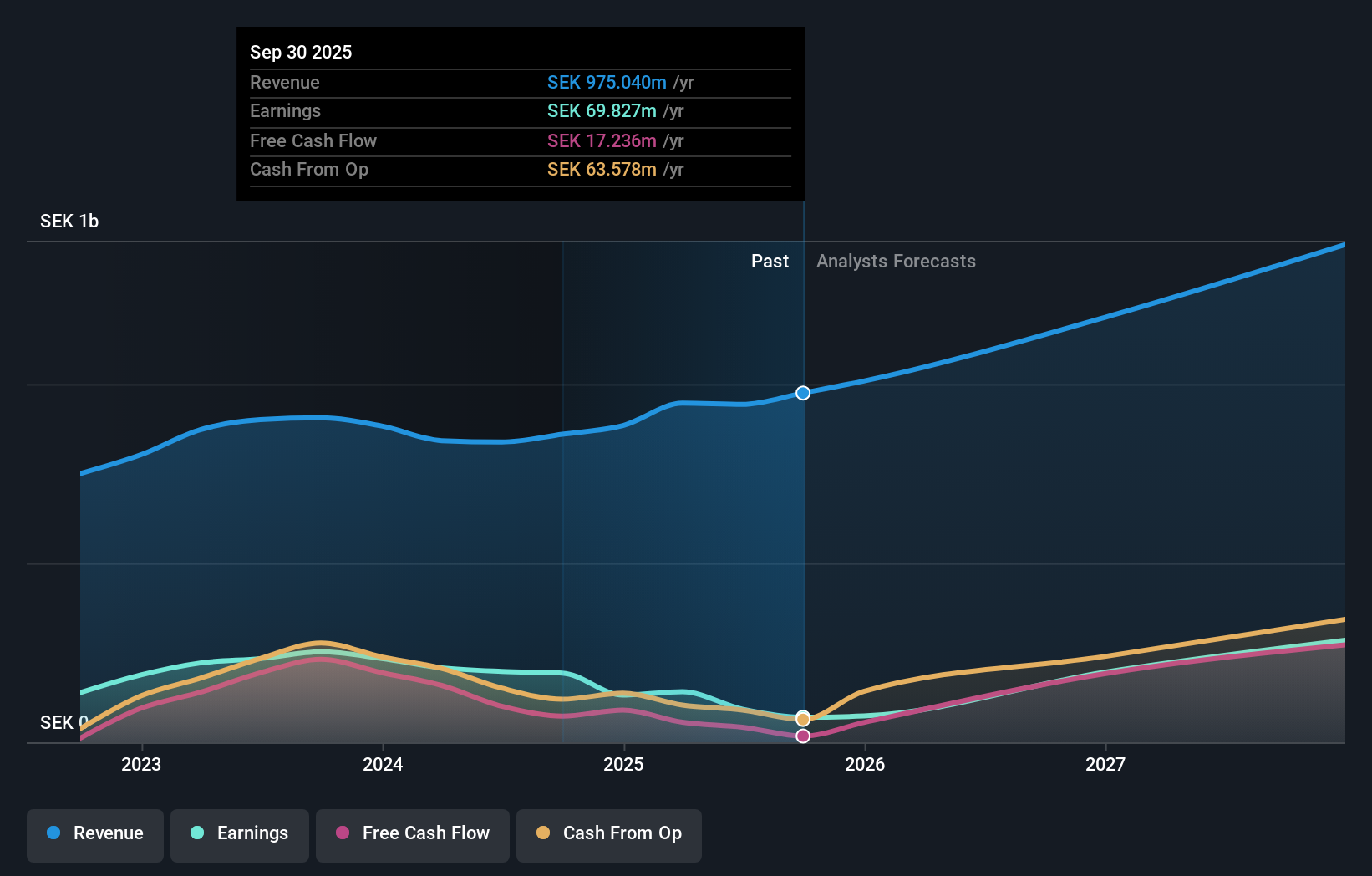

Overview: Surgical Science Sweden AB (publ) develops and markets virtual reality simulators for evidence-based medical training globally, with a market cap of SEK3.61 billion.

Operations: The company generates revenue from two main segments: Industry/OEM, contributing SEK478 million, and Educational Products, accounting for SEK497.04 million.

Insider Ownership: 14.8%

Earnings Growth Forecast: 42.2% p.a.

Surgical Science Sweden is poised for significant earnings growth, projected at 42.2% annually, surpassing the Swedish market average. Despite a recent dip in profit margins from 22.5% to 7.2%, its revenue is expected to grow at 16.9% per year, outpacing the broader market's rate of 3.9%. Trading significantly below fair value estimates and with no substantial insider trading activity reported recently, it remains an attractive option for growth-focused investors in Europe.

- Navigate through the intricacies of Surgical Science Sweden with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Surgical Science Sweden's shares may be trading at a discount.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK7.62 billion.

Operations: The company's revenue is primarily derived from its Security Software & Services segment, amounting to SEK2.29 billion.

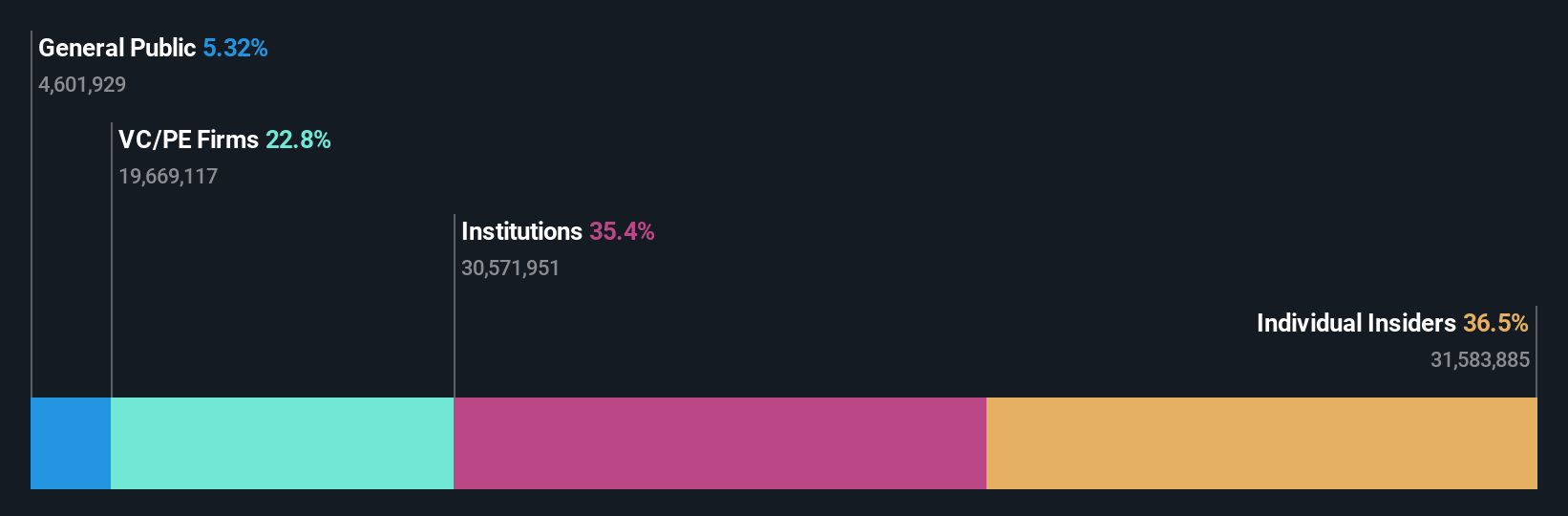

Insider Ownership: 36.7%

Earnings Growth Forecast: 37% p.a.

Yubico's substantial insider buying over the past three months underscores confidence in its growth trajectory, despite recent earnings declines. Analysts expect a 37% annual profit increase, outpacing the Swedish market's 13.5%. Revenue is forecast to grow at 15.3% annually, surpassing market averages but below high-growth benchmarks. The company's strategic retail expansion and partnerships bolster its position in cybersecurity, while volatile share prices may concern risk-averse investors seeking stability.

- Click here and access our complete growth analysis report to understand the dynamics of Yubico.

- In light of our recent valuation report, it seems possible that Yubico is trading behind its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 202 Fast Growing European Companies With High Insider Ownership selection here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives