- France

- /

- Specialty Stores

- /

- ENXTPA:ARAMI

Aramis Group SAS (EPA:ARAMI) Just Reported Earnings, And Analysts Cut Their Target Price

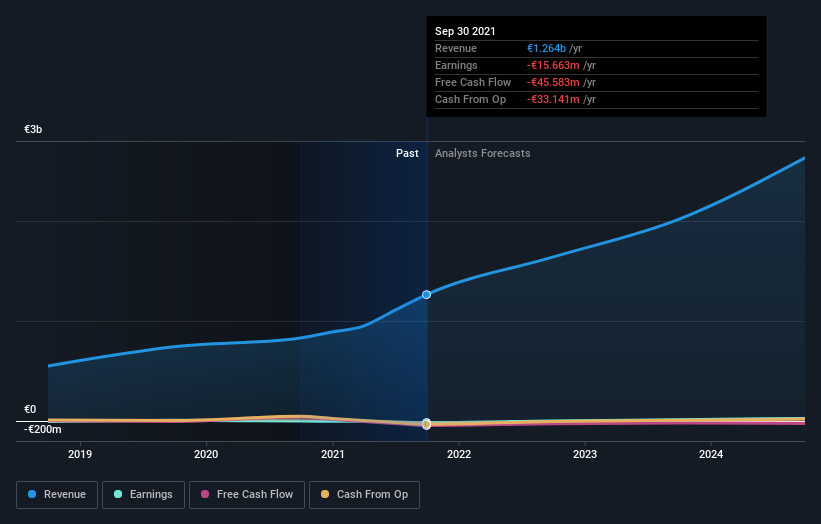

As you might know, Aramis Group SAS (EPA:ARAMI) last week released its latest full-year, and things did not turn out so great for shareholders. Revenues missed expectations somewhat, coming in at €1.3b, but statutory earnings fell catastrophically short, with a loss of €0.21 some 75% larger than what the analysts had predicted. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Aramis Group SAS

Taking into account the latest results, the current consensus from Aramis Group SAS' four analysts is for revenues of €1.64b in 2022, which would reflect a huge 30% increase on its sales over the past 12 months. Aramis Group SAS is also expected to turn profitable, with statutory earnings of €0.0035 per share. In the lead-up to this report, the analysts had been modelling revenues of €1.59b and earnings per share (EPS) of €0.18 in 2022. So it's pretty clear the analysts have mixed opinions on Aramis Group SAS after the latest results; even though they upped their revenue numbers, it came at the cost of a large cut to per-share earnings expectations.

The consensus price target fell 10% to €23.38, suggesting that the analysts are primarily focused on earnings as the driver of value for this business. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Aramis Group SAS analyst has a price target of €25.50 per share, while the most pessimistic values it at €20.00. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that Aramis Group SAS' rate of growth is expected to accelerate meaningfully, with the forecast 30% annualised revenue growth to the end of 2022 noticeably faster than its historical growth of 23% p.a. over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 12% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Aramis Group SAS to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Aramis Group SAS' future valuation.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple Aramis Group SAS analysts - going out to 2024, and you can see them free on our platform here.

And what about risks? Every company has them, and we've spotted 1 warning sign for Aramis Group SAS you should know about.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ARAMI

Aramis Group SAS

Engages in the online sale of used vehicles in France, Belgium, the United Kingdom, Austria, Italy, and Spain.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.