- France

- /

- Metals and Mining

- /

- ENXTPA:ERA

3 Value Stock Picks On Euronext Paris Including Aramis Group SAS

Reviewed by Simply Wall St

The French stock market has faced recent challenges, with the CAC 40 Index dropping 3.65% amid renewed fears about global economic growth. As investors navigate these turbulent times, identifying undervalued stocks can present compelling opportunities for those looking to capitalize on potential market inefficiencies. In this article, we will explore three value stock picks on Euronext Paris, including Aramis Group SAS. In the current environment of economic uncertainty and fluctuating indices, a good stock is often characterized by strong fundamentals and a resilient business model that can weather market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NSE (ENXTPA:ALNSE) | €29.30 | €58.44 | 49.9% |

| MEMSCAP (ENXTPA:MEMS) | €5.67 | €10.50 | 46% |

| Antin Infrastructure Partners SAS (ENXTPA:ANTIN) | €11.56 | €17.46 | 33.8% |

| Vivendi (ENXTPA:VIV) | €10.105 | €18.25 | 44.6% |

| Safran (ENXTPA:SAF) | €192.35 | €307.30 | 37.4% |

| Lectra (ENXTPA:LSS) | €27.40 | €53.79 | 49.1% |

| Guillemot (ENXTPA:GUI) | €5.28 | €9.01 | 41.4% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.07 | €5.14 | 40.3% |

| EKINOPS (ENXTPA:EKI) | €3.40 | €5.58 | 39% |

| OVH Groupe (ENXTPA:OVH) | €5.735 | €8.71 | 34.1% |

Here we highlight a subset of our preferred stocks from the screener.

Aramis Group SAS (ENXTPA:ARAMI)

Overview: Aramis Group SAS operates an online platform for selling used vehicles across France, Belgium, the United Kingdom, Austria, Italy, and Spain with a market cap of €433.26 million.

Operations: Aramis Group SAS generates revenue from various segments, including B2B (€175.70 million), Services (€109.33 million), Refurbished Cars (€1.44 billion), and Pre-Registered Cars (€375.16 million).

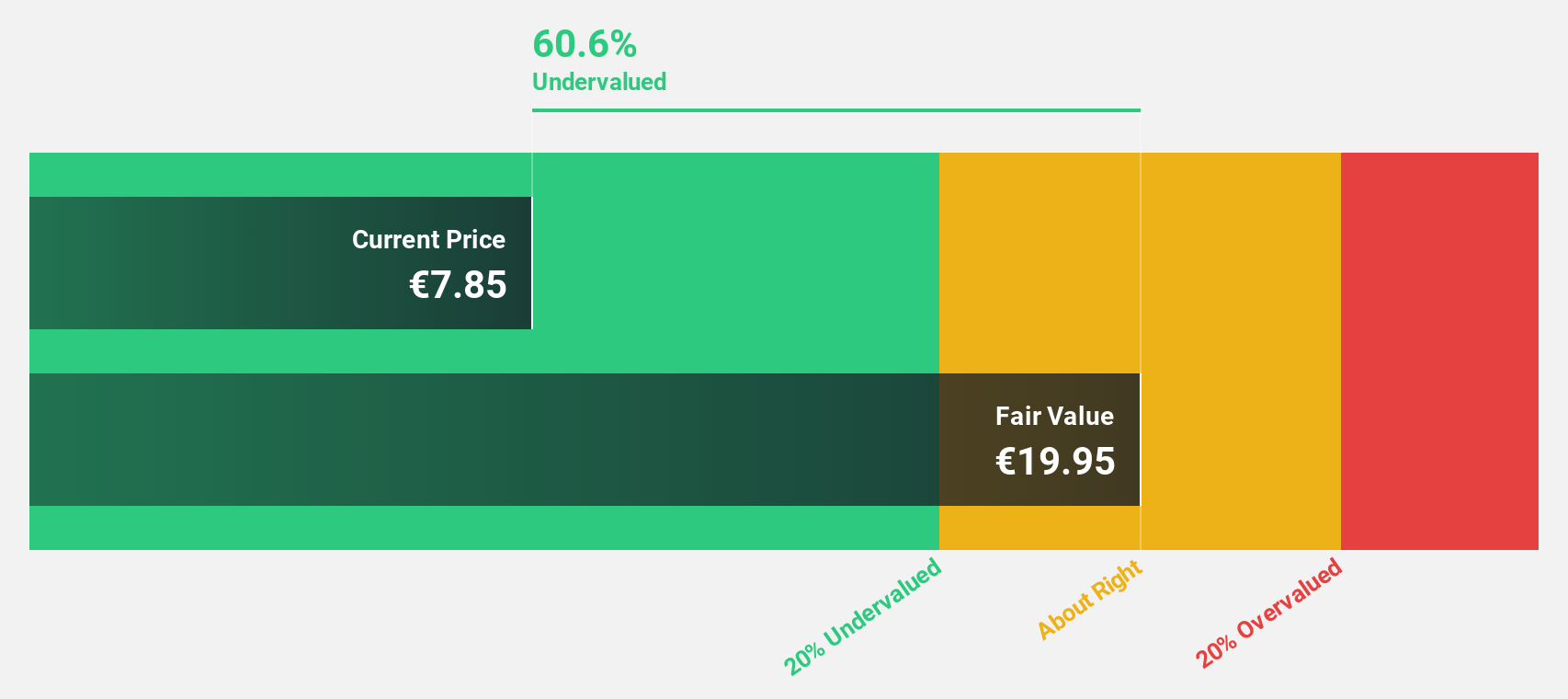

Estimated Discount To Fair Value: 12.3%

Aramis Group SAS is trading at €5.24, which is 12.3% below its estimated fair value of €5.97, indicating it may be undervalued based on cash flows. Despite a forecasted revenue growth of 10.2% per year, slower than the 20% benchmark but faster than the French market's 5.7%, earnings are expected to grow significantly by 117.91% annually and achieve profitability within three years, although its return on equity is projected to remain low at 9.4%.

- According our earnings growth report, there's an indication that Aramis Group SAS might be ready to expand.

- Take a closer look at Aramis Group SAS' balance sheet health here in our report.

ERAMET (ENXTPA:ERA)

Overview: ERAMET S.A. is a mining and metallurgical company with operations in France, Asia, Europe, North America, and internationally, with a market cap of €1.78 billion.

Operations: The company's revenue segments are Mining and Metals - Nickel (€789 million), Mining and Metals - Mineral Sands (€280 million), and Segment Adjustment (€2.03 billion).

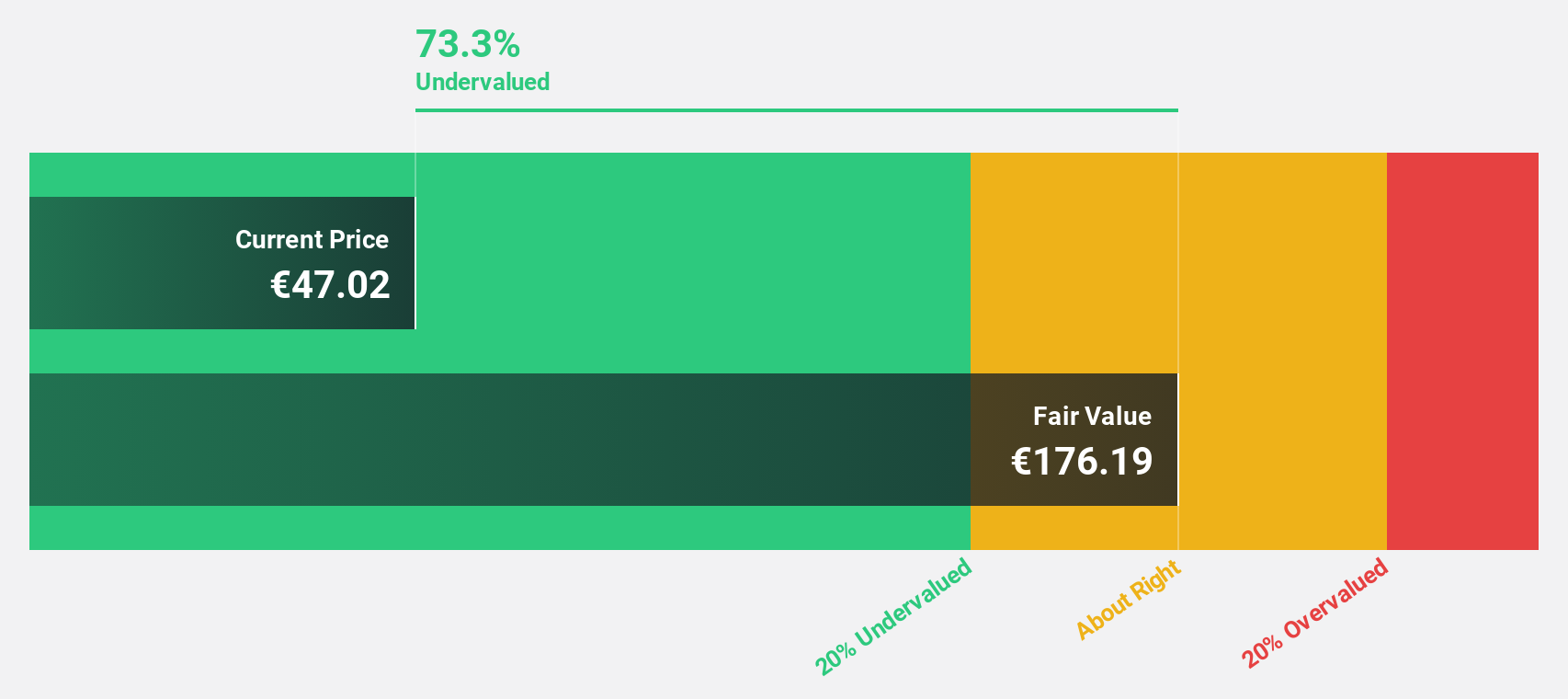

Estimated Discount To Fair Value: 13.7%

ERAMET is trading at €62.3, 13.7% below its estimated fair value of €72.22, suggesting it is undervalued based on cash flows. Despite a net loss of €41 million for H1 2024, the company’s revenue is forecast to grow faster than the French market at 9.6% per year and become profitable within three years. The recent inauguration of its lithium extraction plant in Argentina highlights strategic growth into battery metals, potentially enhancing future cash flows and valuation.

- Insights from our recent growth report point to a promising forecast for ERAMET's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of ERAMET.

Lectra (ENXTPA:LSS)

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets across Northern Europe, Southern Europe, the Americas, and the Asia Pacific with a market cap of €1.04 billion.

Operations: The company's revenue segments include €172.65 million from the Americas and €118.54 million from the Asia-Pacific region.

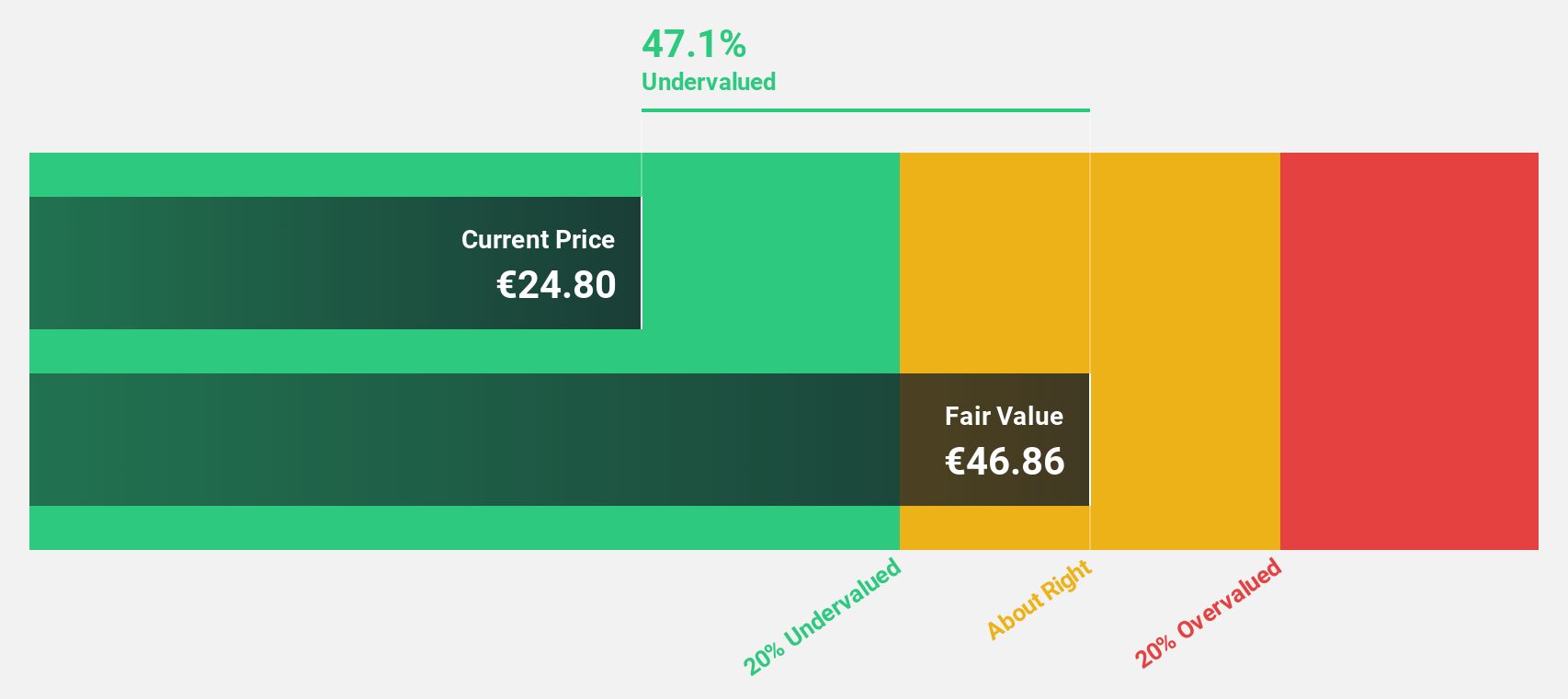

Estimated Discount To Fair Value: 49.1%

Lectra SA is trading at €27.4, significantly below its estimated fair value of €53.79, indicating it is highly undervalued based on cash flows. Despite a slight decline in net income to €12.51 million for H1 2024, the company’s earnings are forecast to grow 29.3% annually over the next three years, outpacing the French market's growth rate of 12.3%. However, its return on equity is expected to remain relatively low at 13.2%.

- In light of our recent growth report, it seems possible that Lectra's financial performance will exceed current levels.

- Click here to discover the nuances of Lectra with our detailed financial health report.

Seize The Opportunity

- Discover the full array of 20 Undervalued Euronext Paris Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ERAMET might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ERA

ERAMET

Produces and sells manganese and nickel in France, Europe, North America, China, Other Asia, Oceania, Africa, South America, and internationally.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives