To find a multi-bagger stock, what are the underlying trends we should look for in a business? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Mr. Bricolage's (EPA:ALMRB) returns on capital, so let's have a look.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Mr. Bricolage, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.14 = €22m ÷ (€364m - €205m) (Based on the trailing twelve months to June 2020).

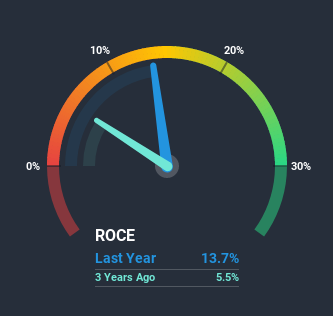

Therefore, Mr. Bricolage has an ROCE of 14%. In absolute terms, that's a satisfactory return, but compared to the Specialty Retail industry average of 10% it's much better.

View our latest analysis for Mr. Bricolage

In the above chart we have measured Mr. Bricolage's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

How Are Returns Trending?

You'd find it hard not to be impressed with the ROCE trend at Mr. Bricolage. The figures show that over the last five years, returns on capital have grown by 166%. That's not bad because this tells for every dollar invested (capital employed), the company is increasing the amount earned from that dollar. Interestingly, the business may be becoming more efficient because it's applying 56% less capital than it was five years ago. If this trend continues, the business might be getting more efficient but it's shrinking in terms of total assets.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Effectively this means that suppliers or short-term creditors are now funding 56% of the business, which is more than it was five years ago. Given it's pretty high ratio, we'd remind investors that having current liabilities at those levels can bring about some risks in certain businesses.

The Bottom Line

In the end, Mr. Bricolage has proven it's capital allocation skills are good with those higher returns from less amount of capital. Given the stock has declined 12% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. So researching this company further and determining whether or not these trends will continue seems justified.

Like most companies, Mr. Bricolage does come with some risks, and we've found 1 warning sign that you should be aware of.

While Mr. Bricolage isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you’re looking to trade Mr. Bricolage, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALMRB

Mr.Bricolage

Engages in retailing of renovation, home, and garden decoration products.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives