If you buy and hold a stock for many years, you'd hope to be making a profit. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Icade (EPA:ICAD) share price is up 22% in the last five years, that's less than the market return. But if you include dividends then the return is market-beating. The last year has been disappointing, with the stock price down 1.6% in that time.

View our latest analysis for Icade

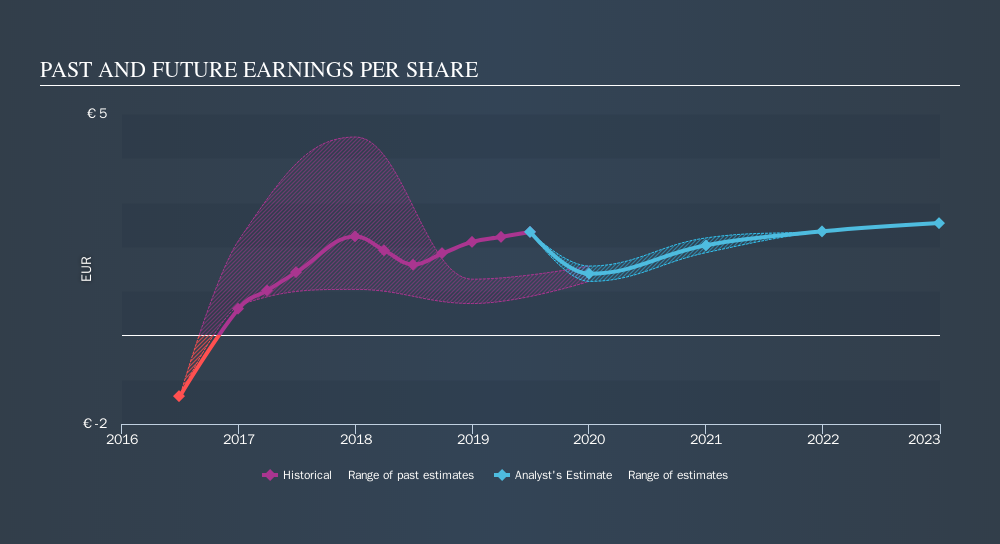

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, Icade moved from a loss to profitability. That's generally thought to be a genuine positive, so we would expect to see an increasing share price.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Icade's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Icade, it has a TSR of 61% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Icade shareholders are up 4.4% for the year (even including dividends). But that was short of the market average. If we look back over five years, the returns are even better, coming in at 10.0% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. Before forming an opinion on Icade you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:ICAD

Icade

A full-service real estate company with expertise in both commercial property investment (portfolio worth €6.8bn on a full consolidation basis as of 12/31/2023) and property development (2023 economic revenue of €1.3bn) that operates throughout France.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives