- France

- /

- Real Estate

- /

- ENXTPA:EFI

The Market Doesn't Like What It Sees From Eurasia Fonciere Investissements Société Anonyme's (EPA:EFI) Earnings Yet As Shares Tumble 39%

Eurasia Fonciere Investissements Société Anonyme (EPA:EFI) shareholders won't be pleased to see that the share price has had a very rough month, dropping 39% and undoing the prior period's positive performance. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

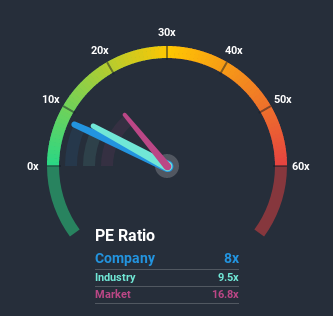

After such a large drop in price, Eurasia Fonciere Investissements Société Anonyme's price-to-earnings (or "P/E") ratio of 8x might make it look like a strong buy right now compared to the market in France, where around half of the companies have P/E ratios above 17x and even P/E's above 34x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Eurasia Fonciere Investissements Société Anonyme recently, which is pleasing to see. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Check out our latest analysis for Eurasia Fonciere Investissements Société Anonyme

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Eurasia Fonciere Investissements Société Anonyme's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 27% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 56% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for a contraction of 1.7% shows the market is more attractive on an annualised basis regardless.

In light of this, it's understandable that Eurasia Fonciere Investissements Société Anonyme's P/E sits below the majority of other companies. However, when earnings shrink rapidly P/E often shrinks too, which could set up shareholders for future disappointment regardless. Even just maintaining these prices will be difficult to achieve as recent earnings trends are already weighing down the shares heavily.

The Final Word

Having almost fallen off a cliff, Eurasia Fonciere Investissements Société Anonyme's share price has pulled its P/E way down as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Eurasia Fonciere Investissements Société Anonyme revealed its sharp three-year contraction in earnings is contributing to its low P/E, given the market is set to shrink less severely. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Although, we would be concerned whether the company can even maintain its medium-term level of performance under these tough market conditions. For now though, it's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Eurasia Fonciere Investissements Société Anonyme (1 is significant!) that you should be aware of before investing here.

If you're unsure about the strength of Eurasia Fonciere Investissements Société Anonyme's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

When trading Eurasia Fonciere Investissements Société Anonyme or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eurasia Fonciere Investissements Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:EFI

Eurasia Fonciere Investissements Société Anonyme

Through its subsidiaries, engages in holding and acquiring real estate assets in France and internationally.

Very low with weak fundamentals.

Market Insights

Community Narratives