Bleecker Société Anonyme (EPA:BLEE) rallies 17% this week, taking three-year gains to 6.3%

This week we saw the Bleecker Société Anonyme (EPA:BLEE) share price climb by 17%. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 14% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

Bleecker Société Anonyme wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Bleecker Société Anonyme saw its revenue grow by 13% per year, compound. That's a pretty good rate of top-line growth. Shareholders have endured a share price decline of 5% per year. So the market has definitely lost some love for the stock. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

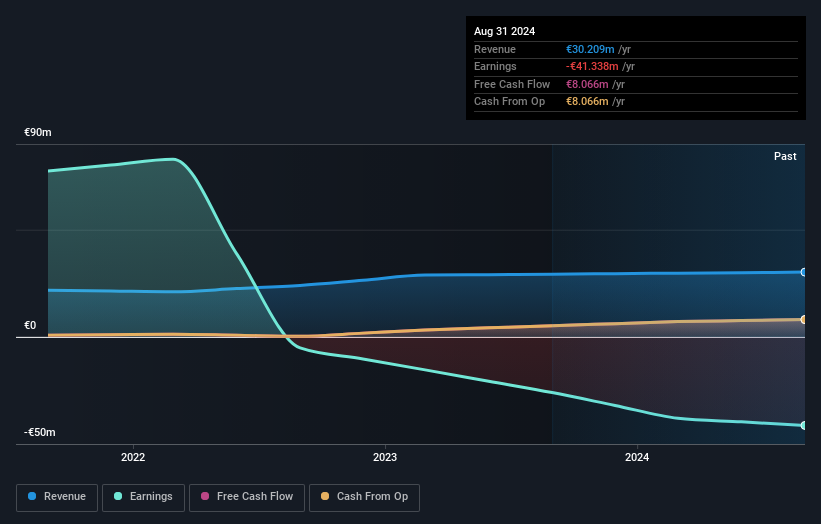

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We've already covered Bleecker Société Anonyme's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Bleecker Société Anonyme's TSR of 6.3% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

While it's certainly disappointing to see that Bleecker Société Anonyme shares lost 2.7% throughout the year, that wasn't as bad as the market loss of 6.4%. Longer term investors wouldn't be so upset, since they would have made 4%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It's always interesting to track share price performance over the longer term. But to understand Bleecker Société Anonyme better, we need to consider many other factors. For example, we've discovered 2 warning signs for Bleecker Société Anonyme that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bleecker Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:BLEE

Bleecker Société Anonyme

A property company, operates in the real estate sector in France.

Good value with very low risk.

Market Insights

Community Narratives