- France

- /

- Industrial REITs

- /

- ENXTPA:ARG

Is Now the Right Time to Reassess Argan After Its 4% Year to Date Rebound?

Reviewed by Simply Wall St

Argan is one of those companies that gets investors talking, especially when the market is as unpredictable as it has been lately. You might be looking at its recent performance and wondering if now is the time to buy, hold, or move on. After all, in the past year, shares have dipped by 12.7% and lagged even further over the three and five-year marks. However, despite these longer-term slides, there has been a flicker of optimism, with a 4.4% climb year-to-date and a slight 0.2% uptick in the last week. These small moves hint at shifting sentiment or perhaps a change in the company’s risk profile.

What is driving this change? Market developments have added some intrigue, as Argan sits in sectors seeing shifting demand and evolving project pipelines. Investors are starting to take notice, which is often a precursor to bigger things in the future.

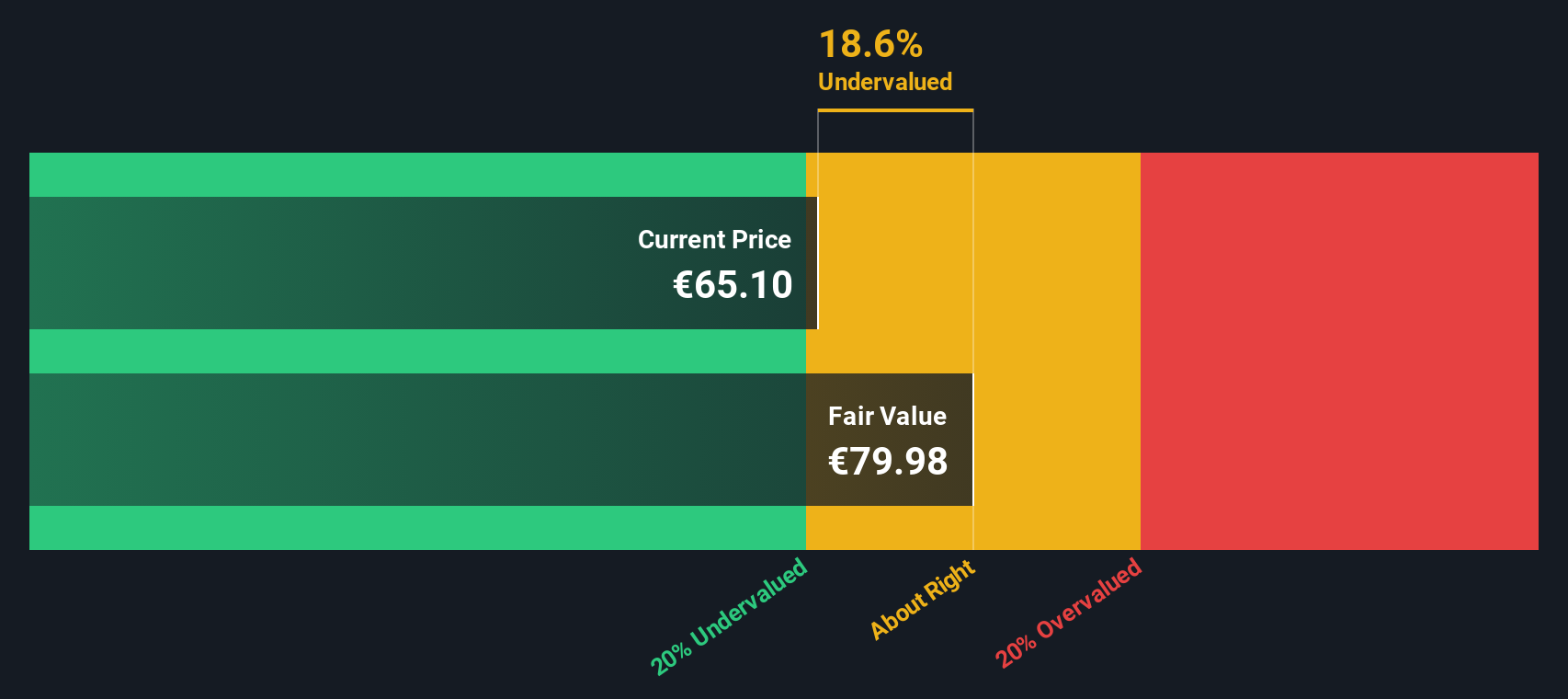

But let us get to what you are really here for: is Argan undervalued? By our count, the company checks off the boxes in 5 out of 6 key valuation metrics, which is an impressive value score and signals potential upside for the patient investor. In the next section, we will break down exactly how those valuation approaches stack up. If you stick around to the end, we will walk through an even better way to think about what Argan is really worth in today’s market.

Why Argan is lagging behind its peersApproach 1: Argan Discounted Cash Flow (DCF) Analysis

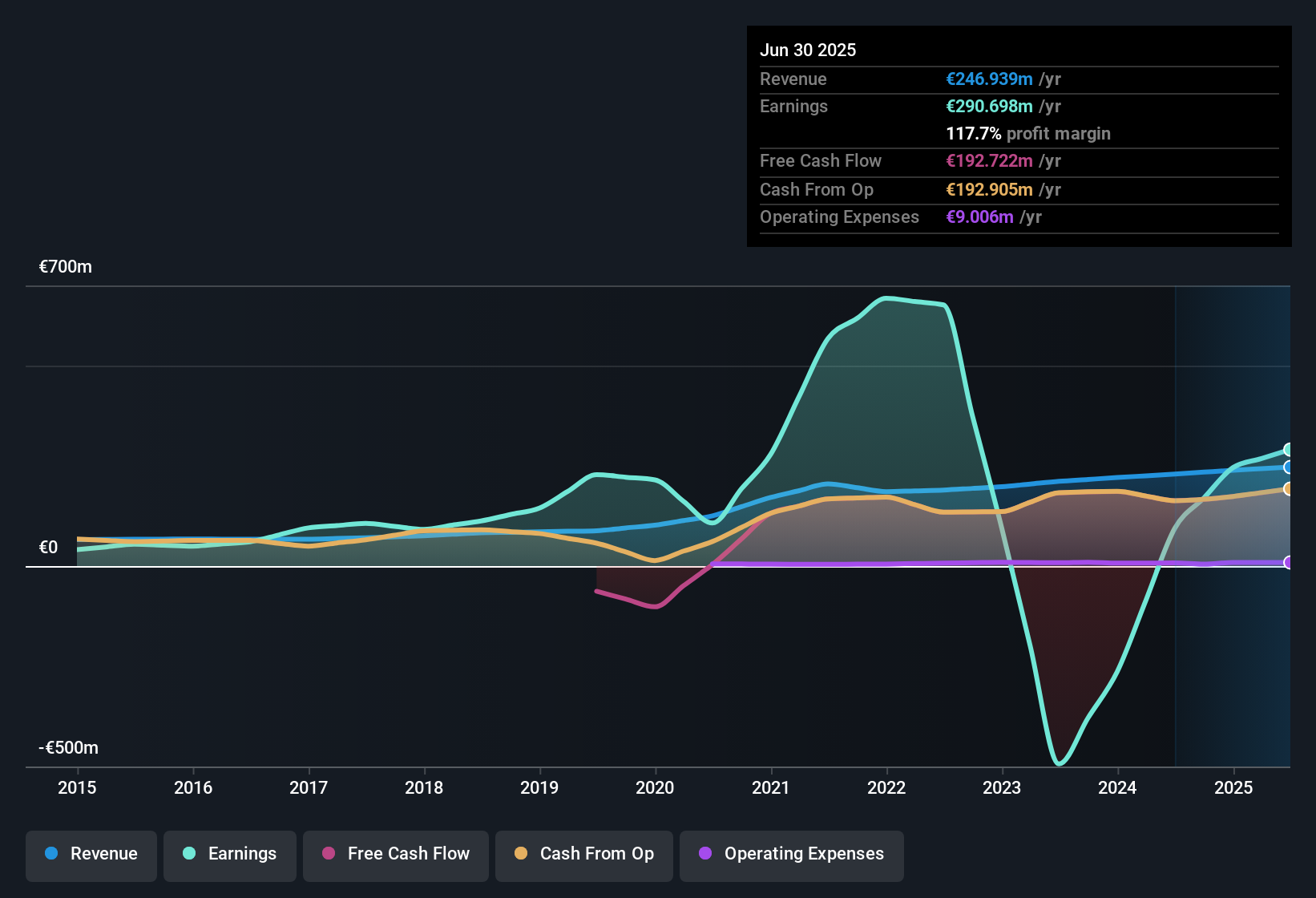

The Discounted Cash Flow (DCF) model estimates the value of Argan by projecting future funds from operations and discounting those cash flows back to today’s value, all calculated in euros. This approach helps investors gauge what the company is really worth based on its ability to generate cash in the years ahead.

Argan’s latest reported Free Cash Flow stands at €192.91 million. Analyst projections extend through 2027, forecasting Free Cash Flow of €156.87 million by that year. Beyond the fifth year, Simply Wall St extrapolates cash flows, expecting a gradual expansion, with the projection for 2035 reaching €179.69 million. All these estimates are provided in millions, not billions, making the numbers straightforward and digestible for investors.

Based on this two-stage DCF analysis, the estimated intrinsic value of Argan shares is €76.78. At current market prices, the stock appears to be trading at a 16.9% discount to this value. This result suggests that Argan is materially undervalued according to the DCF model and may offer an attractive entry point for those with a long-term perspective.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Argan.

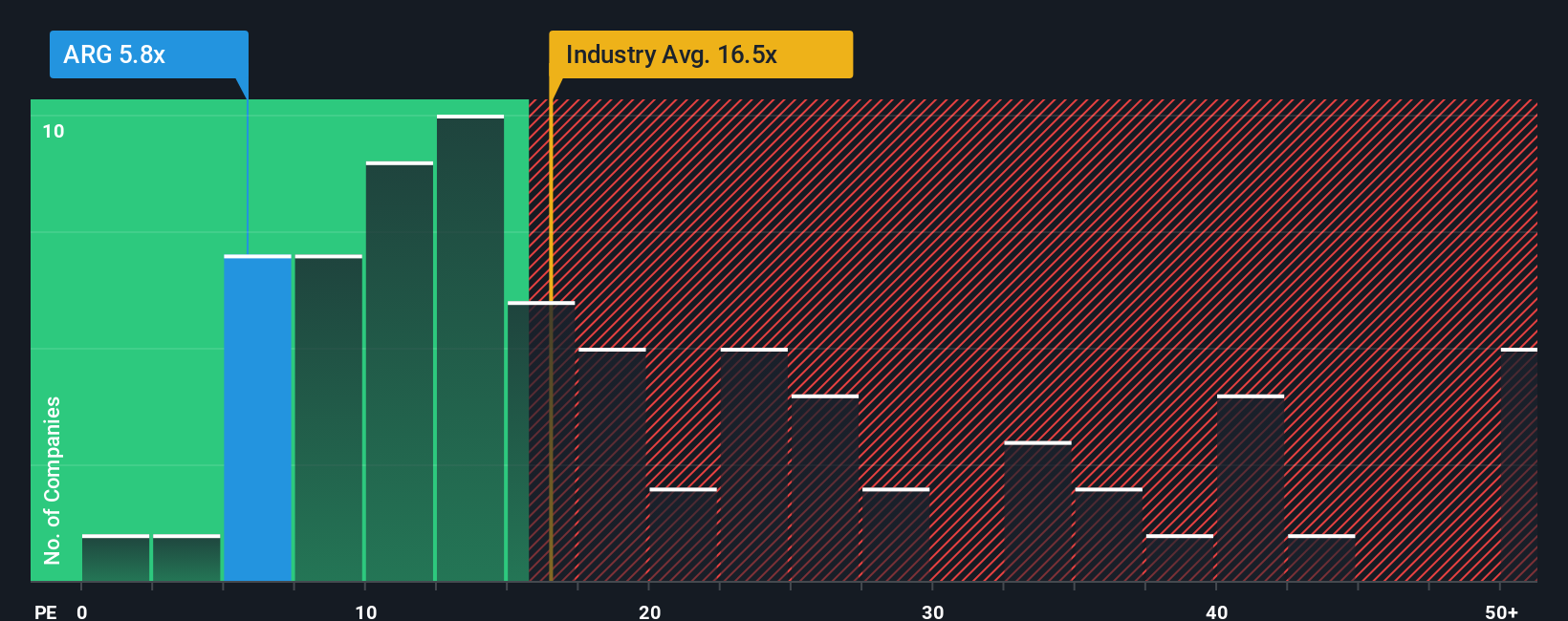

Approach 2: Argan Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Argan because it connects the current share price to the company’s underlying earnings. This makes it useful for evaluating whether the stock is attractively priced relative to how much profit it produces. Generally, investors expect companies with strong growth prospects and lower risks to trade at higher PE ratios. In contrast, slower growers or high-risk businesses tend to have lower ratios.

Currently, Argan trades at a PE ratio of just 5.64x. That figure is well below the average PE of 16.74x for Industrial REITs and the peer group’s 17.20x. At first glance, this significant discount might appear to be a clear buying signal. However, it is important to consider whether Argan's growth outlook, profitability, and risk profile justify a higher or lower ratio compared to these benchmarks.

This is where Simply Wall St’s Fair Ratio comes into play. The Fair Ratio for Argan is 10.77x, which incorporates not only industry dynamics and peer multiples, but also company-specific factors such as earnings growth, profit margins, market cap, and unique risks. By using the Fair Ratio, investors get a more tailored sense of what a reasonable valuation would be instead of relying solely on market averages that might not reflect Argan’s specific situation. With Argan’s current PE at 5.64x and the Fair Ratio at 10.77x, the shares appear to be materially undervalued based on this deeper analysis.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Argan Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. In simple terms, a Narrative is the story or perspective you have about a company, such as Argan, backed by your own assumptions on its future revenue, earnings, margins, and a fair value estimate. Narratives bring together the company’s story, a financial forecast, and a calculated fair value in one place, making complex analysis accessible to every investor.

Simply Wall St’s Narratives, found on the Community page used by millions, help you decide when to buy or sell by showing how your fair value compares with the actual share price. They update dynamically when major events like news or earnings are released, so you always have the latest context. For example, one investor’s optimistic Narrative for Argan might project a fair value of €82 per share, while another takes a more cautious view at €69 per share. With Narratives, you can instantly see how different assumptions shape investment decisions, giving you a smarter, clearer path to act with conviction.

Do you think there's more to the story for Argan? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ARG

Argan

ARGAN is the only French real estate company specializing in the DEVELOPMENT & RENTAL OF PREMIUM WAREHOUSES listed on EURONEXT and is the leading player of its market in France.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives