- France

- /

- Industrial REITs

- /

- ENXTPA:ARG

Argan (ENXTPA:ARG) Valuation in Focus Following Completion of 12-Year Leased Sustainable Logistics Facility

Reviewed by Simply Wall St

Argan (ENXTPA:ARG) has just completed a 9,000 sq.m logistics facility in Vendin-le-Vieil, securing a 12-year lease with a major international logistics group. This project combines operational scale with a focus on sustainability.

See our latest analysis for Argan.

Following this milestone in Vendin-le-Vieil, Argan’s momentum has been steady this year. The stock’s share price return year-to-date sits at a solid 10.31%. Over the past year, total shareholder return reached 4.26%, signaling consistency but also highlighting a period of muted long-term growth. Recent price moves suggest that investors are rewarding Argan’s ability to land high-profile, long-duration leases, while focusing on sustainable expansion and sector trends.

If this mix of growth and reliability appeals to you, it could be worth broadening your search and uncovering opportunities among fast growing stocks with high insider ownership.

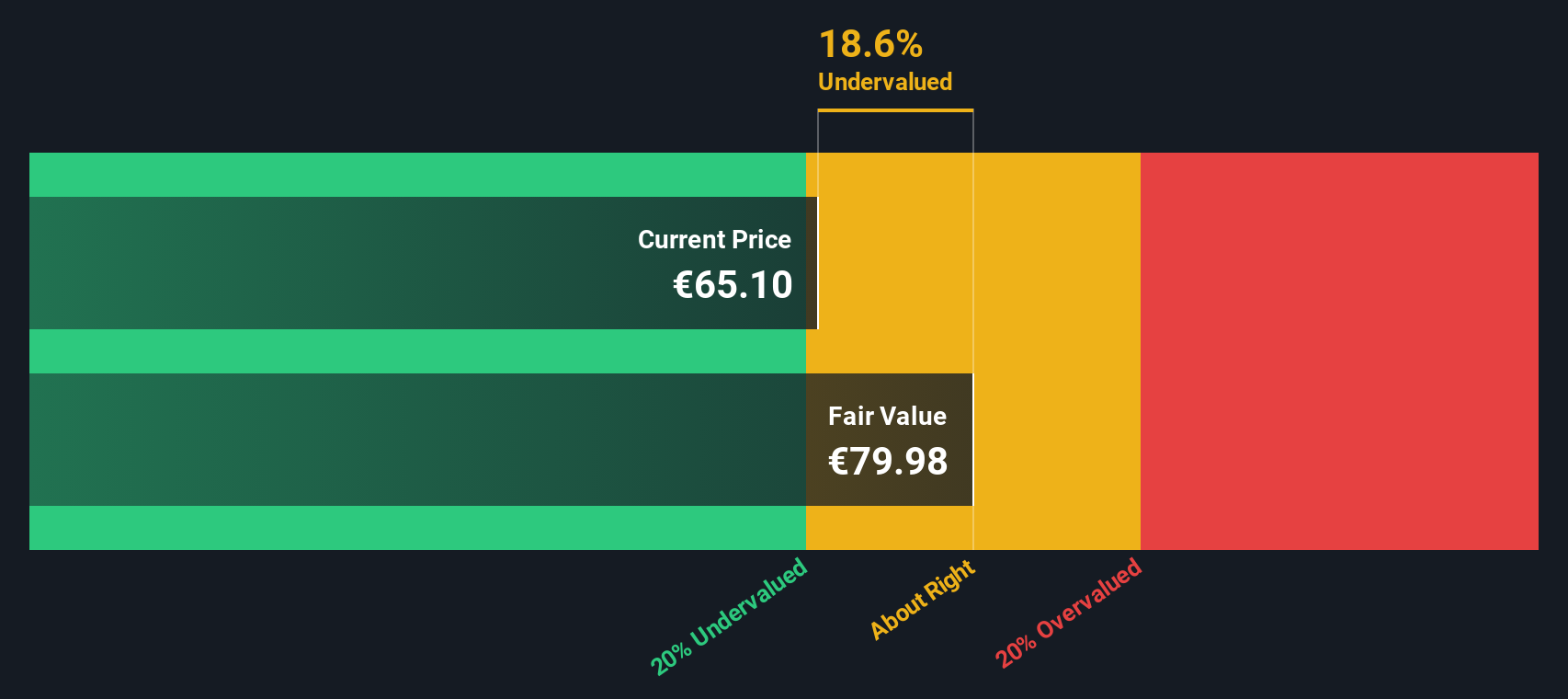

With Argan’s shares trading nearly 20% below analyst targets despite consistent lease wins, the key question is whether investors are overlooking potential value or if the current price already reflects all the company’s future growth prospects.

Price-to-Earnings of 6x: Is it justified?

With Argan trading at a price-to-earnings ratio of 6x, shares look attractively valued when compared to both the company's peers and the wider industry. The last close was €67.4, sitting well below peer and sector averages, which suggests investors are pricing in limited future growth.

The price-to-earnings ratio, or P/E, gauges how much the market is willing to pay for each euro of the company’s reported profits. For real estate investment trusts like Argan, P/E is an especially useful indicator as it captures sector-specific profitability alongside perceived risk and reliability of earnings.

This unusually low ratio, compared to an industry average of 16.9x and a peer average of 21.9x, signals that Argan may be overlooked relative to its consistent dividend stream and recent lease momentum. Regression-based fair value analysis points toward a P/E of 10.7x, a level the market could move closer to if confidence returns.

Explore the SWS fair ratio for Argan

Result: Price-to-Earnings of 6x (UNDERVALUED)

However, recent declines in both annual revenue and net income growth could dampen optimism if these trends continue or worsen in upcoming quarters.

Find out about the key risks to this Argan narrative.

Another View: What Does the DCF Model Suggest?

While the current price-to-earnings ratio points to possible undervaluation, our DCF model arrives at a similar view but uses projected future cash flows instead of profits. According to this approach, Argan’s shares trade below our fair value estimate of €84.12. Could the DCF model be capturing value that the market is missing? Will upcoming results change the picture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Argan for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Argan Narrative

If you have a different perspective or want to dig into the numbers yourself, it takes just a few minutes to build your own view of Argan, and Do it your way.

A great starting point for your Argan research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Fuel your investing journey by checking out smart alternatives curated for growth, innovation, and reliable income. Don’t sit on the sidelines while others capitalize on these unique opportunities.

- Unlock explosive long-term potential by starting with these 27 AI penny stocks, a selection of companies at the forefront of artificial intelligence transformation.

- Boost your passive income strategy and discover attractive yield opportunities amid market uncertainty with these 15 dividend stocks with yields > 3%.

- Tap into high-upside sectors early by viewing these 82 cryptocurrency and blockchain stocks for leading advancements in digital finance and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ARG

Argan

ARGAN is the only French real estate company specializing in the DEVELOPMENT & RENTAL OF PREMIUM WAREHOUSES listed on EURONEXT and is the leading player of its market in France.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives