- France

- /

- Residential REITs

- /

- ENXTPA:ALTA

Is There an Opportunity in Altarea After Its 9% Weekly Price Surge?

Reviewed by Simply Wall St

Wondering what to make of Altarea stock these days? You are definitely not alone. Whether you are seeking your next growth opportunity, looking to time your entry, or just trying to get perspective on its long-term direction, there is a lot to unpack. Altarea has been making waves lately, with the share price popping 9.1% over the past week and bringing its year-to-date gain to 9.8%. Not bad at all, especially considering that last month saw a modest dip of 2.2%, and the one-year return stands in the green at 4.5%. If you have held over the last five years, you have seen a 19.8% total return, but the three-year period has been flatter at -3.0%, highlighting how quickly market sentiment can shift.

It is no secret that changing conditions in the French property sector and renewed market optimism have helped bump up perceived growth prospects for real estate companies. Altarea certainly seems to be benefiting from some of that momentum, as investors look beyond short-term jitters and reassess potential risks versus upside. Naturally, this brings us to the big question: Is Altarea undervalued right now, or is the current price justified? Here is an eye-opener: on a 6-point valuation check, Altarea scores a 3. That means the company passes half the key benchmarks for undervaluation, hinting at genuine value but also flagging areas to scrutinize closely.

To really get under the hood and answer the valuation question, let us break down several valuation approaches side by side. And if you are after the clearest perspective of all, stay tuned, as there is an even more insightful way to look at Altarea’s worth that we will explore at the end.

Altarea delivered 4.5% returns over the last year. See how this stacks up to the rest of the Residential REITs industry.Approach 1: Altarea Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows, in this case, adjusted funds from operations, and discounting them back to today to reflect their present value. This approach aims to determine what Altarea is really worth, based solely on its ability to generate cash in the years ahead.

Altarea’s latest Twelve-Month Free Cash Flow amounts to €127.2 million. Analysts provide reliable estimates for about five years, but projections stretch to ten years, factoring in declining growth rates that taper off as time goes by. For example, estimated Free Cash Flow is set to be €100.8 million in 2026 and €70.7 million by 2035, each discounted to reflect today's value.

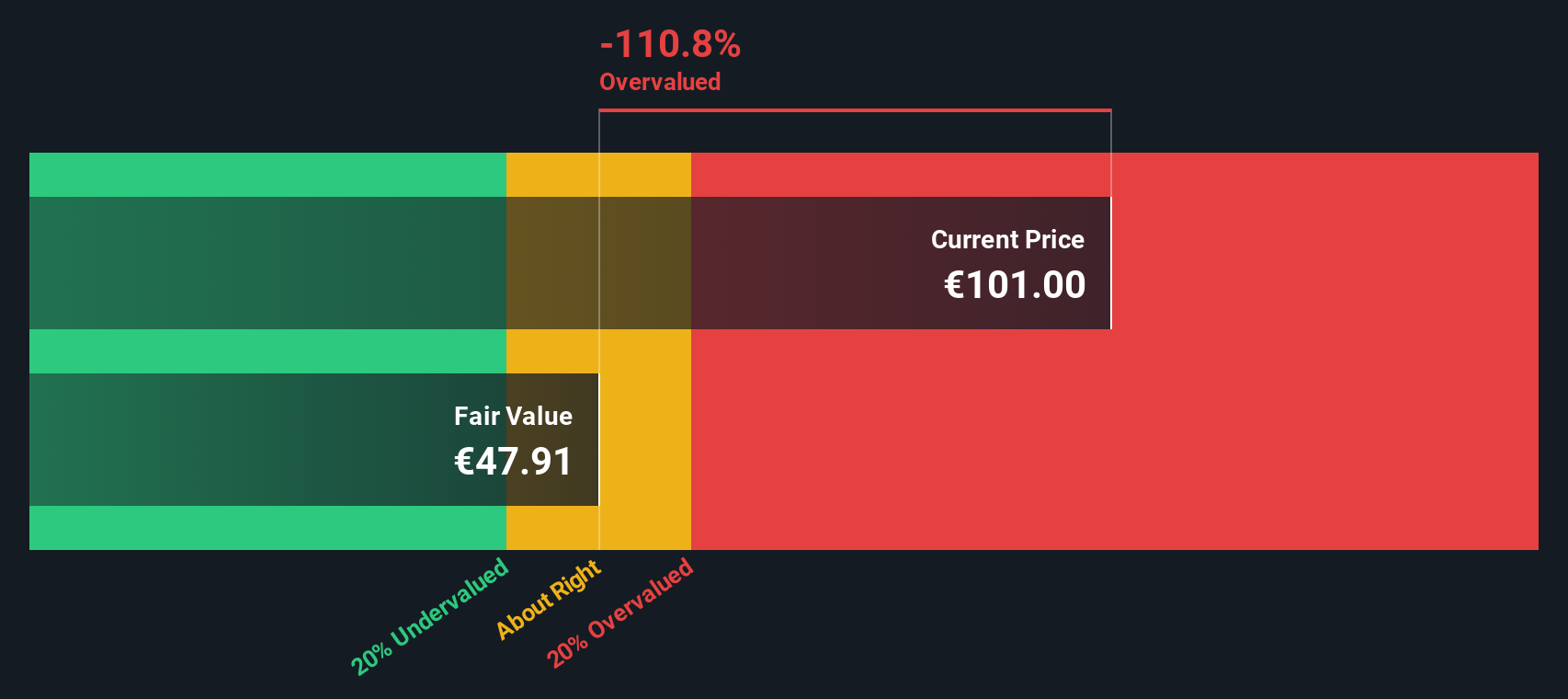

When all future cash flows are summed up and discounted, the DCF model produces an intrinsic value of €47.69 per share for Altarea. Compared to the current market price, this implies the share is trading at a 123.9% premium to its calculated worth, indicating significant overvaluation according to the DCF standpoint.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Altarea.

Approach 2: Altarea Price vs Sales

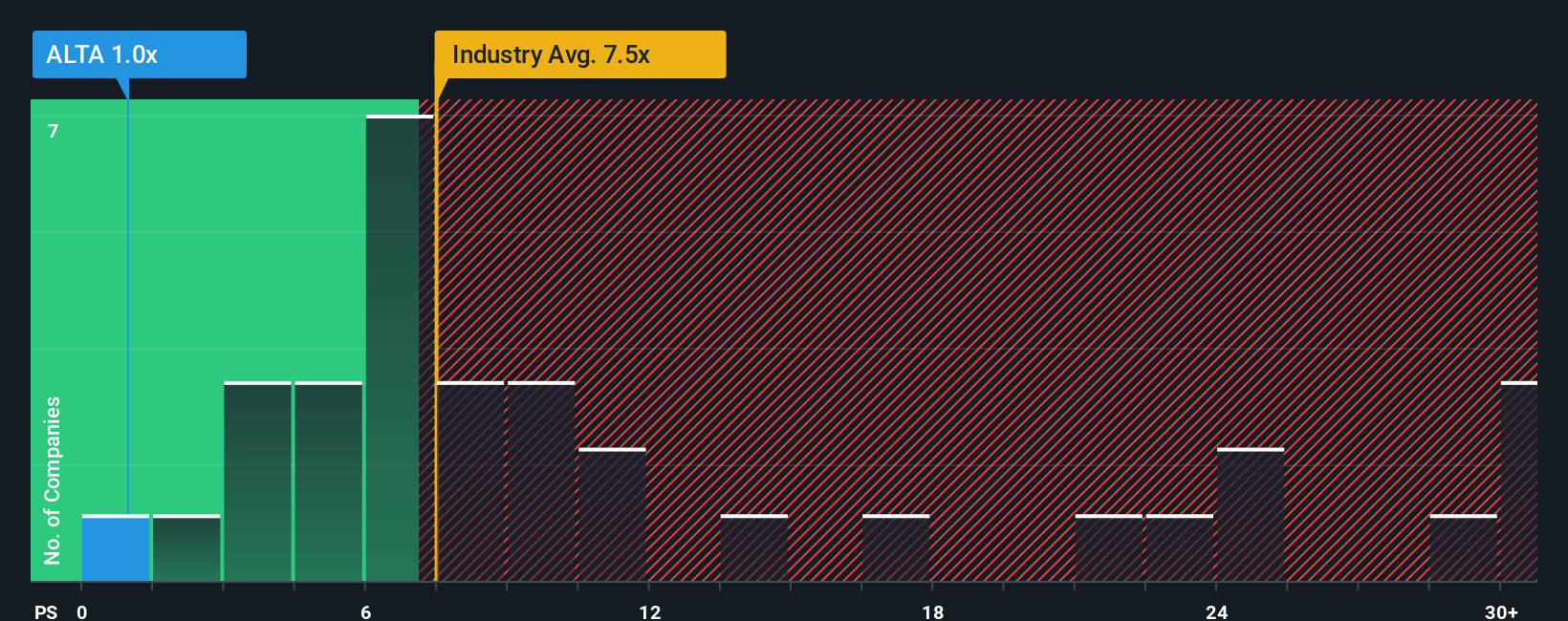

For profitable companies, the Price-to-Sales (P/S) ratio is a well-recognized method to gauge valuation, especially when earnings figures might be volatile or influenced by unique accounting items. The P/S ratio provides a clear lens by comparing a company's market value to its revenue, making it useful for evaluating real estate businesses like Altarea, where sales reflect the underlying asset activity more reliably than profits alone.

Market expectations for growth and a company's perceived risk profile both play vital roles in what is considered a “normal” or “fair” P/S multiple. Fast-growing and lower-risk companies typically command higher multiples, while slower growth or more uncertainty tends to suppress them. Currently, Altarea trades on a P/S ratio of 1.01x. To give this context, the industry average for Residential REITs stands at a much higher 7.00x, and Altarea’s closest peers average 11.65x. On the surface, this suggests Altarea is trading at a considerable discount to both industry and peers.

However, not all discounts suggest value. This is where the Simply Wall St "Fair Ratio" comes in. Unlike raw industry or peer comparisons, the Fair Ratio sets expectations based on Altarea’s specific growth outlook, profit margins, market cap, and risk factors. It distills how the market should price the business after considering what truly drives its prospects. For Altarea, the Fair P/S ratio is 1.65x, which is noticeably higher than its current level. This means the shares are trading below what you might consider reasonable, even after factoring in the company’s unique risks and fundamentals. By focusing on the Fair Ratio, investors get a clearer sense of whether the discount is justified or an actual opportunity.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Altarea Narrative

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives, a simple yet smarter approach to making investment decisions. A Narrative is more than just numbers; it lets you tell the story behind a company by linking your perspective on its future with financial forecasts and a personalized fair value. Narratives connect the dots between Altarea’s performance, your expectations for its revenue and profits, and what you believe the shares should be worth.

This tool is easy to use and available on the Simply Wall St platform within the Community page, used by millions of investors worldwide. Narratives help you know when to buy or sell by comparing your fair value estimate with the current price, and they automatically update as new company news or earnings come in. For example, one investor might use a Narrative to justify a much higher Altarea fair value based on a bullish outlook for the real estate sector, while another might set a lower estimate based on more cautious assumptions. Narratives make your investment strategy clearer and more agile, putting you in the driver’s seat with real-time insights tailored to your view.

Do you think there's more to the story for Altarea? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALTA

Altarea

Altarea is the French leader in low-carbon urban transformation, with the most comprehensive real estate offering to serve the city and its users.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives