- France

- /

- Capital Markets

- /

- ENXTPA:BSD

Exploring Bourse Direct And 2 Other Undiscovered Gems In France

Reviewed by Simply Wall St

As European markets respond to the European Central Bank's recent interest rate cut, France's CAC 40 Index has shown modest gains, reflecting a cautiously optimistic sentiment among investors. In this environment of potential monetary easing, identifying promising small-cap stocks like Bourse Direct and other lesser-known players in France can offer unique opportunities for those seeking growth beyond the mainstream indices.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative | 10.84% | 3.22% | 6.38% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| ADLPartner | 82.84% | 9.86% | 16.18% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Vaziva Société anonyme | 8.03% | 68.56% | 431.41% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Bourse Direct (ENXTPA:BSD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bourse Direct SA is a French company specializing in Internet stock brokerage services with a market capitalization of €246.17 million.

Operations: Bourse Direct generates revenue primarily through its Stock Exchange Online segment, contributing €60.25 million, and Financial Intermediation services at €6.94 million.

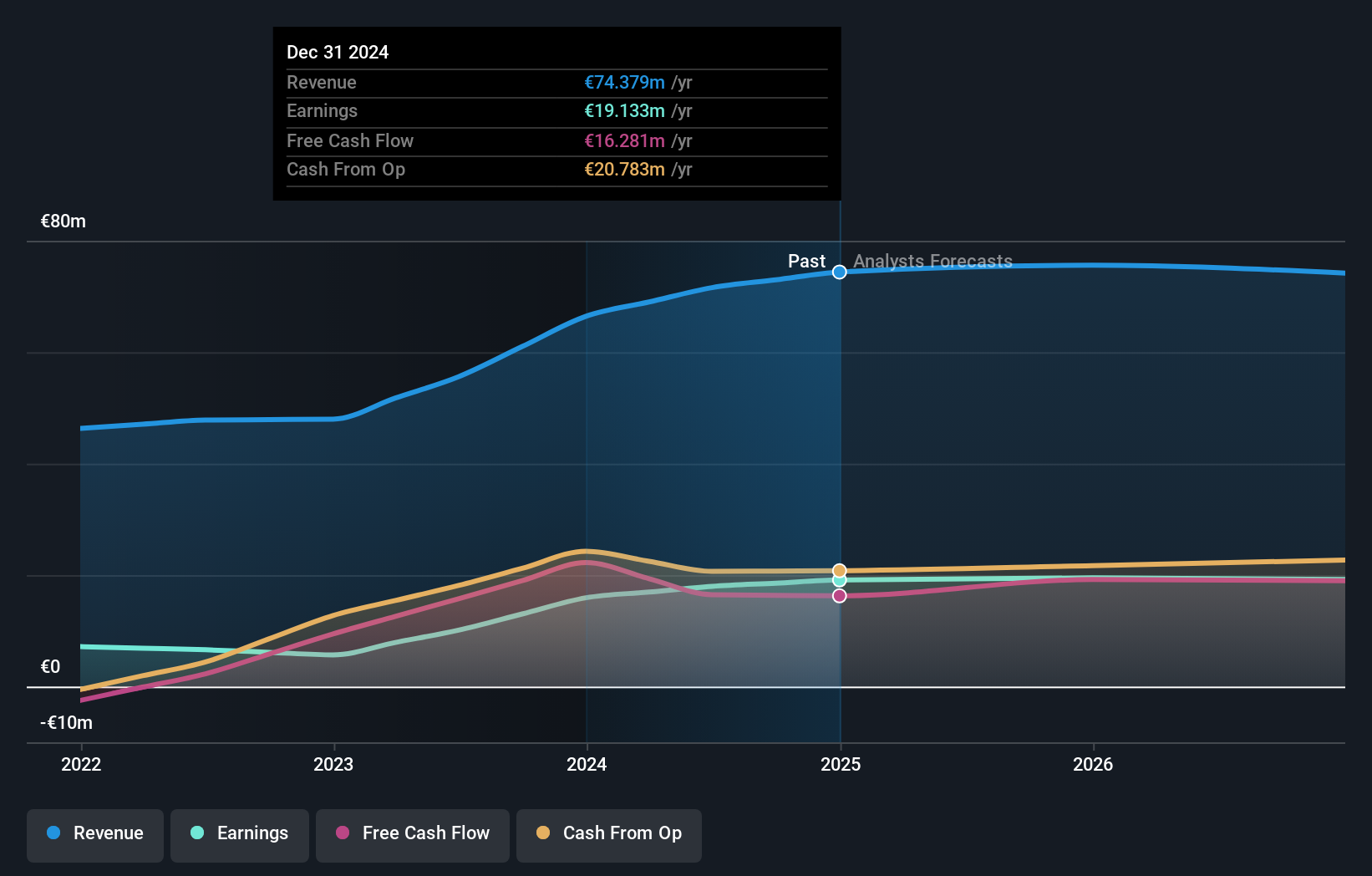

Bourse Direct, a notable player in the financial sector, showcases impressive earnings growth of 77.5% over the past year, surpassing the Capital Markets industry average of 47.8%. With a price-to-earnings ratio of 13.7x, it offers better value compared to the French market's 14.1x. The company has significantly reduced its debt to equity ratio from a hefty 224% to a more manageable 61% over five years, indicating improved financial health. Additionally, Bourse Direct is free cash flow positive and maintains high-quality earnings, positioning itself as an intriguing option for those exploring investment opportunities in France's financial landscape.

- Click to explore a detailed breakdown of our findings in Bourse Direct's health report.

Gain insights into Bourse Direct's historical performance by reviewing our past performance report.

Caisse Regionale de Credit Agricole Mutuel Toulouse 31 (ENXTPA:CAT31)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caisse Regionale de Credit Agricole Mutuel Toulouse 31 operates as a cooperative bank in France with a market capitalization of approximately €299.98 million.

Operations: The cooperative bank generates revenue primarily from its retail banking segment, amounting to €249.69 million.

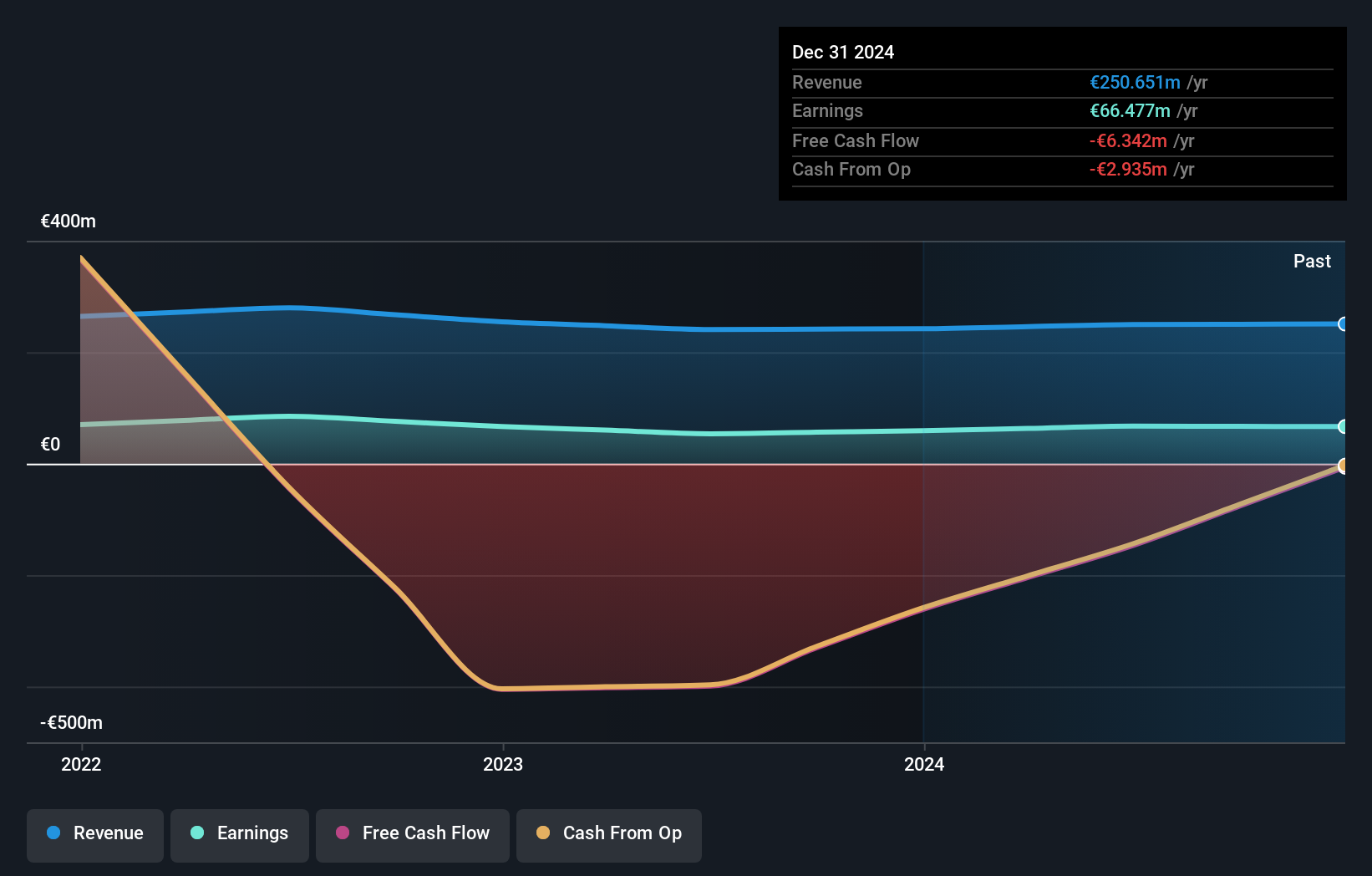

Toulouse 31, a regional player in France's banking sector, showcases impressive financial health with total assets of €16.3 billion and equity of €2 billion. Its earnings growth over the past year hit 25.4%, outpacing the industry average of 4%, while maintaining high-quality earnings. The bank's liabilities are primarily low-risk customer deposits, making up 95% of its funding sources, which is less risky than external borrowing. Additionally, it has an appropriate bad loans ratio at 1.4% and trades at a significant discount to estimated fair value by about 65%.

Fiducial Real Estate (ENXTPA:ORIA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fiducial Real Estate SA operates and manages real estate properties in France with a market capitalization of €424.86 million.

Operations: Fiducial Real Estate generates revenue primarily from land activities (€71.21 million) and service provider activities (€23.01 million), while intersector sales reduce total revenue by €7.95 million.

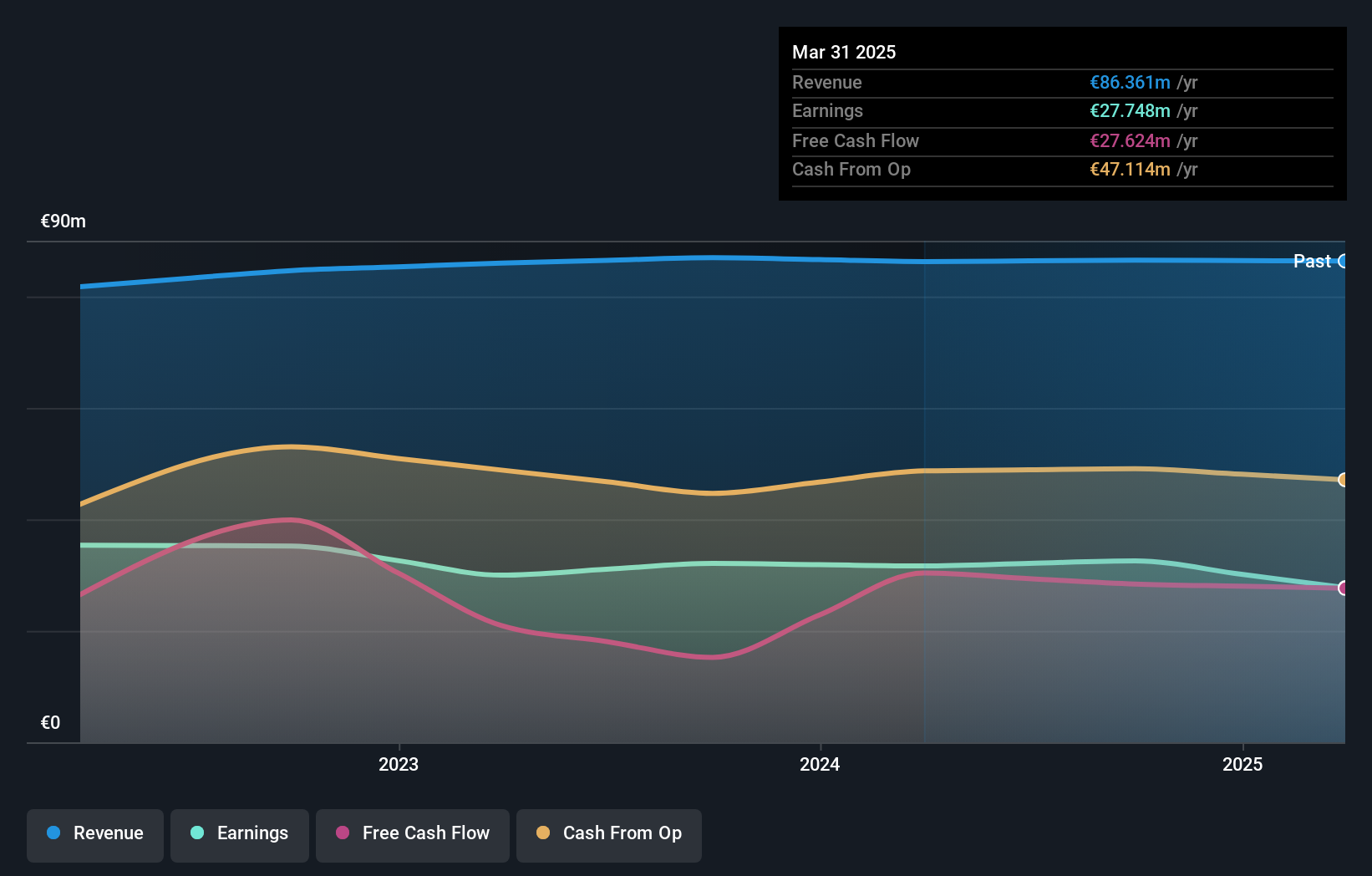

Fiducial Real Estate, a relatively smaller player in the market, has demonstrated solid financial health with earnings growing by 5.6% over the past year, outpacing the broader real estate industry's -12.3%. The company appears to be trading at a slight discount of 1.9% below its estimated fair value, suggesting potential for value appreciation. Over five years, Fiducial's debt-to-equity ratio impressively decreased from 81.2% to 33.8%, indicating effective debt management and financial stability. Additionally, interest payments are well-covered by EBIT at six times coverage, which underscores its robust earnings quality and prudent financial practices in the current environment.

Next Steps

- Click through to start exploring the rest of the 36 Euronext Paris Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bourse Direct might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BSD

Solid track record with excellent balance sheet.

Market Insights

Community Narratives