- France

- /

- Real Estate

- /

- ENXTPA:NXI

Improved Revenues Required Before Nexity SA (EPA:NXI) Stock's 26% Jump Looks Justified

The Nexity SA (EPA:NXI) share price has done very well over the last month, posting an excellent gain of 26%. Looking further back, the 15% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

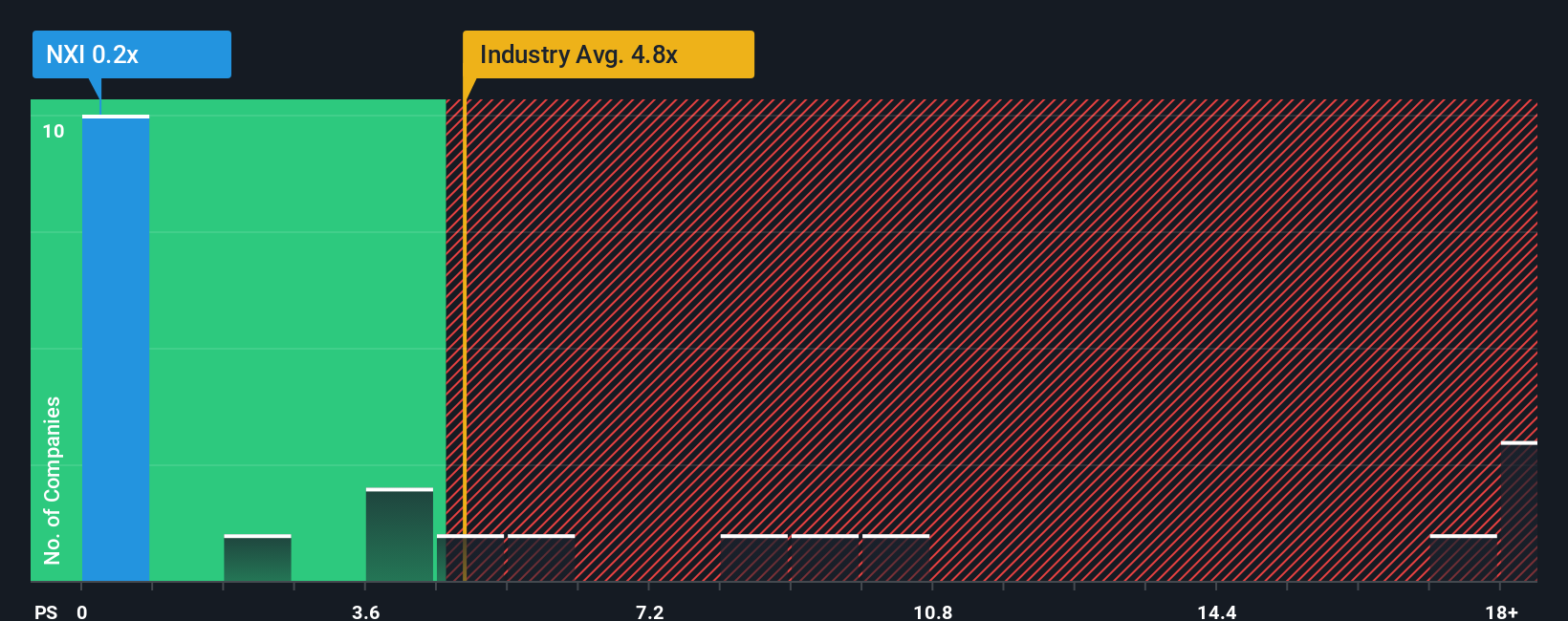

In spite of the firm bounce in price, Nexity may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Real Estate industry in France have P/S ratios greater than 1.9x and even P/S higher than 10x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Nexity

How Has Nexity Performed Recently?

While the industry has experienced revenue growth lately, Nexity's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nexity.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Nexity's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. As a result, revenue from three years ago have also fallen 27% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company are not good at all, suggesting revenue should decline by 6.6% over the next year. With the rest of the industry predicted to shrink by 2.8%, it's a sub-optimal result.

In light of this, it's understandable that Nexity's P/S sits below the majority of other companies. However, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What We Can Learn From Nexity's P/S?

Despite Nexity's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Nexity's analyst forecasts revealed that its even shakier outlook against the industry is contributing factor to why its P/S is so low. With such a gloomy outlook, investors feel the potential for an improvement in revenue isn't great enough to justify paying a premium resulting in a higher P/S ratio. Typically when industry conditions are tough, there's a real risk of company revenues sliding further, which is a concern of ours in this case. Given the current circumstances, it's difficult to envision any significant increase in the share price in the near term.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Nexity with six simple checks on some of these key factors.

If you're unsure about the strength of Nexity's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nexity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:NXI

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives