As European markets navigate the complexities of U.S. trade policies and economic adjustments, investor sentiment remains cautious yet hopeful for growth opportunities. Penny stocks, while an older term, continue to capture attention as they often represent smaller or newer companies poised for potential growth at lower price points. In this article, we explore three penny stocks that combine robust financials with promising prospects, offering investors a chance to uncover hidden value in the European market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.75 | SEK281.19M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.16 | SEK208.63M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.954 | €31.95M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK4.00 | SEK243.36M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.61 | €51.27M | ★★★★★★ |

| Deceuninck (ENXTBR:DECB) | €2.24 | €310.01M | ★★★★★★ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.40 | €24.25M | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.998 | SEK1.91B | ★★★★☆☆ |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.69 | RON844.44M | ★★★★★★ |

| IMS (WSE:IMS) | PLN3.63 | PLN123.04M | ★★★★☆☆ |

Click here to see the full list of 433 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

AFYREN SAS (ENXTPA:ALAFY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AFYREN SAS offers sustainable solutions by replacing petroleum-based ingredients with products derived from non-food biomass in France, with a market cap of €46.21 million.

Operations: The company's revenue is derived entirely from its Chemicals segment, amounting to €2.79 million.

Market Cap: €46.21M

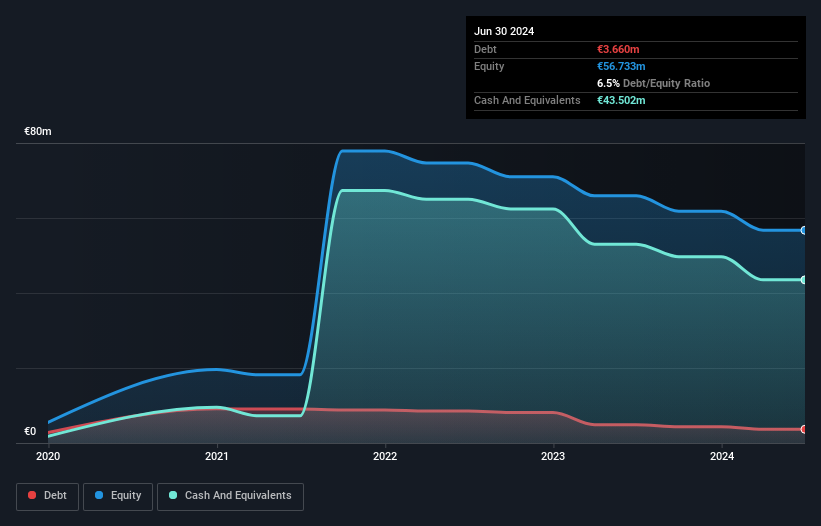

AFYREN SAS, with a market cap of €46.21 million, is focused on sustainable solutions in the chemicals sector. Despite being unprofitable and not expected to achieve profitability in the next three years, it has a strong cash position with short-term assets of €47.2 million exceeding liabilities and sufficient cash runway for over three years based on current free cash flow. The company’s revenue stands at €2.79 million, indicating limited meaningful revenue generation currently. While its share price has been highly volatile recently, shareholders have not faced significant dilution over the past year.

- Dive into the specifics of AFYREN SAS here with our thorough balance sheet health report.

- Explore AFYREN SAS' analyst forecasts in our growth report.

Electricité et Eaux de Madagascar Société Anonyme (ENXTPA:EEM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Electricité et Eaux de Madagascar Société Anonyme operates in the luxury hotel sector in Cambodia and has a market capitalization of €25.48 million.

Operations: The company's revenue is derived from its Real Estate segment, totaling €0.23 million.

Market Cap: €25.48M

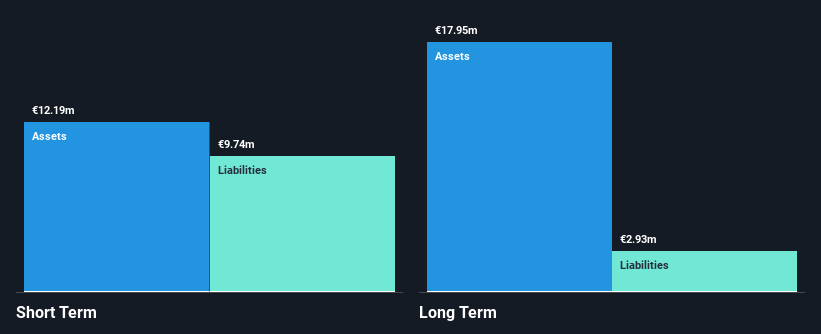

Electricité et Eaux de Madagascar Société Anonyme, with a market cap of €25.48 million, operates in the luxury hotel sector in Cambodia and is pre-revenue, generating only €335K. The company recently achieved profitability, though its earnings are heavily reliant on non-cash components. Despite having more cash than total debt and short-term assets (€12.2M) exceeding liabilities (€9.7M), its operating cash flow remains negative, indicating potential challenges in covering debt obligations without external financing or improved operations. The stock has experienced high volatility over the past three months but shareholders haven't faced significant dilution recently.

- Click to explore a detailed breakdown of our findings in Electricité et Eaux de Madagascar Société Anonyme's financial health report.

- Evaluate Electricité et Eaux de Madagascar Société Anonyme's historical performance by accessing our past performance report.

Neola Medical (OM:NEOLA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Neola Medical AB (publ) specializes in developing medical equipment for continuous lung monitoring of premature infants, with a market cap of SEK182.39 million.

Operations: The company generates revenue primarily from its patient monitoring equipment segment, totaling SEK10.39 million.

Market Cap: SEK182.39M

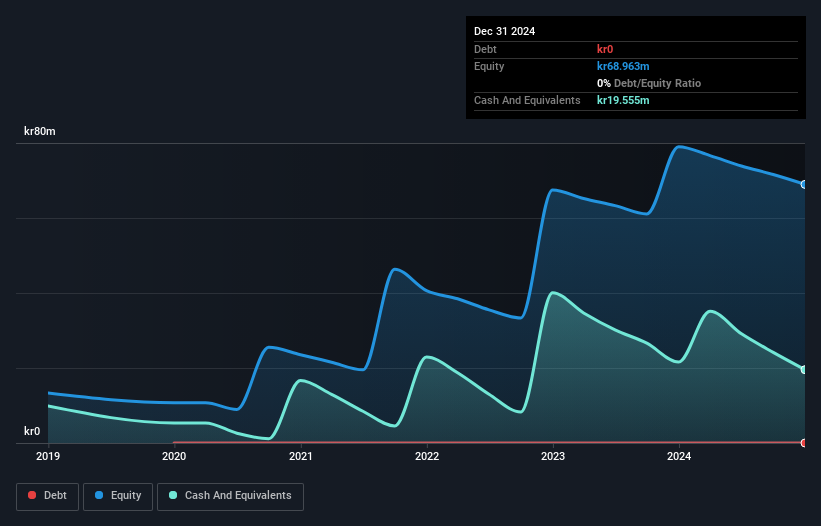

Neola Medical AB, with a market cap of SEK182.39 million, focuses on medical equipment for premature infants and is pre-revenue, generating SEK10.39 million primarily from patient monitoring. Recent approvals in Sweden for clinical trials mark a significant step towards validating its Neola® device's safety and performance in preterm infants, crucial for future U.S. market entry. Despite stable weekly volatility over the past year, the stock remains highly volatile short-term. The company is debt-free but unprofitable with less than a year's cash runway at current burn rates; however, revenue growth is forecasted at 44% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of Neola Medical.

- Evaluate Neola Medical's prospects by accessing our earnings growth report.

Where To Now?

- Click this link to deep-dive into the 433 companies within our European Penny Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALAFY

AFYREN SAS

Provides solutions to replace petroleum-based ingredients with products derived from non-food biomass in France.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives