Virbac SA (EPA:VIRP) Investors Are Less Pessimistic Than Expected

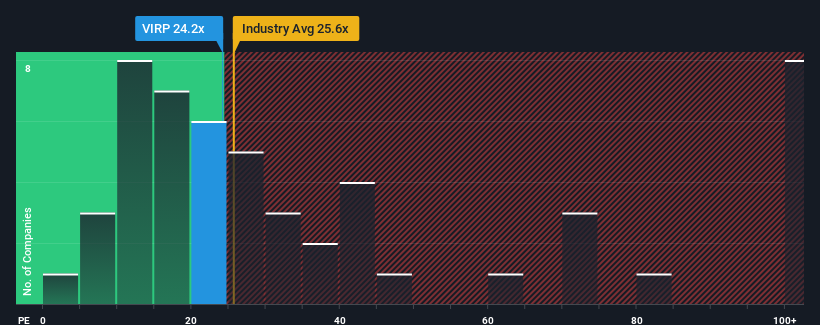

With a price-to-earnings (or "P/E") ratio of 24.2x Virbac SA (EPA:VIRP) may be sending bearish signals at the moment, given that almost half of all companies in France have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Virbac's negative earnings growth of late has neither been better nor worse than most other companies. One possibility is that the P/E is high because investors think the company can turn things around and break free from the broader downward trend in earnings. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Virbac

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Virbac's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 10% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 13% each year during the coming three years according to the eight analysts following the company. With the market predicted to deliver 13% growth per year, the company is positioned for a comparable earnings result.

With this information, we find it interesting that Virbac is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Virbac's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Virbac with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VIRP

Virbac

Manufactures and sells a range of products and services for companion and farm animals in Europe, North America, Latin America, East Asia, India, Africa, the Middle East, and the Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives