Virbac (ENXTPA:VIRP) Raises 2024 Earnings Guidance, Eyes Growth with Acquisitions and Market Expansion

Reviewed by Simply Wall St

Virbac (ENXTPA:VIRP) has recently raised its earnings guidance for fiscal year 2024, anticipating net revenue growth of 12.5% to 14.5% due to strategic acquisitions. Despite impressive earnings growth and a solid financial position, the company faces challenges with a forecasted return on equity below the French market average and competitive pressures that may affect its margins. In the following discussion, we will explore Virbac's strategic initiatives, potential vulnerabilities, and regulatory challenges that could impact its market position.

Get an in-depth perspective on Virbac's performance by reading our analysis here.

Unique Capabilities Enhancing Virbac's Market Position

Virbac has shown impressive earnings growth, with a 14% annual increase over the past five years, and an 18.5% rise last year, surpassing the pharmaceutical industry average. This growth reflects a strong market position and effective strategies. The company's net profit margin improved to 10.5% from 9.8% last year, highlighting operational efficiency. Furthermore, the net debt to equity ratio of 21.3% indicates sound financial health, and the EBIT coverage of interest payments is at 87.6 times. The recent corporate guidance raised for fiscal 2024, expecting net revenue growth between 12.5% and 14.5% due to acquisitions, underscores Virbac's strategic foresight.

Vulnerabilities Impacting Virbac

Virbac faces challenges with a forecasted return on equity of 13.9% in three years, which remains below the French market average. The anticipated earnings growth of 10.8% per year also lags behind market expectations of 12.3%. Additionally, the company offers a modest dividend yield of 0.37%, significantly lower than the top 25% of dividend payers in the French market. These factors may impact investor sentiment. The competitive pressures in the industry, as noted by former CEO Sébastien Huron, could necessitate adjustments to pricing strategies to maintain margins.

Potential Strategies for Leveraging Growth and Competitive Advantage

Virbac is poised for growth through market expansion and digital transformation. The company is eyeing emerging markets, which could diversify its revenue streams and reduce market risk. Digital initiatives are set to enhance operational efficiency and customer engagement, as emphasized by CFO Habib Ramdani. Strategic partnerships, such as the recent acquisitions of Globion and Sasaeah, are expected to be accretive, boosting EBIT and strengthening Virbac's market offerings.

Regulatory Challenges Facing Virbac

Economic headwinds and regulatory challenges pose significant threats. The company is vigilant about potential economic downturns that could affect sales, as highlighted by Huron. Regulatory changes could impact operational practices, necessitating compliance to avoid penalties. Supply chain disruptions remain a concern, with efforts underway to mitigate these risks and ensure resilience in meeting customer demand.

To learn about how Virbac's valuation metrics are shaping its market position, check out our detailed analysis of Virbac's Valuation.

Conclusion

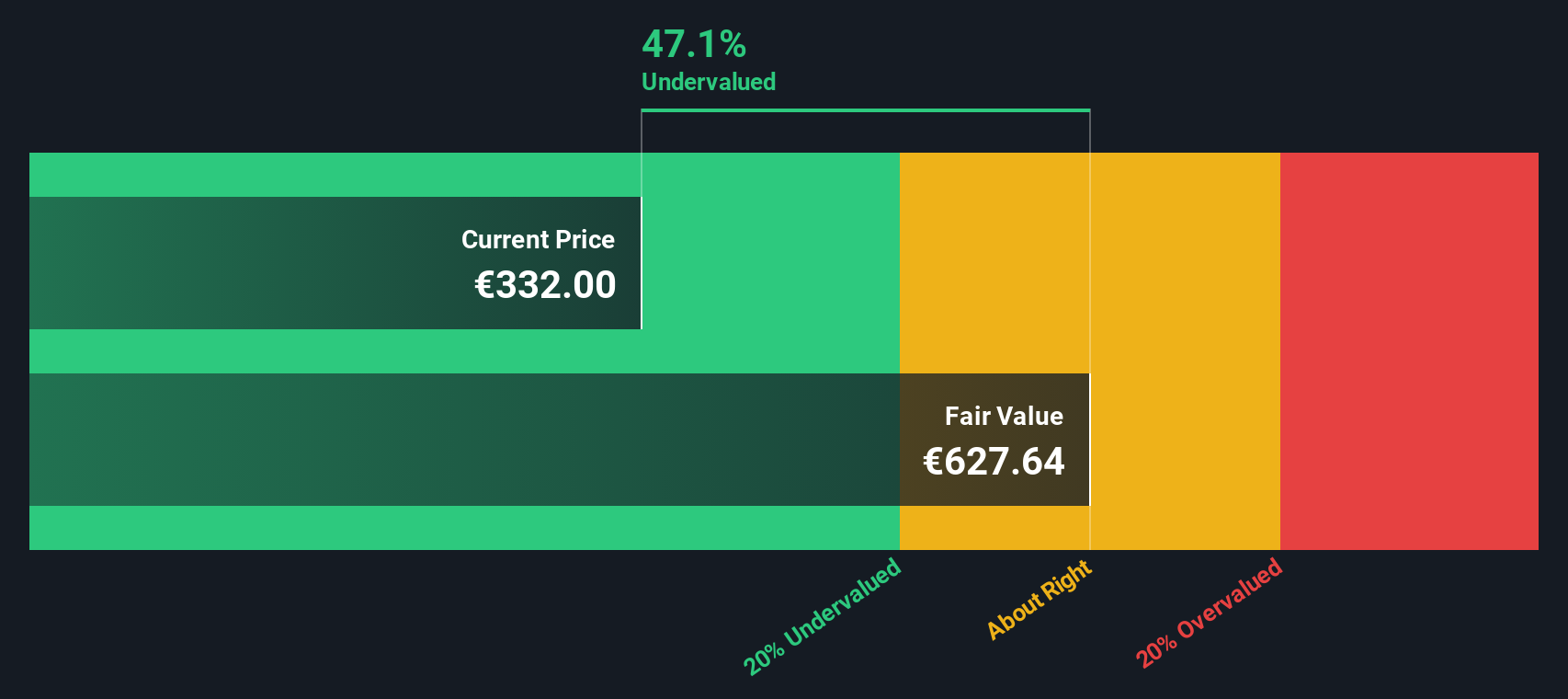

Virbac's impressive earnings growth and improved profit margins highlight its strong market position and operational efficiency, which are crucial for sustaining its competitive edge. The company's strategic initiatives, including acquisitions and digital transformation, are poised to drive future growth and enhance market offerings. The company's vigilance in addressing economic and regulatory challenges further supports its resilience. Additionally, with a Price-To-Earnings Ratio of 20.9x, slightly below the peer average, and trading significantly below its estimated fair value of €705.87, Virbac presents a compelling investment opportunity, suggesting potential for future appreciation in value.

Next Steps

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ENXTPA:VIRP

Virbac

Manufactures and sells a range of products and services for companion and farm animals in Europe, North America, Latin America, East Asia, India, Africa, the Middle East, and the Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives