A Look at Virbac (ENXTPA:VIRP) Valuation Following Upgraded 2025 Guidance and Strong Q3 Results

Reviewed by Kshitija Bhandaru

Virbac (ENXTPA:VIRP) just raised its 2025 revenue guidance following a solid third quarter, now expecting annual growth between 5.5% and 7.5%. This updated outlook is attracting the attention of investors.

See our latest analysis for Virbac.

Following this upbeat guidance, Virbac’s share price jumped more than 7% in a single day, reversing recent declines and signaling renewed optimism around the company’s growth outlook. While the stock is still down slightly on a one-year total shareholder return basis, its strong multi-year performance indicates building momentum as investors respond to Virbac’s improved fundamentals.

If Virbac’s story has you scanning for other dynamic opportunities, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

But with shares rebounding and expectations running high, the big question for investors is whether Virbac remains undervalued at current prices or if the market is already factoring in all the future growth ahead.

Most Popular Narrative: 16.1% Undervalued

With Virbac last closing at €333.5 and the most-followed narrative assigning fair value at €397.61, there is a substantial price gap investors are watching closely. This difference spotlights the market’s expectations when weighed against future growth and profitability projections.

The company is focused on increasing R&D investments to fuel a rich pipeline for future growth, targeting a ratio of 8.3% of revenue in 2025. This suggests future innovation and new product launches, which could impact future revenue positively. The construction of new facilities, including a new biology site in Carros, a pet food facility in Nîmes, and a logistics center in Carros, aims to enhance operational capacity and efficiency. These efforts may potentially improve gross margins and profitability.

Want to know what is powering this bullish price target? The narrative focuses on ambitious upgrades in innovation and bold bets on operating scale. Discover the eye-opening financial targets and aggressive assumptions that could either fuel Virbac’s next leap or challenge consensus thinking.

Result: Fair Value of €397.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing currency volatility and elevated R&D spending could weigh on margins and earnings growth. These factors may challenge the upbeat expectations around Virbac’s trajectory.

Find out about the key risks to this Virbac narrative.

Another View: Multiples Suggest a Cautious Stance

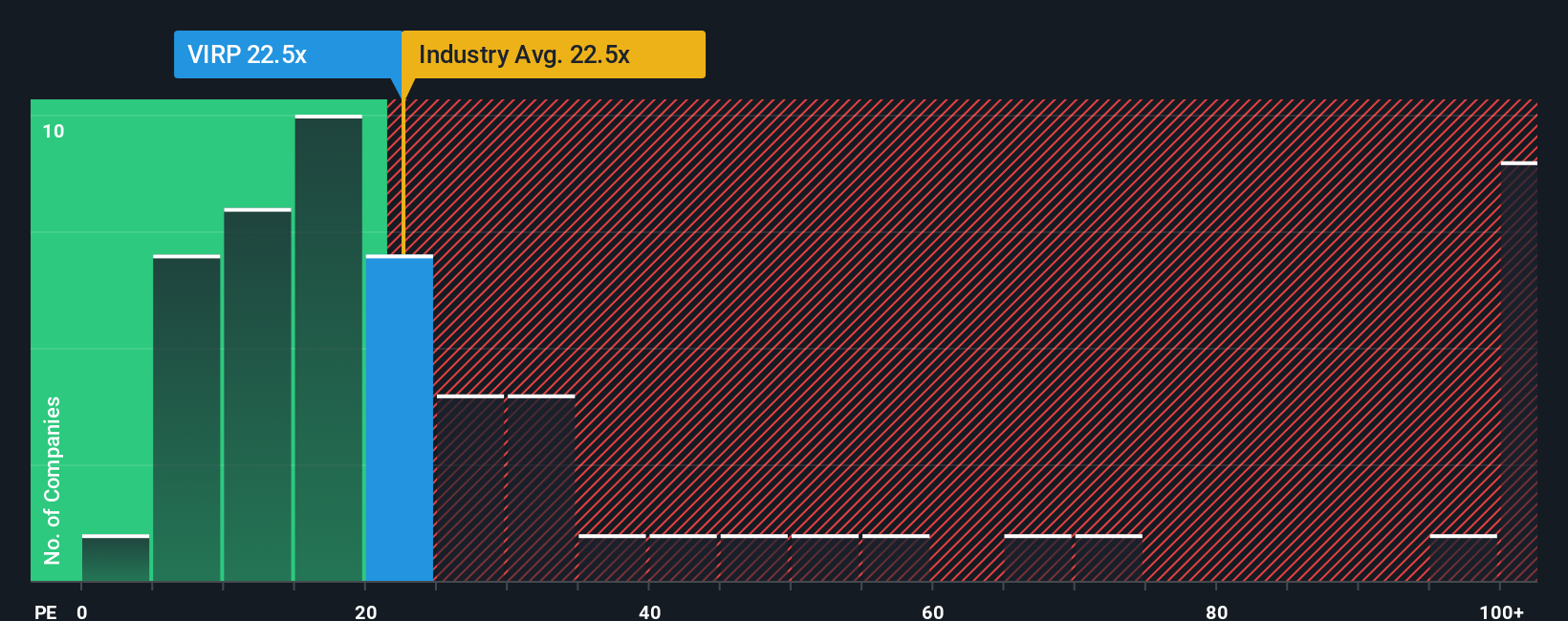

While analyst targets see Virbac as undervalued, another way to value the company is by comparing its current price-to-earnings ratio of 21x to peers and industry standards. Notably, this is above both the sector average (19.4x) and its estimated fair ratio of 14.4x, which means investors may be paying a premium. If the market starts to favor companies priced closer to their fair ratio, Virbac’s valuation could come under pressure.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Virbac Narrative

If you want to dig into the details and craft your own perspective, creating a custom narrative takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Virbac.

Looking for more investment ideas?

Expand your portfolio with unique opportunities found using the Simply Wall Street Screener. Seize your chance to get ahead of the curve with these targeted strategies:

- Enhance your income potential by spotting companies offering strong yields in today’s market through these 18 dividend stocks with yields > 3%.

- Tap into game-changing tech trends by tracking the leaders of tomorrow in artificial intelligence using these 24 AI penny stocks.

- Power up your growth with undervalued stocks poised for strong gains by getting insights from these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIRP

Virbac

Manufactures and sells a range of products and services for companion and farm animals in Europe, North America, Latin America, East Asia, India, Africa, the Middle East, and the Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives