Does Sanofi’s Share Price Offer Opportunity After Recent Weakness in 2025?

Reviewed by Simply Wall St

If you are looking at Sanofi and wondering whether now is the right moment to make a move, you are definitely not alone. Over the past year, Sanofi's stock has travelled a bumpy road, dropping 18.6% in twelve months and falling 14.7% year-to-date. That's a noticeable decline for a major pharmaceutical player, but there has also been a recent flicker of optimism. The stock ticked up 1.2% in the last week, which some see as a sign that the worst may be behind, or at least that sentiment is starting to shift.

Several factors have played into this volatility, ranging from broader sector pressures and shifting risk appetites to ongoing debates about drug pricing and access. There is also growing interest in how European healthcare firms, like Sanofi, will adapt as global markets evolve. While short-term moves can be dramatic, it is Sanofi's ability to deliver steady long-term returns, such as up around 17.2% over three years and 12.3% over five years, that keeps value-focused investors intrigued and sometimes puzzled.

So, how does Sanofi stack up in terms of valuation? On a scale of 0 to 6, where each point reflects an area the company is considered undervalued, Sanofi earns a perfect 6 out of 6. By traditional scoring the stock checks every box for value. As we explore the specifics behind this score, we will not only look at different valuation yardsticks but will also point out an even more insightful lens for thinking about Sanofi's true market worth at the end of the article.

Why Sanofi is lagging behind its peersApproach 1: Sanofi Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by projecting its future cash flows and then discounting them back to present value. This method is especially relevant for long-term investors because it focuses on the company's core earnings potential rather than short-term market swings.

For Sanofi, analysts estimate its Free Cash Flow (FCF) for the last twelve months at approximately €8.17 billion. FCF projections suggest steady growth, with analysts expecting FCF to reach €8.51 billion by 2026 and €9.37 billion by 2029. After 2029, further growth is extrapolated and is expected to reach just over €10.6 billion by 2035. These figures illustrate confidence in Sanofi's ability to generate significant cash over the coming decade.

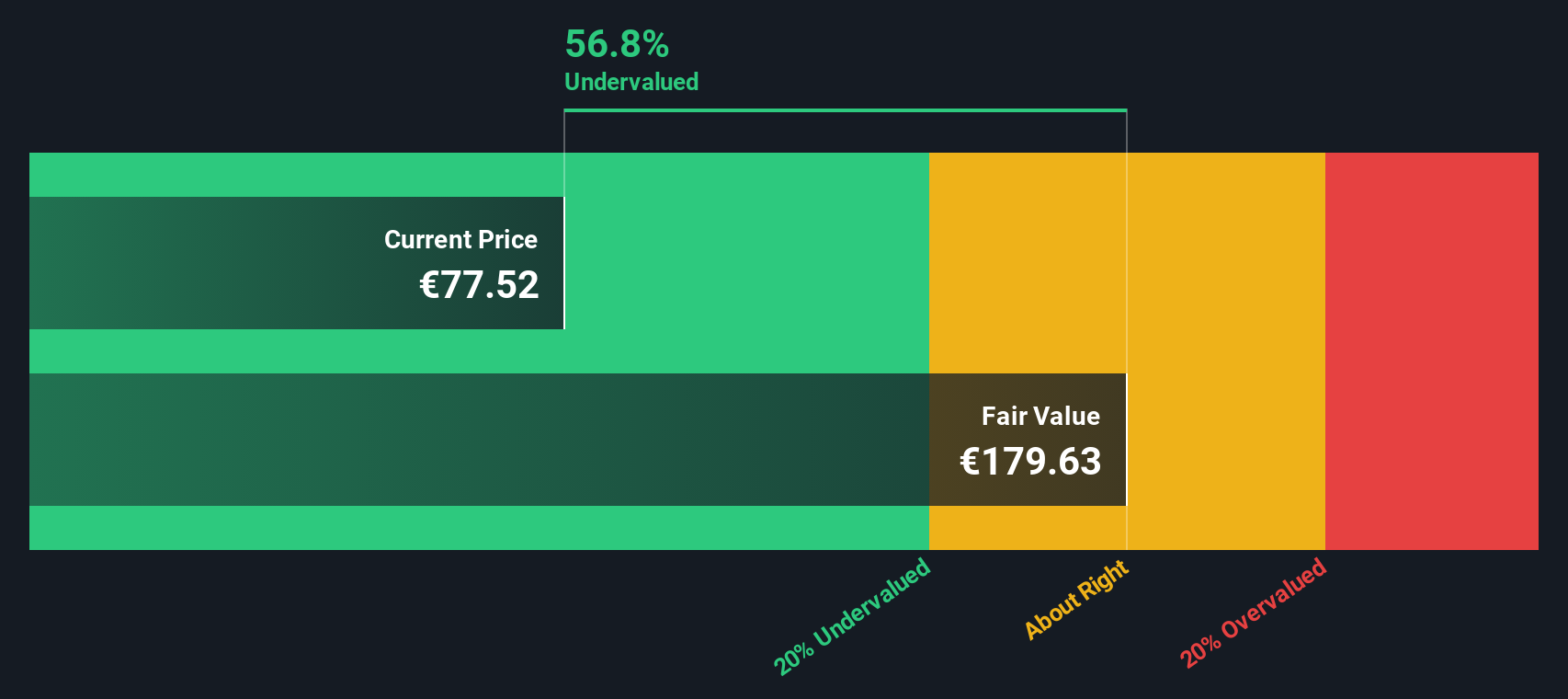

Applying the DCF model's two-stage Free Cash Flow to Equity approach, Sanofi's intrinsic value is calculated at €179.63 per share. This results in an implied discount of 55.2% compared to its current share price, indicating that the stock is trading well below what the DCF model believes it is truly worth.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Sanofi.

Approach 2: Sanofi Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation measure for profitable companies like Sanofi because it directly links a company’s share price to its bottom-line performance. By comparing price to earnings, investors can quickly gauge how much the market is willing to pay for each euro of profit. For stable, earnings-generating firms, the PE ratio provides valuable context for determining relative value within the sector and the broader market.

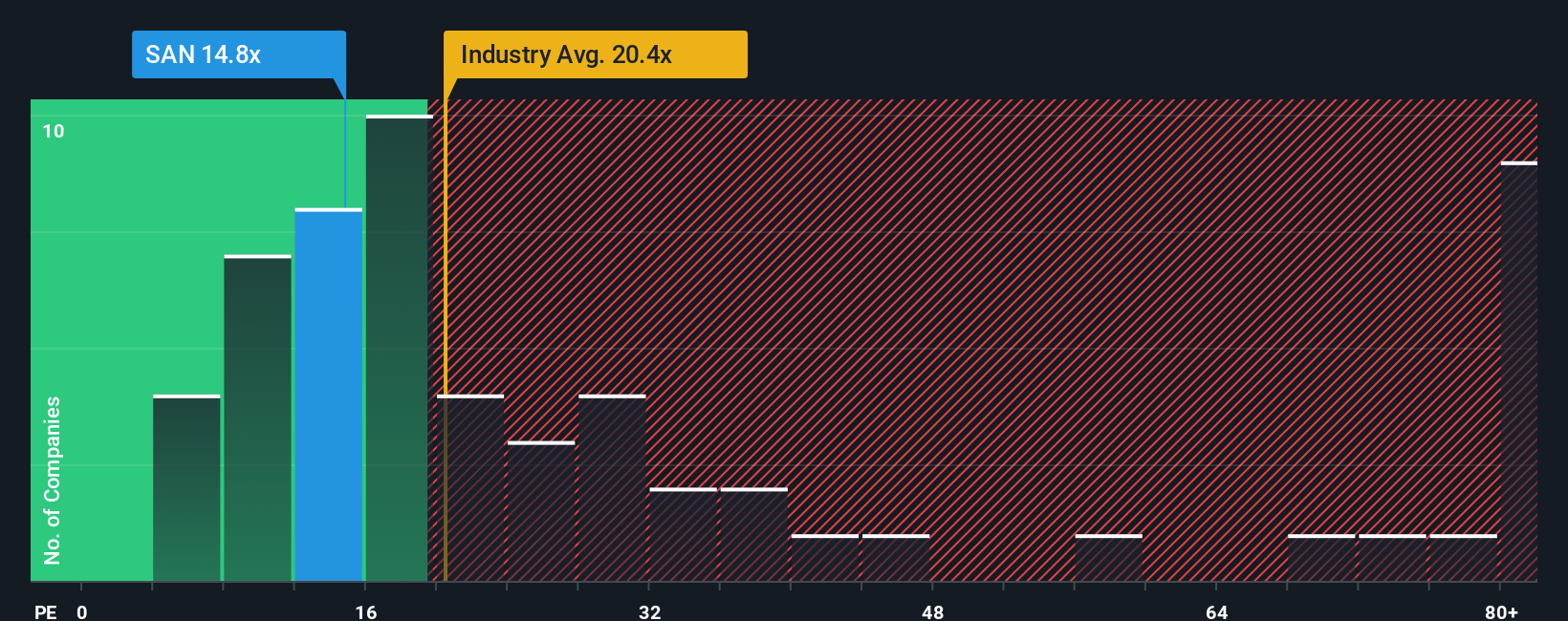

It’s important to recognize that growth prospects and risk factors play a key role in shaping what counts as a “fair” PE ratio. Faster-growing or safer companies typically command higher PEs, while slower growers or riskier firms often trade at discounts. Sanofi’s current PE is 15.3x, which sits well below the industry average of 25.2x and also trails the average for its peer group at 25.3x. On the surface, this low PE might suggest a bargain, especially in a sector that tends to support richer valuations.

However, Simply Wall St's proprietary “Fair Ratio” for Sanofi is calculated at 26.3x. This Fair Ratio considers not only how Sanofi stacks up against industry and peers, but also factors in its specific earnings growth outlook, risk profile, profit margins, and overall market cap. This approach goes beyond broad comparisons and tailors the benchmark to Sanofi’s individual strengths and risks, giving a much clearer picture of where value truly lies.

Given that Sanofi’s current PE of 15.3x is substantially below its Fair Ratio of 26.3x, this suggests the market is undervaluing the company based on its future earnings potential and other fundamentals. The numbers point to a stock that is not just cheap compared to its sector, but even more so when weighed on a custom-fit basis.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Sanofi Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is essentially your personalized story about a company, connecting your outlook on Sanofi’s future revenue, earnings, and profit margins directly to a fair value estimate and then comparing that to the current price. Narratives make these stories accessible and transparent, allowing every investor on Simply Wall St's platform and Community page to anchor their decisions in their own beliefs about what matters most for Sanofi, whether that’s pipeline advances, regulatory shifts, or margin pressures.

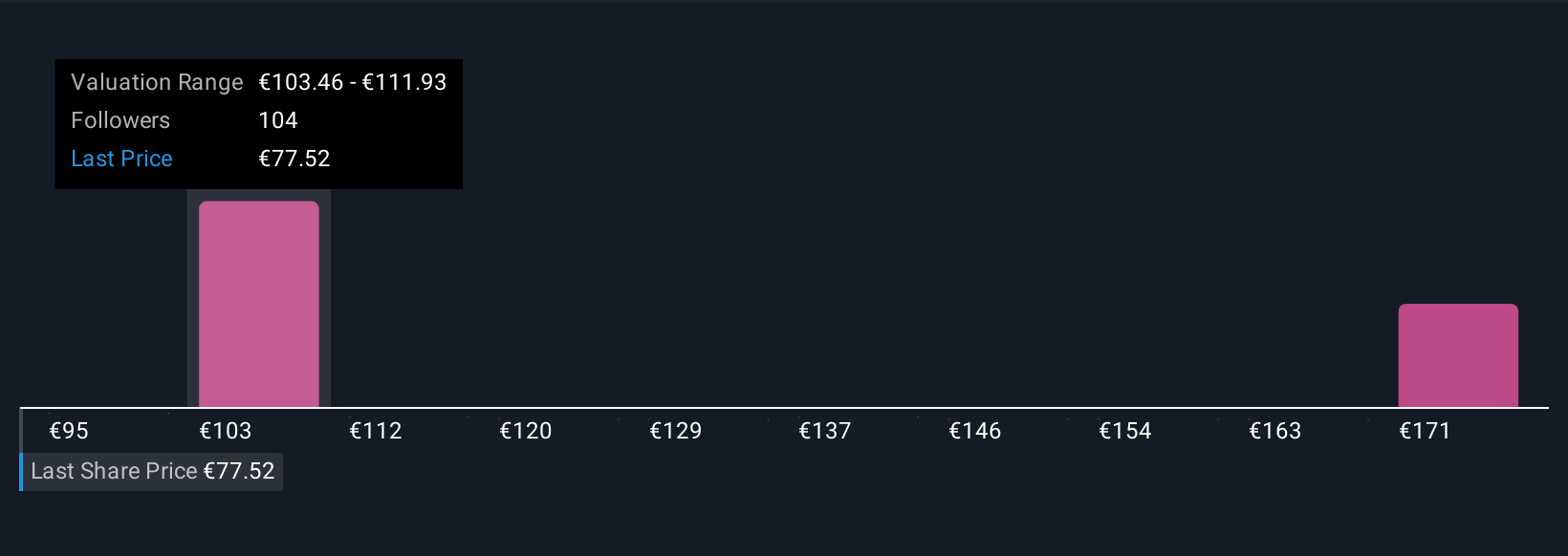

Narratives help guide when to buy or sell, as you can instantly see if your fair value (based on your assumptions) is above or below the current share price, and they update dynamically whenever new news or company results come in. For instance, looking at Sanofi right now, some investors believe the pipeline and acquisitions will spark premium growth and set fair values as high as €124.8 per share, while others focus on margin risks and competition, setting fair values as low as €92.0, all depending on which story you think is most likely.

Do you think there's more to the story for Sanofi? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAN

Sanofi

Engages in the research, development, manufacture, and marketing of therapeutic solutions.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives