Revenues Working Against OSE Immunotherapeutics SA's (EPA:OSE) Share Price

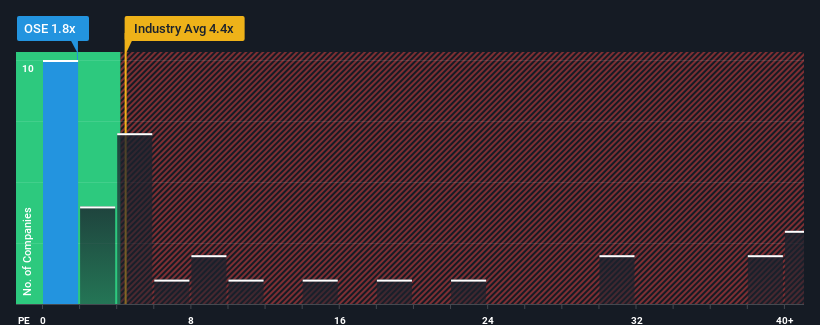

You may think that with a price-to-sales (or "P/S") ratio of 1.8x OSE Immunotherapeutics SA (EPA:OSE) is definitely a stock worth checking out, seeing as almost half of all the Biotechs companies in France have P/S ratios greater than 4.4x and even P/S above 9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for OSE Immunotherapeutics

What Does OSE Immunotherapeutics' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, OSE Immunotherapeutics has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think OSE Immunotherapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is OSE Immunotherapeutics' Revenue Growth Trending?

OSE Immunotherapeutics' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 34% each year as estimated by the three analysts watching the company. That's not great when the rest of the industry is expected to grow by 51% per annum.

With this in consideration, we find it intriguing that OSE Immunotherapeutics' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On OSE Immunotherapeutics' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that OSE Immunotherapeutics maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with OSE Immunotherapeutics (at least 1 which can't be ignored), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:OSE

OSE Immunotherapeutics

A clinical-stage biotechnology company, develops immunotherapies in the areas of immune-oncology and immune-inflammation in France and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives