A Closer Look at MedinCell (ENXTPA:MEDCL) Valuation Following FDA Approval for UZEDY in Bipolar I Disorder

Reviewed by Kshitija Bhandaru

MedinCell (ENXTPA:MEDCL) shares drew attention after the U.S. FDA cleared UZEDY, its long-acting risperidone injection, for use as a monthly treatment in adults with bipolar I disorder. This marks an added approval beyond schizophrenia.

See our latest analysis for MedinCell.

MedinCell’s share price has surged recently, booking a 64.2% gain over the past month and notching a remarkable 111.9% share price return in the last 90 days. Momentum clearly accelerated since the FDA expanded UZEDY’s approval. Over the past year, shareholders have enjoyed a total return of 116.8% as confidence in MedinCell’s long-term potential continues to grow.

If you’re interested in what’s driving strong results across healthcare, see the full list of innovators and industry leaders with our free screener: See the full list for free.

With MedinCell shares soaring after the latest FDA approval, investors might be asking themselves if the impressive run-up has left the stock undervalued or if the market has already priced in the company’s future growth prospects.

Most Popular Narrative: 26% Overvalued

With MedinCell shares trading at €33.90, the most widely followed narrative pegs fair value much lower. Optimism about growth and new approvals has fueled recent momentum.

Recent tripling of revenues, driven by successful commercialization of UZEDY and a strong ongoing ramp in prescriptions, suggests that MedinCell's growth assumptions remain underappreciated. Continued expansion into new indications, such as bipolar disorder, is likely to further enhance royalty revenue streams and accelerate top-line growth.

Unlock the financial logic behind this bold valuation. The full narrative introduces industry-beating growth rates, margin expansion, and a profit multiple typically reserved for blockbuster stories. Want to know what’s fueling this outlook? Discover which jaw-dropping assumptions power the consensus and how aggressive the fair value calculation really is.

Result: Fair Value of $26.90 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, MedinCell’s outlook is still tied closely to regulatory approvals and successful commercialization of just two core products. Both are potential catalysts for downside risk.

Find out about the key risks to this MedinCell narrative.

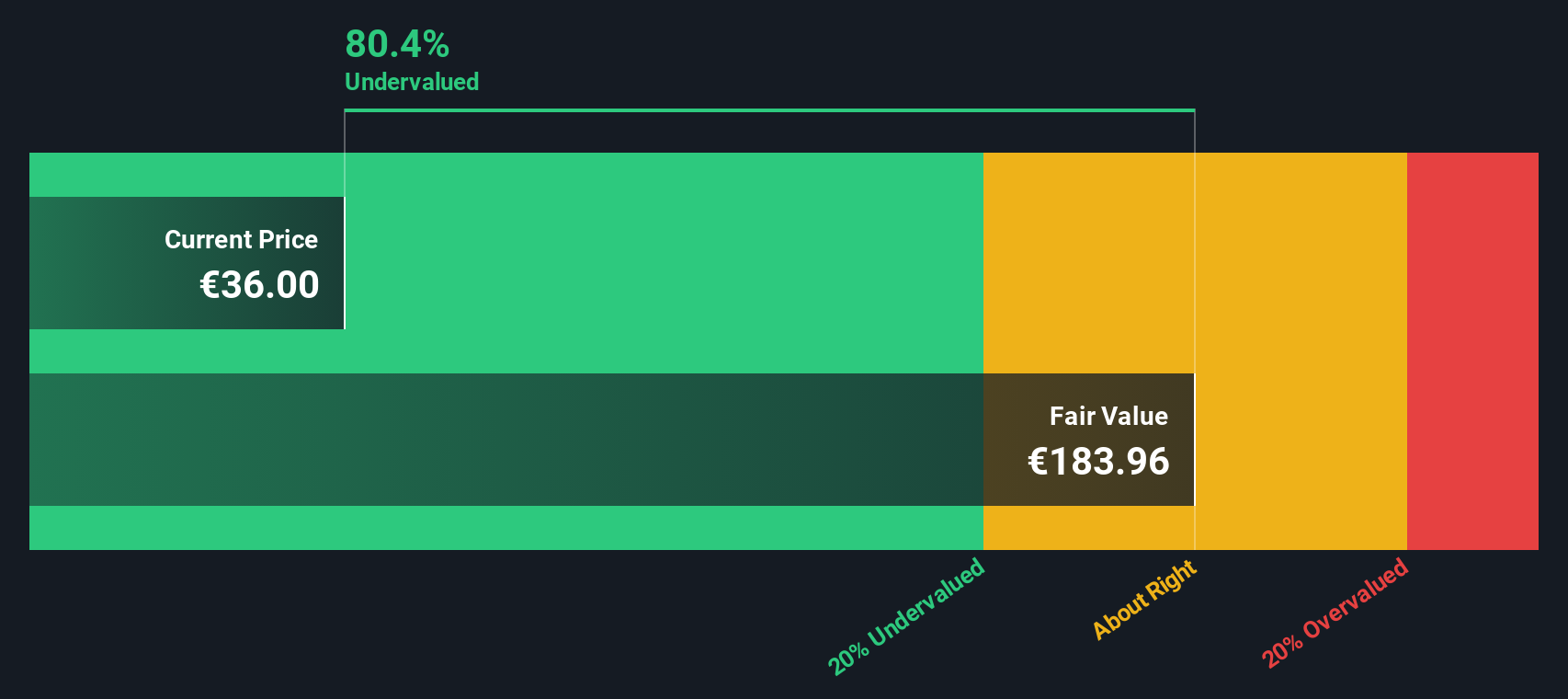

Another View: DCF Model Suggests Deep Value

While analyst consensus points to MedinCell being overvalued, our SWS DCF model presents a very different picture. By projecting future cash flows, the DCF implies MedinCell shares could be trading well below fair value. This may indicate untapped upside or reflect risks that the market has not fully considered.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MedinCell for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MedinCell Narrative

If you see things differently, or want to dive into the data yourself, you can craft your own take in just a few minutes. Do it your way

A great starting point for your MedinCell research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizons and sharpen your portfolio by tapping into handpicked opportunities using the Simply Wall Street Screener. Don’t let tomorrow’s market leaders pass you by.

- Capitalize on emerging technology trends by investigating the top performers within these 24 AI penny stocks. These companies are shaping artificial intelligence breakthroughs and driving automation growth.

- Maximize your income potential by selecting proven companies from these 18 dividend stocks with yields > 3%, which offer attractive yields and strong track records for reliable payouts.

- Spot undervalued gems trading below fair value by exploring these 878 undervalued stocks based on cash flows and position yourself for smart, long-term gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MEDCL

MedinCell

A pharmaceutical company, develops long acting injectables in various therapeutic areas in France.

Exceptional growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives