Imagine Owning Inventiva (EPA:IVA) While The Price Tanked 56%

Inventiva S.A. (EPA:IVA) shareholders will doubtless be very grateful to see the share price up 67% in the last quarter. But that's not enough to compensate for the decline over the last twelve months. Like a receding glacier in a warming world, the share price has melted 56% in that period. The share price recovery is not so impressive when you consider the fall. Of course, it could be that the fall was overdone.

Check out our latest analysis for Inventiva

Given that Inventiva didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Inventiva's revenue didn't grow at all in the last year. In fact, it fell 16%. That looks pretty grim, at a glance. In the absence of profits, it's not unreasonable that the share price fell 56%. Having said that, if growth is coming in the future, the stock may have better days ahead. We have a natural aversion to companies that are losing money and shrinking revenue. But perhaps that is being too careful.

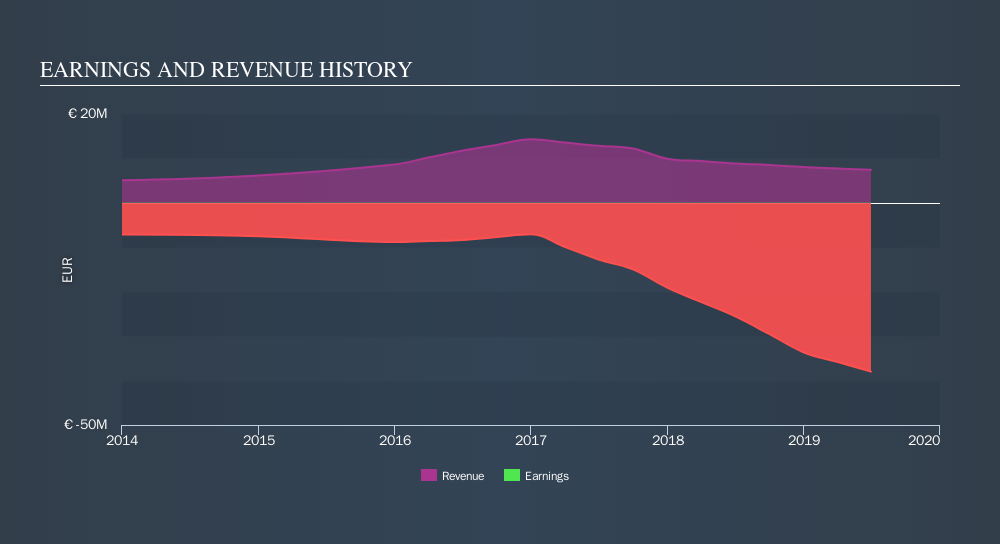

You can see how earnings and revenue have changed over time in the image below.

Take a more thorough look at Inventiva's financial health with this free report on its balance sheet.

A Different Perspective

Given that the market gained 19% in the last year, Inventiva shareholders might be miffed that they lost 56%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Putting aside the last twelve months, it's good to see the share price has rebounded by 67%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:IVA

Inventiva

A clinical-stage biopharmaceutical company, focuses on the development of oral small molecule therapies for the treatment of metabolic dysfunction-associated steatohepatitis (MASH) and other diseases in France and internationally.

Low and slightly overvalued.

Market Insights

Community Narratives