Ipsen (ENXTPA:IPN): Is There More Value in This Biopharma After Recent Share Price Gains?

Reviewed by Simply Wall St

Ipsen (ENXTPA:IPN) has experienced share price movement recently, sparking investor interest in the French biopharma company's long-term outlook. With a diverse focus in oncology, neuroscience, and rare diseases, Ipsen continues to attract attention on the Paris exchange.

See our latest analysis for Ipsen.

Over the past several months, Ipsen's share price has been steadily building momentum, with a 30-day share price return of 4.6% and a standout year-to-date gain of 10.5%. That positive trend is underscored by a 12-month total shareholder return of 15.7%, as well as three- and five-year total returns that highlight Ipsen’s appeal for investors seeking both steady performance and long-term growth opportunity.

If Ipsen’s track record in biopharma innovation interests you, this could be the perfect moment to discover more opportunities using our healthcare stocks screener See the full list for free.

Given Ipsen’s recent run, investors are now asking a crucial question: does the current price reflect the company’s long-term growth potential, or is there still an undervalued buying opportunity that the market may have missed?

Most Popular Narrative: 4.4% Undervalued

Ipsen’s most widely followed narrative sets its fair value at €130.79 per share, just above the recent closing price of €125. With momentum in sales forecasts and continued guidance upgrades, the gap between current pricing and potential value has caught investor attention.

Strong initial launches and accelerating adoption of new specialty drugs like Iqirvo and Bylvay in rare liver diseases, especially as major reimbursement and regulatory approvals expand access in the US and Europe. Upcoming launches in additional large European countries also directly support revenue growth and geographic diversification.

Want to know the real reason behind Ipsen's valuation boost? There is a quantitative leap in profit margins, and a bold profit forecast that only gets revealed to those who dig deeper. The biggest financial driver at play is anything but “business as usual.” Click through to discover what market-moving projections are shaping this price.

Result: Fair Value of €130.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few key drugs and growing competition from generics could quickly undermine the optimistic outlook for Ipsen's future growth.

Find out about the key risks to this Ipsen narrative.

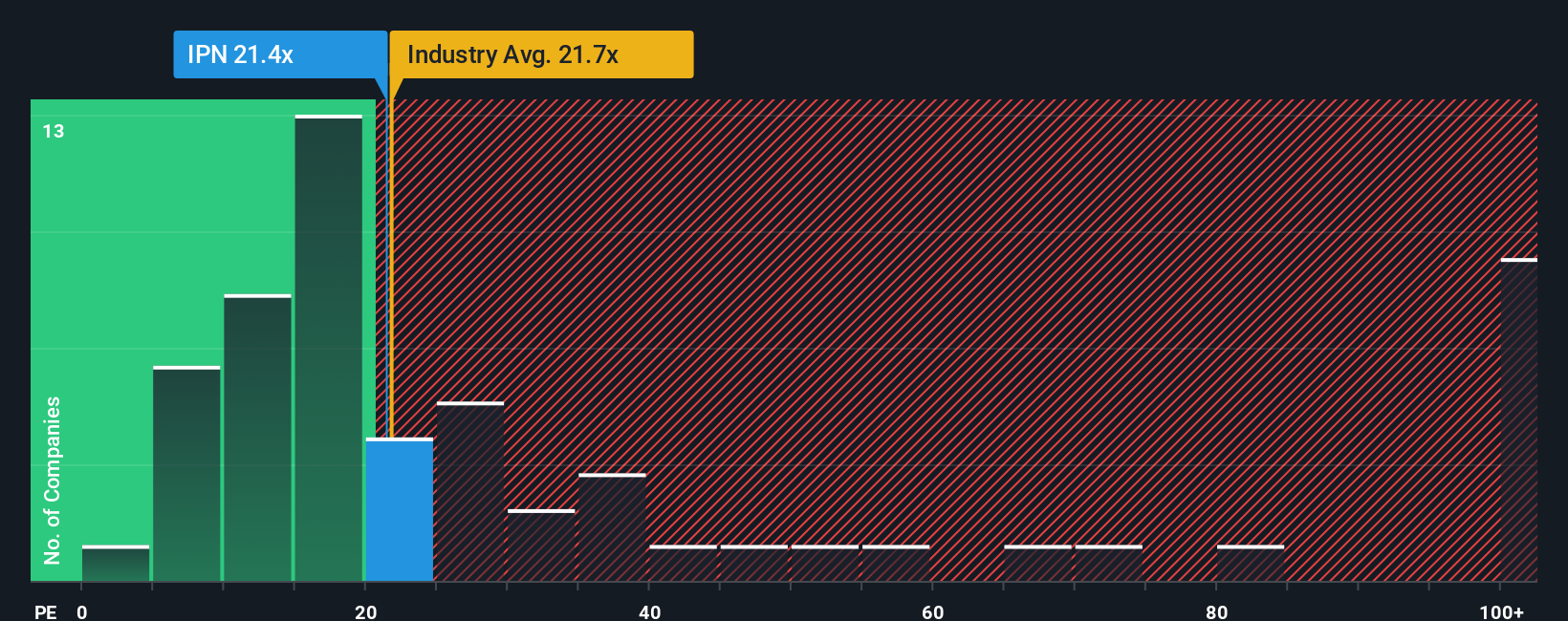

Another View: Multiples Tell a Different Story

While the fair value estimate suggests Ipsen is undervalued, the picture looks different when considering its price-to-earnings ratio. At 22.9x, Ipsen trades above both its peer average and the fair ratio of 16.6x. This raises questions about valuation risk if market sentiment shifts. Is the market overlooking something, or just pricing in growth with caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ipsen Narrative

If you see things differently, or want to dig into the numbers yourself, you can create your own narrative in just a few minutes. Do it your way

A great starting point for your Ipsen research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit their vision. Expand your opportunities with these fresh market angles. If you wait, you could miss the next big move.

- Capitalize on high-yield potential by checking out these 15 dividend stocks with yields > 3% delivering steady income and attractive returns.

- Tap into innovation and rapid growth by following these 25 AI penny stocks that are transforming industries with artificial intelligence and automation.

- Catch undervalued gems before the crowd by reviewing these 926 undervalued stocks based on cash flows stocked with the best value finds based on real cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IPN

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success