- France

- /

- Life Sciences

- /

- ENXTPA:DIM

What Sartorius Stedim Biotech S.A.'s (EPA:DIM) 30% Share Price Gain Is Not Telling You

Sartorius Stedim Biotech S.A. (EPA:DIM) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

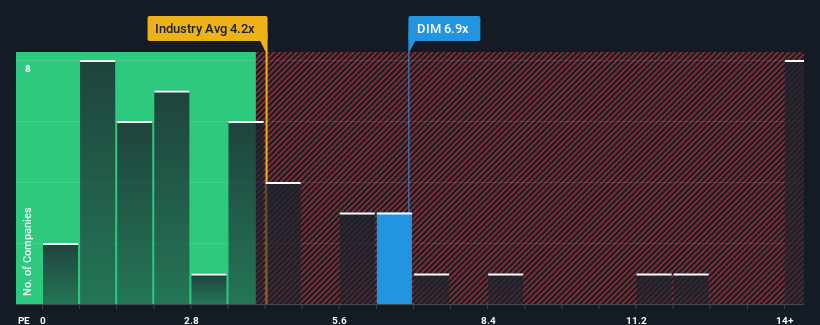

Since its price has surged higher, Sartorius Stedim Biotech's price-to-sales (or "P/S") ratio of 6.9x might make it look like a strong sell right now compared to other companies in the Life Sciences industry in France, where around half of the companies have P/S ratios below 4.2x and even P/S below 2x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

We've discovered 1 warning sign about Sartorius Stedim Biotech. View them for free.View our latest analysis for Sartorius Stedim Biotech

How Has Sartorius Stedim Biotech Performed Recently?

With revenue growth that's superior to most other companies of late, Sartorius Stedim Biotech has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sartorius Stedim Biotech.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Sartorius Stedim Biotech would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.2%. Still, lamentably revenue has fallen 7.6% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 10% per year during the coming three years according to the eleven analysts following the company. With the industry predicted to deliver 13% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Sartorius Stedim Biotech's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Sartorius Stedim Biotech's P/S Mean For Investors?

The strong share price surge has lead to Sartorius Stedim Biotech's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Sartorius Stedim Biotech, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

You always need to take note of risks, for example - Sartorius Stedim Biotech has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Sartorius Stedim Biotech, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:DIM

Sartorius Stedim Biotech

Engages in the production and sale of instruments and consumables for the biopharmaceutical industry worldwide.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives