- France

- /

- Life Sciences

- /

- ENXTPA:DIM

Sartorius Stedim Biotech (ENXTPA:DIM) Net Margin Surges, Challenging Bearish Community Narratives

Reviewed by Simply Wall St

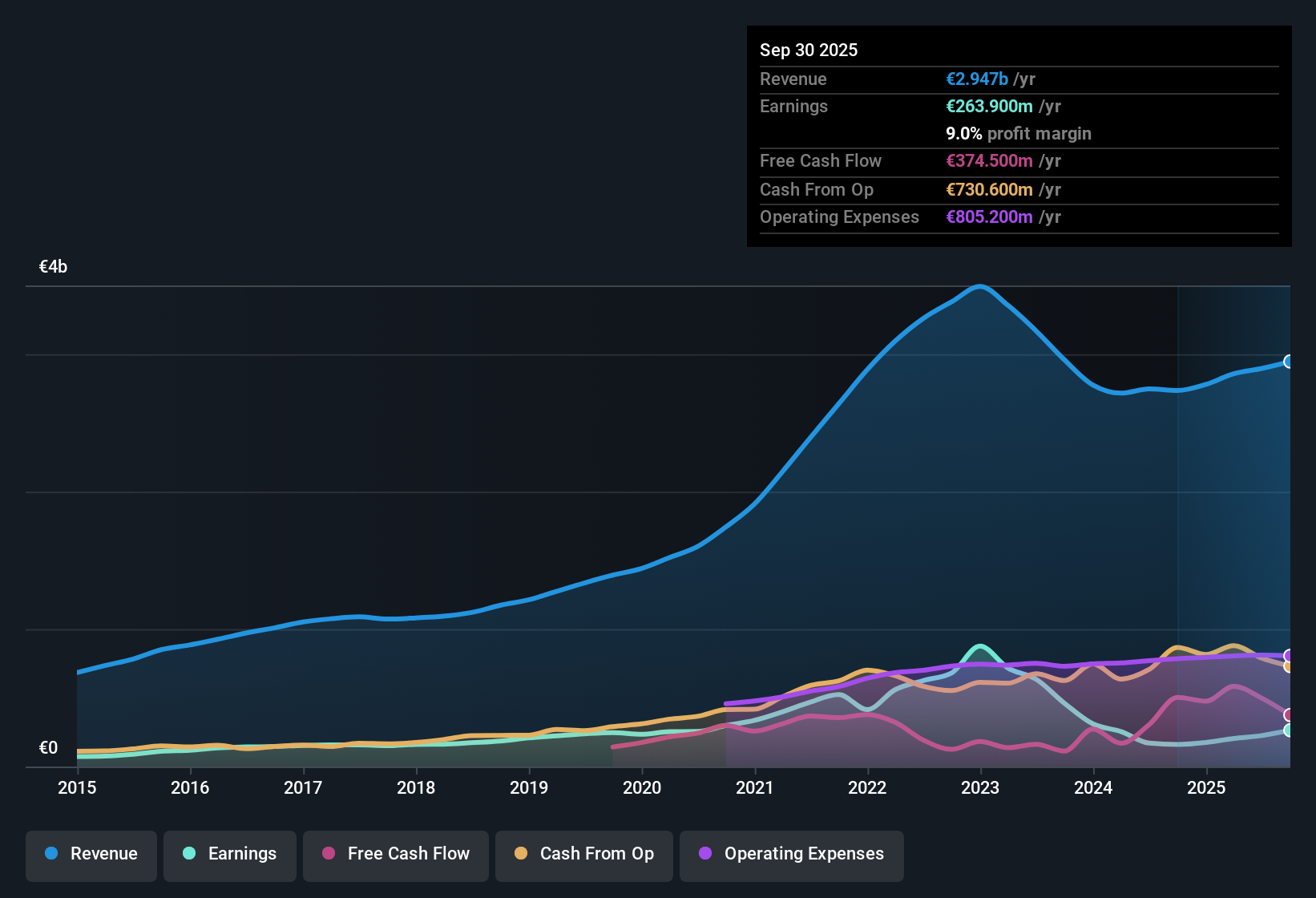

Sartorius Stedim Biotech (ENXTPA:DIM) reported a net profit margin of 9%, significantly higher than last year’s 5.9%. The company delivered a striking 64.3% earnings growth over the past twelve months, compared to the previous five-year average of a 14% decline per year. Earnings are now forecast to increase by 25.8% annually, with revenue expected to rise at 10.2% per year, outpacing the broader French market’s growth rate. Investors will be watching to see whether the company’s momentum continues, especially as shares trade at a premium Price-To-Earnings Ratio of 74.7x and financial stability remains a concern.

See our full analysis for Sartorius Stedim Biotech.The next section puts these headline results side by side with the broader market narratives, highlighting where the numbers affirm or challenge prevailing views.

See what the community is saying about Sartorius Stedim Biotech

Analyst Price Target 14% Above Current Share Price

- Sartorius Stedim Biotech is currently trading at €202.60, which is 14% below the analysts’ consensus price target of €231.92.

- According to the analysts' consensus view, sustained growth from single-use consumables and high-margin products, combined with robust end-market demand and strong compliance expertise, are expected to drive profitability and justify higher valuations.

- Consensus narrative points to a forecast revenue growth of 10.6% per year for the next three years and profit margin improvement from 7.8% today to 15.9% by 2028.

- The company’s leadership in bioprocess technologies and rising customer equipment utilization are highlighted as key strengths that may reduce business risk and support a premium valuation.

Premium Price-to-Earnings Ratio vs. Peers

- Sartorius Stedim trades at a Price-To-Earnings Ratio of 74.7x, far above both the peer group average (20.3x) and the European Life Sciences industry average (35x).

- Analysts' consensus view suggests the premium P/E is partly justified by the company’s recurring high-quality earnings and accelerating innovation, but it remains a point of tension since the projected 2028 P/E (45.5x) would still exceed many industry comparables.

- This valuation gap is anchored by consensus expectations for earnings per share to rise from €6.53 by 2028, up from €225.2 million in total earnings today to €623.7 million. This reflects bullish sentiment for continued operational outperformance.

- Nonetheless, a moderation in multiples over time is required to reach analyst price targets, highlighting risk if future growth underperforms.

Financial Stability Remains a Key Watchpoint

- The company is not considered to be in a good financial position by analysts, raising concerns about whether current performance can be sustained as growth slows or if macroeconomic headwinds arise.

- Analysts' consensus view notes that while recurring revenues and strong compliance credentials underpin margin strength, ongoing risks include weak equipment demand, geopolitics-driven cost pressures, elevated inventory write-downs, and heightened competition in China. These factors could drag on profitability and disrupt positive momentum.

- Specifically, the ongoing underperformance in the Lab Products & Services segment and slow recovery in China are seen as key factors that could limit margin expansion and challenge the bullish growth story.

- The balance between attractive forecasts and financial vulnerabilities presents a nuanced outlook for investors weighing premium valuations against underlying stability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sartorius Stedim Biotech on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your perspective and shape your own story in just a few minutes with us: Do it your way.

A great starting point for your Sartorius Stedim Biotech research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Sartorius Stedim Biotech faces ongoing concerns over its financial stability, with analysts questioning whether performance can hold up if growth slows or headwinds intensify.

For investors seeking companies with stronger balance sheets and less financial risk, check out solid balance sheet and fundamentals stocks screener (1985 results) for options that offer greater resilience in uncertain markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DIM

Sartorius Stedim Biotech

Engages in the production and sale of instruments and consumables for the biopharmaceutical industry worldwide.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives