DBV Technologies (ENXTPA:DBV) Valuation After Viaskin Peanut’s Phase 3 Success and Regulatory Pathway Progress

Reviewed by Simply Wall St

DBV Technologies (ENXTPA:DBV) just cleared a key hurdle, reporting that its Viaskin Peanut patch hit the primary endpoint in the pivotal Phase 3 VITESSE trial, and the stock reacted immediately.

See our latest analysis for DBV Technologies.

The VITESSE win caps a remarkable run, with DBV Technologies posting a roughly 470% year to date share price return and a 534% one year total shareholder return that signals powerful, event driven momentum rather than a slow grind higher.

If this kind of biotech re rating has caught your eye, it is worth exploring other healthcare names through healthcare stocks to see what else might be setting up for a similar shift.

With Viaskin Peanut now de risked and a pivotal US filing on the horizon, has DBV’s near sixfold surge still left room for upside, or are investors already paying today for tomorrow’s growth?

Price to Book of 14.7 times, Is it justified?

DBV Technologies last closed at €3.68, but on a price to book basis the shares look expensive versus both peers and the wider French biotech space.

The price to book ratio compares the market value of the company to its net assets, a useful yardstick for loss making biotechs where earnings are not yet meaningful. With DBV still unprofitable and burning cash, a high price to book can indicate investors are paying a steep premium for future optionality rather than current balance sheet strength.

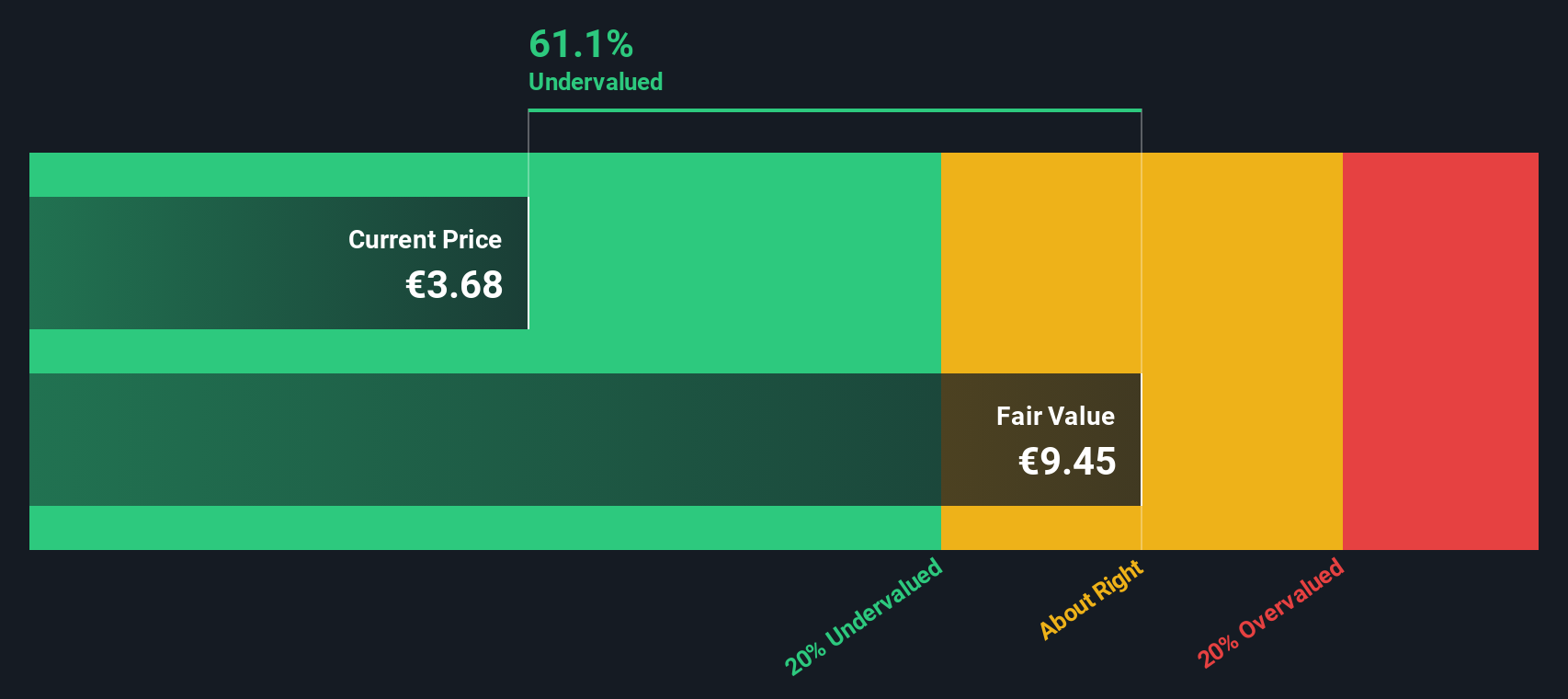

DBV is trading at 14.7 times book value, almost double the peer average of 7.8 times and far above the French biotech industry average of 2.6 times. This suggests the market is assigning a much richer valuation than is typical for the sector. At the same time, our DCF model implies a fair value of €9.45 per share, meaning the stock trades at a 61.1% discount to that intrinsic estimate even as it screens expensive on this simple balance sheet metric.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 14.7 times (OVERVALUED)

However, downside risks remain, including regulatory or commercialization setbacks for Viaskin Peanut and fresh equity dilution if cash burn persists beyond expectations.

Find out about the key risks to this DBV Technologies narrative.

Another View, What Our DCF Suggests

While the price to book ratio says DBV Technologies looks expensive versus peers, our DCF model tells a very different story. It points to a fair value of €9.45 a share, around 61% above today’s price. Is the market still underpricing Viaskin’s long term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DBV Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DBV Technologies Narrative

If you see the story differently or want to test your own assumptions, you can build a personalized view in just minutes, Do it your way.

A great starting point for your DBV Technologies research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next opportunity?

Do not stop with one compelling story. Use the Simply Wall Street Screener to uncover fresh ideas that could shape your next big investment win.

- Capture high potential turnarounds by targeting these 3636 penny stocks with strong financials that pair small market caps with strengthening financials and real progress, not just hype.

- Supercharge your growth watchlist by focusing on these 24 AI penny stocks positioned at the front line of automation, data intelligence, and scalable software models.

- Lock in value opportunities by zeroing in on these 915 undervalued stocks based on cash flows that trade below what their cash flows suggest, before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DBV

DBV Technologies

A clinical-stage biopharmaceutical company, engages in the research and development of epicutaneous immunotherapy products in France.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion