- Sweden

- /

- Interactive Media and Services

- /

- OM:ALPCOT B

European Penny Stocks To Consider In May 2025

Reviewed by Simply Wall St

As European markets show resilience with the pan-European STOXX Europe 600 Index rising by 3.44% amidst easing tariff concerns, investors are increasingly exploring diverse opportunities across the continent. Penny stocks, a term that may seem outdated, continue to capture interest due to their potential for significant value and growth within smaller or less-established companies. By focusing on financial strength and clear growth prospects, these stocks can offer investors a chance to uncover promising opportunities in Europe's evolving market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Transferator (NGM:TRAN A) | SEK2.66 | SEK263.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.75 | SEK281.19M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.48 | SEK211.72M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.66 | PLN124.05M | ✅ 4 ⚠️ 2 View Analysis > |

| AMSC (OB:AMSC) | NOK1.538 | NOK110.53M | ✅ 2 ⚠️ 5 View Analysis > |

| Cellularline (BIT:CELL) | €2.58 | €54.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.995 | €33.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.67 | €17.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22.01M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.13 | €294.08M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 433 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Valbiotis (ENXTPA:ALVAL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Valbiotis SA focuses on the research and development of dietary supplements aimed at preventing metabolic and cardiovascular diseases in France, with a market cap of €17.88 million.

Operations: The company generates revenue from its Vitamins & Nutrition Products segment, amounting to €0.18 million.

Market Cap: €17.88M

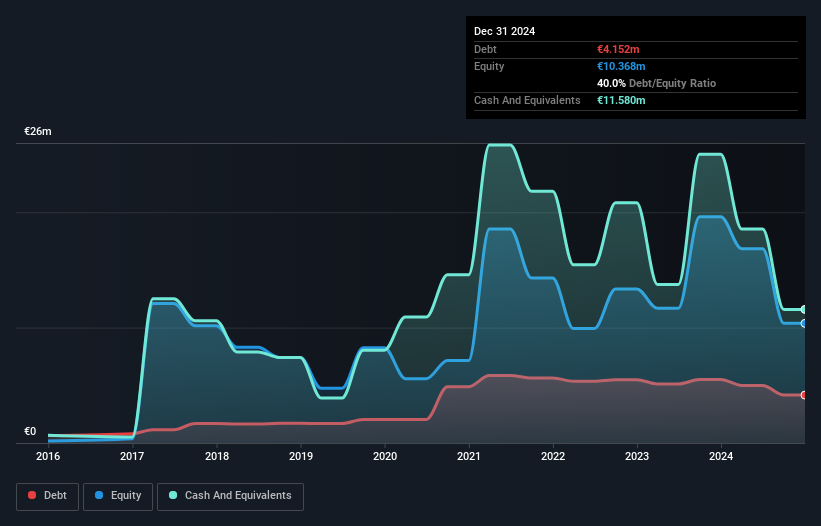

Valbiotis SA, a pre-revenue biotech company with a market cap of €17.88 million, focuses on dietary supplements for metabolic and cardiovascular disease prevention. Despite having more cash than its total debt and seasoned management, the company faces financial challenges with less than a year of cash runway based on current free cash flow. Recent earnings showed a significant decrease in sales to €0.18 million from the previous year's €4.73 million, alongside an increased net loss of €10.03 million. While trading at 78.6% below estimated fair value, profitability remains elusive over the next three years according to forecasts.

- Navigate through the intricacies of Valbiotis with our comprehensive balance sheet health report here.

- Gain insights into Valbiotis' outlook and expected performance with our report on the company's earnings estimates.

Alpcot Holding (OM:ALPCOT B)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alpcot Holding AB (publ) operates a digital platform for personal finance in the financial industry in Sweden, with a market cap of approximately SEK144.57 million.

Operations: The company generates revenue from its asset management segment, totaling SEK110.07 million.

Market Cap: SEK144.57M

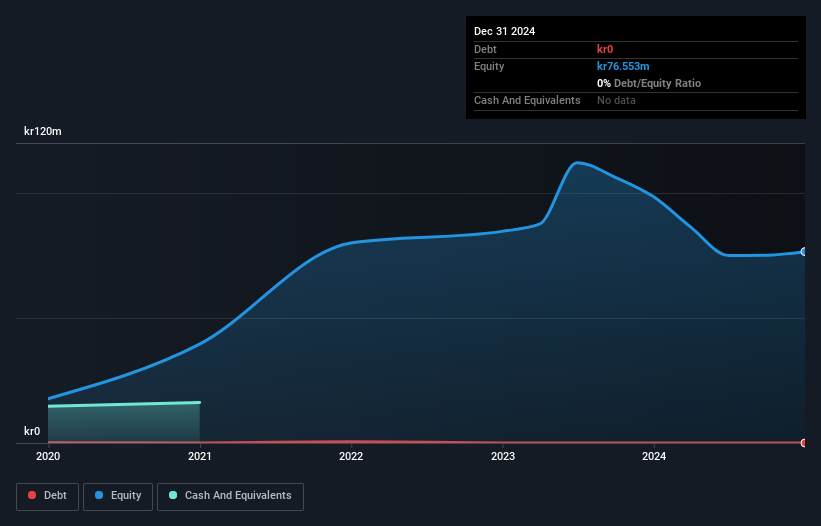

Alpcot Holding AB, with a market cap of SEK144.57 million, operates in the financial industry and generates revenue from its asset management segment totaling SEK110.07 million. Despite being unprofitable, it has reduced losses by 18.9% annually over five years and maintains a debt-free status with short-term assets exceeding liabilities. Recent earnings showed an improvement with a net income of SEK0.608 million for Q4 2024 against a previous loss but an increased annual net loss to SEK23.26 million from the prior year’s SEK17.27 million indicates ongoing challenges amidst management's limited experience and stable volatility at 9%.

- Dive into the specifics of Alpcot Holding here with our thorough balance sheet health report.

- Gain insights into Alpcot Holding's historical outcomes by reviewing our past performance report.

ad pepper media International (XTRA:APM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ad pepper media International N.V. is an investment holding company that develops performance marketing solutions across several European countries, with a market cap of €68.49 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: €68.49M

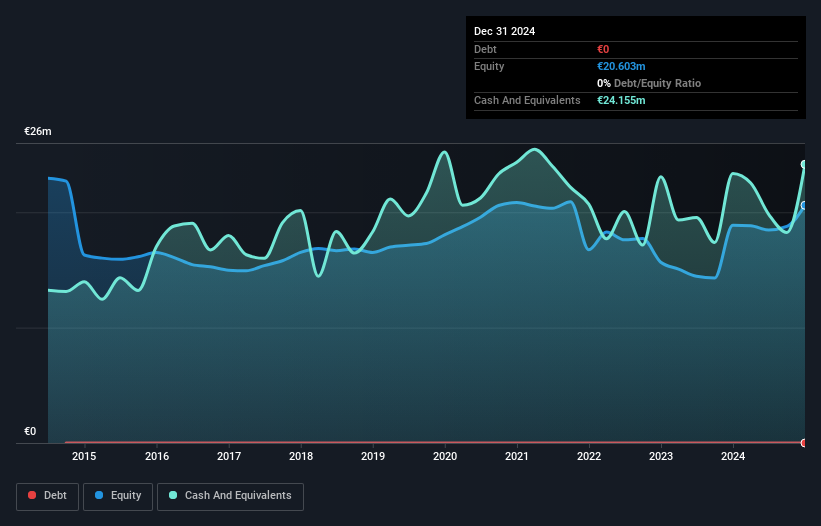

Ad pepper media International, with a market cap of €68.49 million, recently reported improved financials for 2024, achieving profitability with a net income of €2.07 million compared to a prior loss. The company operates debt-free and maintains strong liquidity, as short-term assets of €41.3 million exceed both short- and long-term liabilities significantly. Trading at 42.9% below its estimated fair value suggests potential undervaluation in the penny stock space. While earnings have declined by 43.4% annually over five years, recent profitability marks a positive shift with forecasted earnings growth of 14.15% per year amidst stable volatility at 7%.

- Get an in-depth perspective on ad pepper media International's performance by reading our balance sheet health report here.

- Understand ad pepper media International's earnings outlook by examining our growth report.

Summing It All Up

- Reveal the 433 hidden gems among our European Penny Stocks screener with a single click here.

- Curious About Other Options? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALPCOT B

Alpcot Holding

Through its subsidiaries, owns and operates a digital platform for personal finance in the financial industry in Sweden.

Adequate balance sheet and overvalued.

Market Insights

Community Narratives