Novacyt S.A. (EPA:ALNOV) Stock Catapults 39% Though Its Price And Business Still Lag The Industry

Novacyt S.A. (EPA:ALNOV) shares have had a really impressive month, gaining 39% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

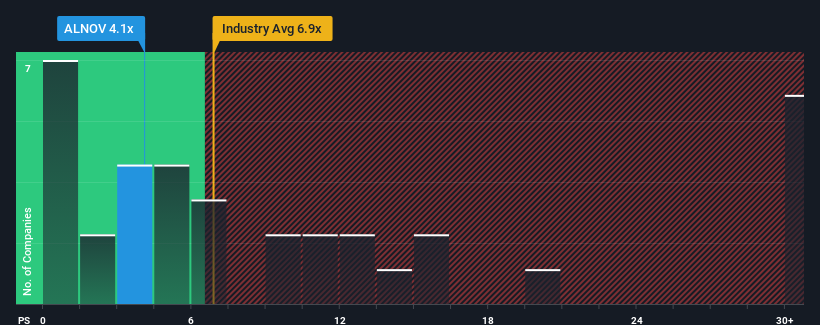

In spite of the firm bounce in price, Novacyt's price-to-sales (or "P/S") ratio of 4.1x might still make it look like a buy right now compared to the Biotechs industry in France, where around half of the companies have P/S ratios above 6.9x and even P/S above 15x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Novacyt

How Has Novacyt Performed Recently?

For example, consider that Novacyt's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Novacyt will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Novacyt, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Novacyt's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Novacyt's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 45%. The last three years don't look nice either as the company has shrunk revenue by 96% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 242% shows it's an unpleasant look.

In light of this, it's understandable that Novacyt's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Novacyt's P/S

The latest share price surge wasn't enough to lift Novacyt's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's no surprise that Novacyt maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Novacyt (at least 2 which don't sit too well with us), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Novacyt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALNOV

Novacyt

Provides in vitro and molecular diagnostic tests for a range of infectious diseases in the United Kingdom, rest of Europe, France, the United States, the Asia Pacific, the Middle East, and Africa.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives