Pinning Down IntegraGen SA's (EPA:ALINT) P/E Is Difficult Right Now

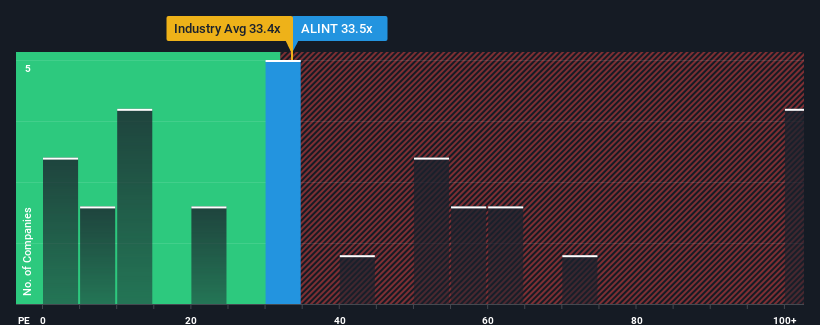

When close to half the companies in France have price-to-earnings ratios (or "P/E's") below 15x, you may consider IntegraGen SA (EPA:ALINT) as a stock to avoid entirely with its 33.5x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that IntegraGen's financial performance has been pretty ordinary lately as earnings growth is non-existent. It might be that many are expecting an improvement to the uninspiring earnings performance over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for IntegraGen

What Are Growth Metrics Telling Us About The High P/E?

IntegraGen's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

This is in contrast to the rest of the market, which is expected to grow by 9.1% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that IntegraGen is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of IntegraGen revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with IntegraGen, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on IntegraGen, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALINT

IntegraGen

Provides researchers with sequencing solutions, data management tools, and biostatistical, and bioinformatics support services in France.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives