- France

- /

- Life Sciences

- /

- ENXTPA:ALECR

Investors Aren't Entirely Convinced By Eurofins-Cerep SA's (EPA:ALECR) Revenues

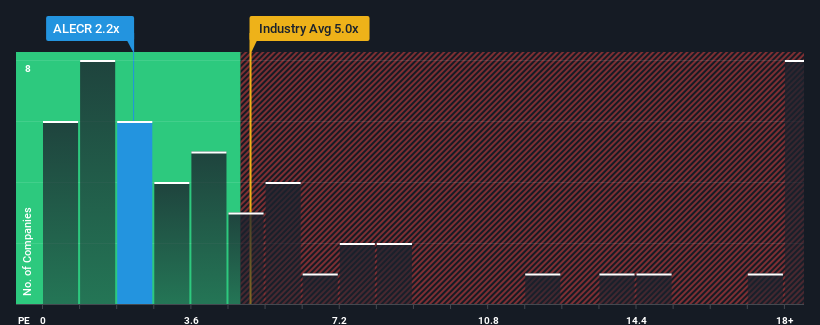

Eurofins-Cerep SA's (EPA:ALECR) price-to-sales (or "P/S") ratio of 2.2x might make it look like a strong buy right now compared to the Life Sciences industry in France, where around half of the companies have P/S ratios above 5x and even P/S above 13x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Eurofins-Cerep

How Has Eurofins-Cerep Performed Recently?

For example, consider that Eurofins-Cerep's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Eurofins-Cerep's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Eurofins-Cerep?

Eurofins-Cerep's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.5%. Even so, admirably revenue has lifted 35% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 9.5% shows it's about the same on an annualised basis.

With this information, we find it odd that Eurofins-Cerep is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Eurofins-Cerep's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Eurofins-Cerep revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Eurofins-Cerep that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Eurofins-Cerep might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALECR

Eurofins-Cerep

Provides various drug discovery services to pharmaceutical, biopharmaceutical, and biotechnology companies France and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives