Improved Revenues Required Before Cellectis S.A. (EPA:ALCLS) Stock's 32% Jump Looks Justified

Those holding Cellectis S.A. (EPA:ALCLS) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 47% in the last twelve months.

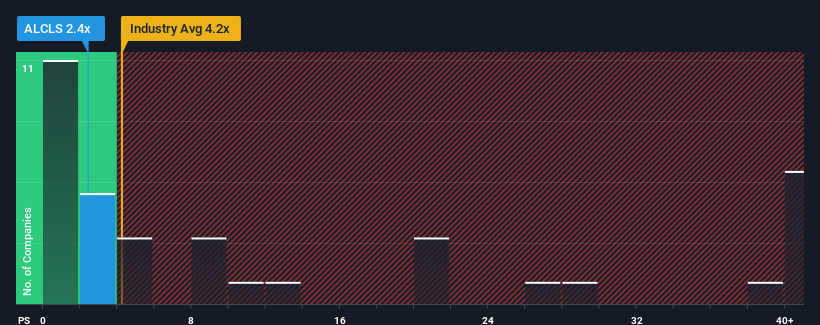

Although its price has surged higher, Cellectis may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.4x, since almost half of all companies in the Biotechs industry in France have P/S ratios greater than 4.2x and even P/S higher than 26x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

We've discovered 2 warning signs about Cellectis. View them for free.Check out our latest analysis for Cellectis

How Has Cellectis Performed Recently?

Cellectis certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Cellectis' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Cellectis would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen a 28% overall rise in revenue, aided extensively by its short-term performance. So while the recent revenue growth has been good for the company, we do note that it does tend to experience some large revenue swings, particularly over the last 12 months.

Turning to the outlook, the next three years should generate growth of 27% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 74% per year, which is noticeably more attractive.

With this information, we can see why Cellectis is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Cellectis' P/S Mean For Investors?

The latest share price surge wasn't enough to lift Cellectis' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Cellectis' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Cellectis is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALCLS

Cellectis

A clinical stage biotechnological company, develops products based on gene-editing with a portfolio of allogeneic chimeric antigen receptor T-cells product candidates in the field of immuno-oncology and gene therapy product candidates in other therapeutic indications.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives