This article will reflect on the compensation paid to Alain Moussy who has served as CEO of AB Science S.A. (EPA:AB) since 2001. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for AB Science.

Check out our latest analysis for AB Science

Comparing AB Science S.A.'s CEO Compensation With the industry

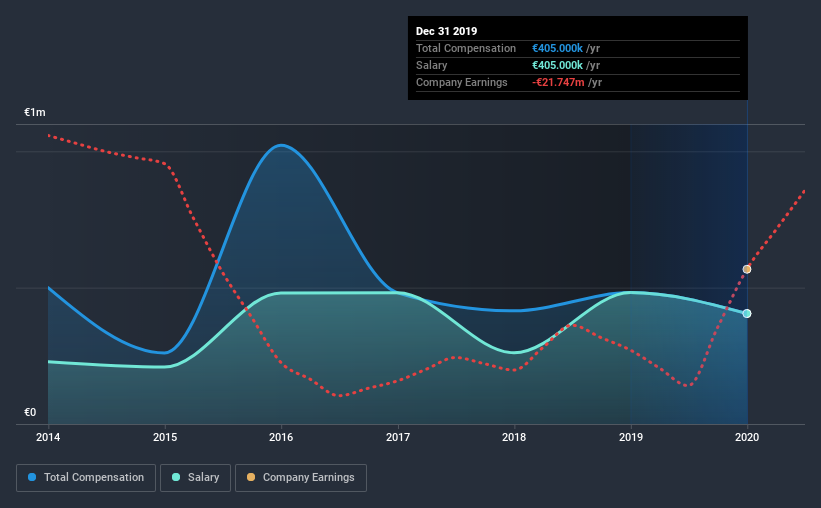

Our data indicates that AB Science S.A. has a market capitalization of €422m, and total annual CEO compensation was reported as €405k for the year to December 2019. We note that's a decrease of 16% compared to last year. Notably, the salary of €405k is the entirety of the CEO compensation.

On comparing similar companies from the same industry with market caps ranging from €169m to €674m, we found that the median CEO total compensation was €409k. So it looks like AB Science compensates Alain Moussy in line with the median for the industry. Furthermore, Alain Moussy directly owns €12m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | €405k | €482k | 100% |

| Other | - | - | - |

| Total Compensation | €405k | €482k | 100% |

On an industry level, roughly 52% of total compensation represents salary and 48% is other remuneration. On a company level, AB Science prefers to reward its CEO through a salary, opting not to pay Alain Moussy through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at AB Science S.A.'s Growth Numbers

AB Science S.A.'s earnings per share (EPS) grew 13% per year over the last three years. It saw its revenue drop 2.0% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has AB Science S.A. Been A Good Investment?

With a total shareholder return of 3.7% over three years, AB Science S.A. has done okay by shareholders. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

AB Science pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As we noted earlier, AB Science pays its CEO in line with similar-sized companies belonging to the same industry. However, it's admirable that over the last three years, EPS growth for the company has been impressive, though the same can't be said for investor returns. Considering overall performance, we'd say the compensation is fair, although stockholders will want to see higher returns moving forward.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for AB Science you should be aware of, and 1 of them is significant.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade AB Science, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:AB

AB Science

A clinical-stage company, designs and develops novel drugs to various diseases with high unmet medical needs for inflammatory diseases, pathologies affecting peripheral and central nervous system, and cancers in France.

Medium-low with concerning outlook.

Market Insights

Community Narratives