- France

- /

- Entertainment

- /

- ENXTPA:VIV

Esker And 2 High Growth Tech Stocks To Watch In France

Reviewed by Simply Wall St

The French market has recently seen cautious optimism, with the CAC 40 Index adding 0.47% amid broader European gains following the U.S. Federal Reserve's interest rate cut. As investors navigate these evolving conditions, focusing on high-growth tech stocks like Esker and others in France can be a strategic move given their potential for innovation and expansion in a supportive economic environment.

Top 10 High Growth Tech Companies In France

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Icape Holding | 14.08% | 28.13% | ★★★★★☆ |

| Cogelec | 11.33% | 23.96% | ★★★★★☆ |

| Valneva | 28.00% | 25.49% | ★★★★★☆ |

| Munic | 26.68% | 149.10% | ★★★★★☆ |

| VusionGroup | 28.35% | 82.32% | ★★★★★★ |

| Oncodesign Société Anonyme | 14.68% | 101.18% | ★★★★★☆ |

| Adocia | 70.20% | 63.97% | ★★★★★☆ |

| beaconsmind | 28.59% | 133.36% | ★★★★★★ |

| Pherecydes Pharma Société anonyme | 63.30% | 78.85% | ★★★★★☆ |

| OSE Immunotherapeutics | 30.02% | 5.91% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Esker (ENXTPA:ALESK)

Simply Wall St Growth Rating: ★★★★☆☆

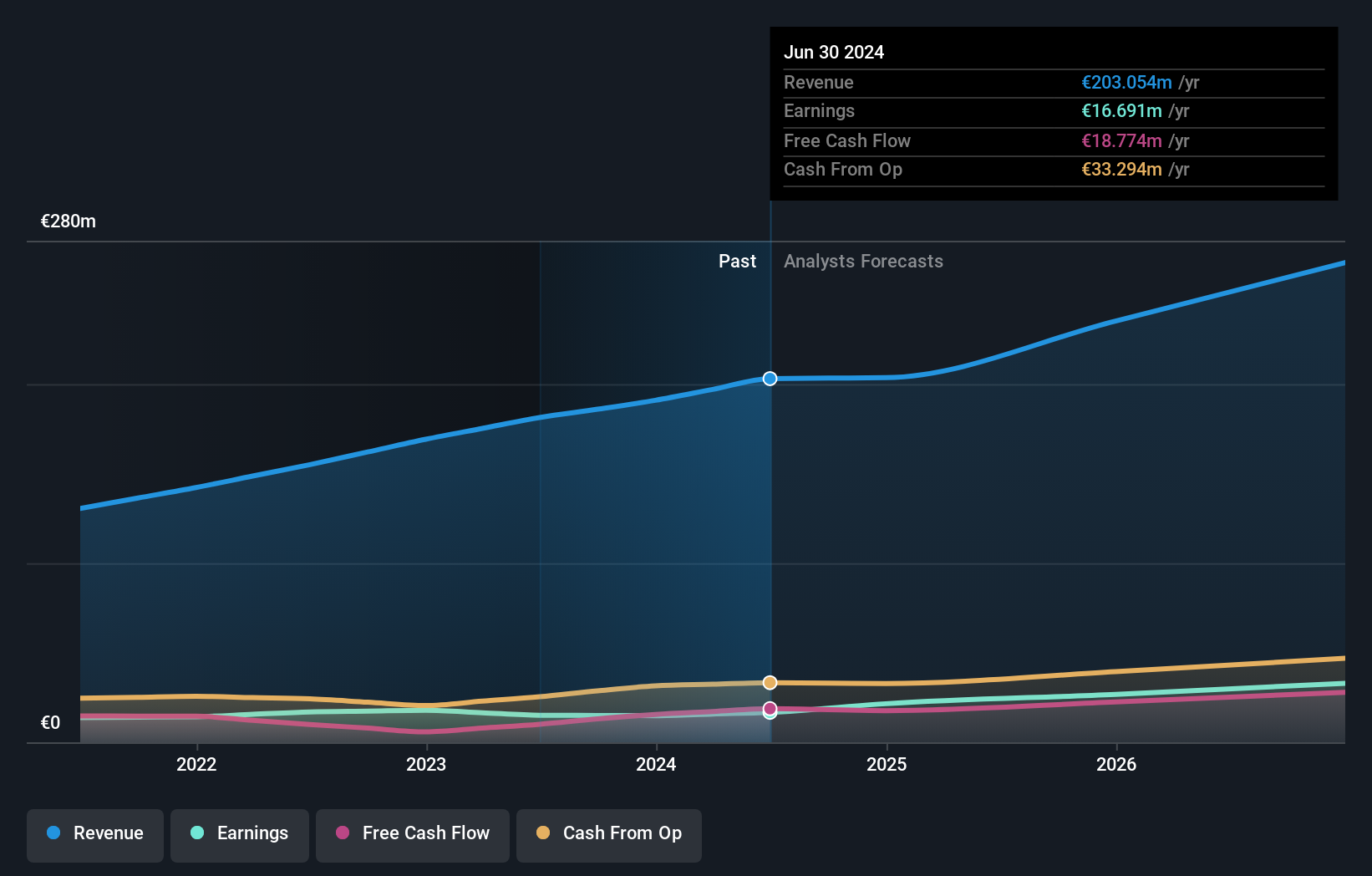

Overview: Esker SA operates a cloud platform for finance and customer service professionals in France and internationally, with a market cap of €1.59 billion.

Operations: Esker SA generates revenue primarily through its Software & Programming segment, which brought in €202.22 million. The company's operations focus on providing cloud-based solutions for finance and customer service sectors across various regions.

Esker, a French software company, is navigating a transformative phase with its anticipated acquisition by General Atlantic and Bridgepoint Group for €1.58 billion, reflecting a robust valuation of €262 per share. This strategic move is underscored by Esker's solid financial performance, with revenue and earnings forecasted to grow annually at 12.4% and 27.1%, respectively—outpacing the broader French market significantly. The firm's commitment to innovation is evident in its R&D spending trends, which have consistently aligned with these growth metrics, ensuring Esker remains at the forefront of technological advancements in the software industry. Moreover, recent enhancements to its Source-to-Pay suite emphasize sustainability—a critical component that not only aligns with global ESG standards but also positions Esker favorably among eco-conscious clients and investors looking toward long-term viability and compliance in tech landscapes.

Bolloré (ENXTPA:BOL)

Simply Wall St Growth Rating: ★★★★☆☆

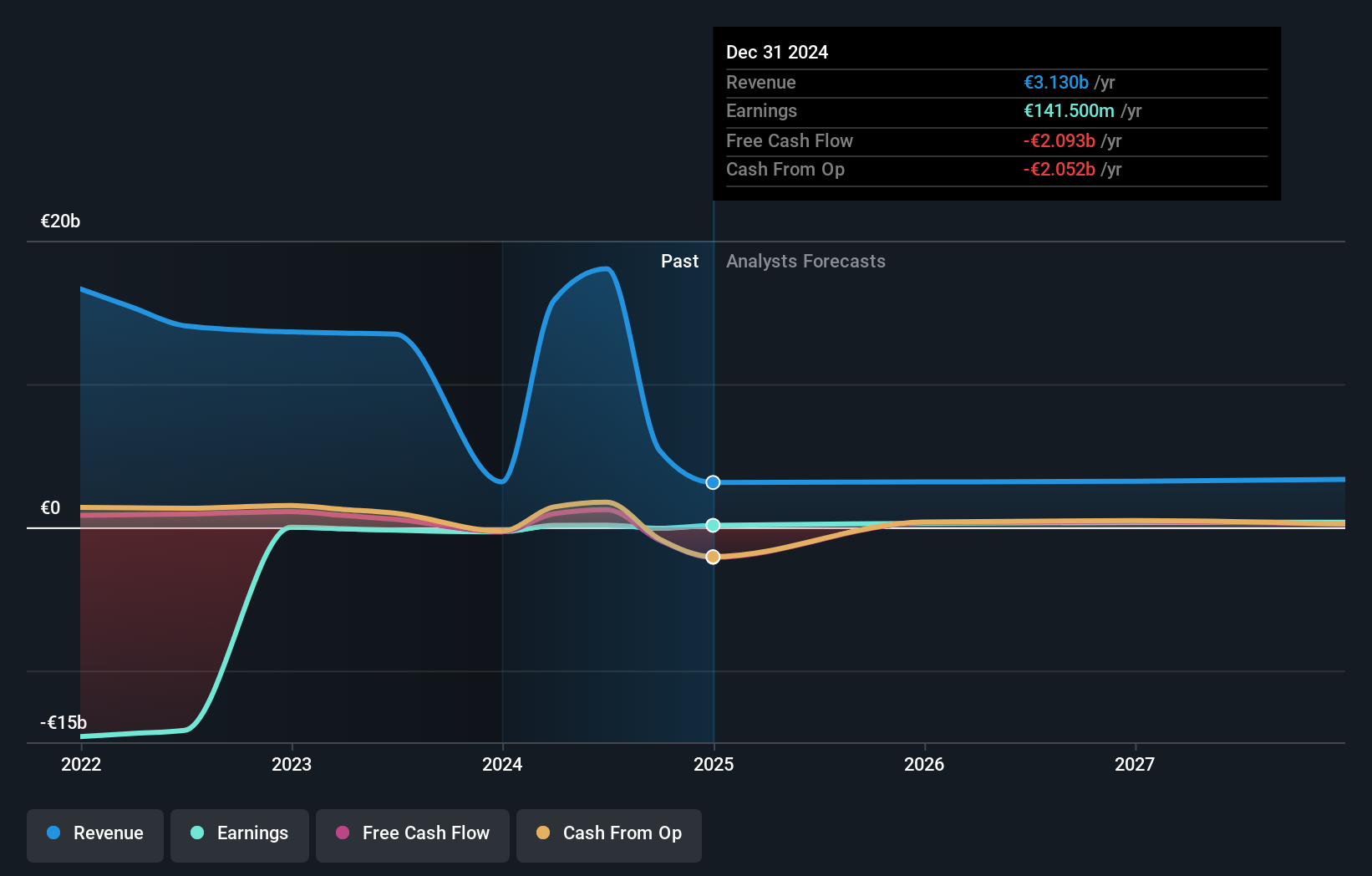

Overview: Bolloré SE operates in transportation and logistics, communications, and industry sectors across multiple continents including Europe, the Americas, Asia, Oceania, and Africa with a market cap of €17.15 billion.

Operations: Bolloré SE generates revenue primarily from its communications segment (€14.86 billion), followed by Bollore Energy (€2.75 billion) and industry (€353 million). The company operates across multiple continents including Europe, the Americas, Asia, Oceania, and Africa.

Bolloré SE has demonstrated a notable turnaround, becoming profitable this year with its earnings expected to surge by 32.7% annually, significantly outpacing the French market's average of 12.2%. This growth is underpinned by a strategic focus on high-margin segments, as evidenced in their latest half-year financials where sales jumped to €10.59 billion from €6.23 billion year-over-year. Despite slower revenue growth projections at 8.3% annually—still above the market average of 5.7%—the company's robust profit trajectory and recent decisions to maintain dividend payouts reflect a stable financial policy amidst its expansion efforts.

- Dive into the specifics of Bolloré here with our thorough health report.

Gain insights into Bolloré's historical performance by reviewing our past performance report.

Vivendi (ENXTPA:VIV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivendi SE is a global entertainment, media, and communication company with operations spanning France, Europe, the Americas, Asia/Oceania, and Africa; it has a market cap of approximately €10.45 billion.

Operations: Vivendi SE generates revenue primarily from its Canal+ Group (€6.20 billion), Havas Group (€2.92 billion), and Gameloft (€304 million) segments, among others. The company operates across multiple regions, including France, Europe, the Americas, Asia/Oceania, and Africa.

Vivendi SE, amid a strategic reshaping, reported a robust half-year with sales doubling to €9.05 billion from €4.7 billion, reflecting its dynamic market adaptation. Despite a slight dip in net income to €159 million from €174 million, the company's earnings growth projection stands at an impressive 30.6% annually, outstripping the French market's average of 12.2%. Additionally, Vivendi has actively returned value to shareholders through the repurchase of 15.42 million shares for €155 million earlier this year. This financial agility coupled with plans for Canal+’s potential listing underscores its proactive stance in optimizing business structure and enhancing shareholder value.

- Get an in-depth perspective on Vivendi's performance by reading our health report here.

Explore historical data to track Vivendi's performance over time in our Past section.

Turning Ideas Into Actions

- Delve into our full catalog of 43 Euronext Paris High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIV

Vivendi

Operates as an entertainment, media, and communication company in France, the rest of Europe, the Americas, Asia/Oceania, and Africa.

Undervalued with excellent balance sheet and pays a dividend.