- France

- /

- Hospitality

- /

- ENXTPA:SW

3 Top Dividend Stocks On Euronext Paris To Consider

Reviewed by Simply Wall St

As the European Central Bank's recent rate cuts have buoyed major stock indexes, including France’s CAC 40, investors are increasingly looking towards dividend stocks for stable returns amid evolving economic conditions. In this environment, a strong dividend stock is often characterized by a consistent payout history and the ability to maintain profitability despite market fluctuations.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.73% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.96% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.00% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.20% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.64% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.33% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.73% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.86% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.94% | ★★★★★☆ |

| Infotel (ENXTPA:INF) | 4.71% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Samse (ENXTPA:SAMS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samse SA is a French company that distributes building materials and tools, with a market cap of €541.54 million.

Operations: Samse SA's revenue is primarily derived from its Trading segment, which contributes €1.69 billion, and its Do-It-Yourself segment, which adds €429.36 million.

Dividend Yield: 6.3%

Samse SA's dividend is notable for its high yield, ranking in the top 25% of French dividend payers. Despite a volatile and unreliable track record over the past decade, dividends are well-covered by both earnings and cash flows, with a payout ratio of 79.7% and a cash payout ratio of 28%. However, recent financial results show declining sales and net income, raising concerns about future earnings sustainability amidst forecasts of further earnings decline.

- Navigate through the intricacies of Samse with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Samse is trading behind its estimated value.

Sodexo (ENXTPA:SW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sodexo S.A. is a global provider of food services and facilities management, with a market cap of €11.01 billion.

Operations: Sodexo S.A.'s revenue is derived from three main segments: Europe (€8.30 billion), North America (€10.74 billion), and the Rest of the World (€4.12 billion).

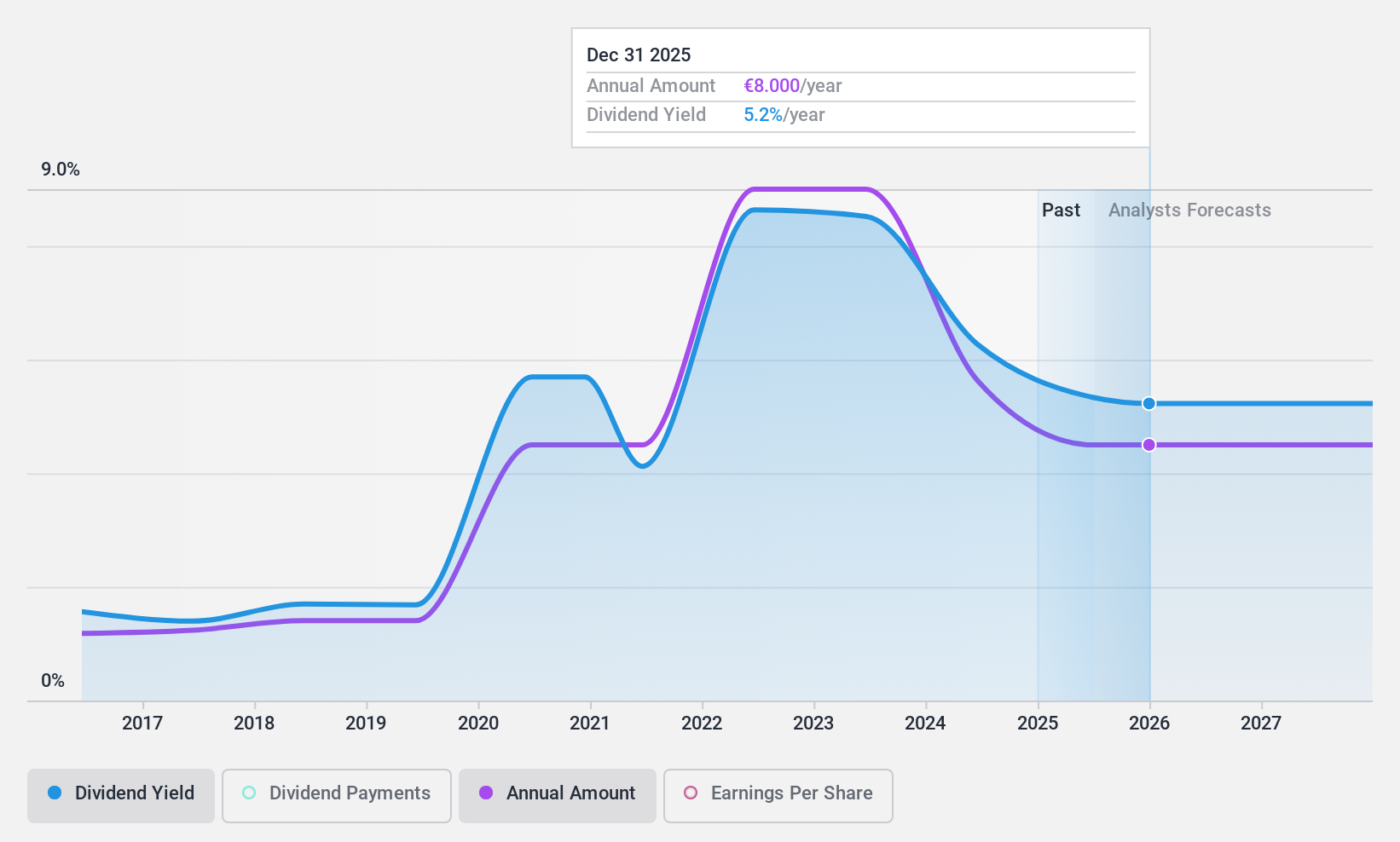

Dividend Yield: 4.1%

Sodexo's dividend yield is relatively low compared to the top French dividend payers, but its payments are well-covered by earnings and cash flows, with payout ratios of 63.2% and 44%, respectively. Despite a history of volatility in dividends, recent announcements include a special interim dividend of €6.24 per share. The company's financial position shows high debt levels, yet it has secured an expanded credit facility to support liquidity needs amidst ongoing acquisition discussions with Aramark.

- Click here and access our complete dividend analysis report to understand the dynamics of Sodexo.

- Our expertly prepared valuation report Sodexo implies its share price may be lower than expected.

TF1 (ENXTPA:TFI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TF1 SA operates in broadcasting, studios and entertainment, and digital businesses both in France and internationally, with a market cap of €1.68 billion.

Operations: TF1 SA generates revenue through its Newen Studios segment (€377.40 million) and Media (Including Digital) segment (€2.06 billion).

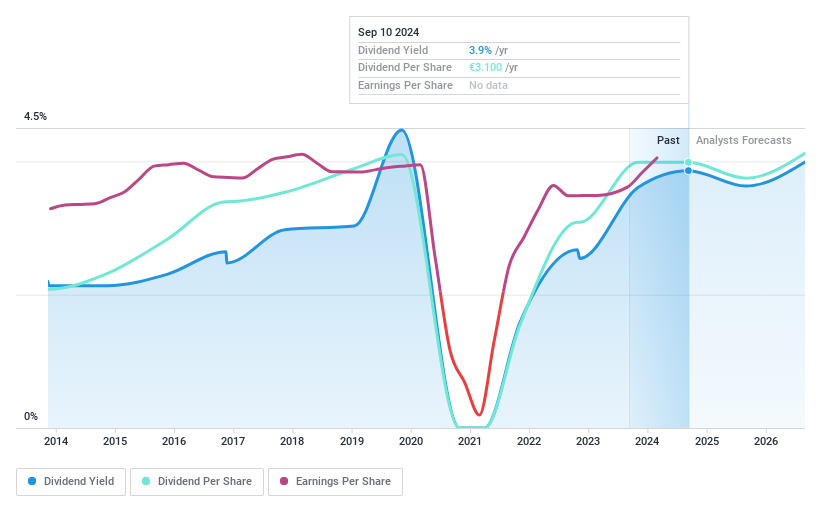

Dividend Yield: 6.9%

TF1's dividend yield ranks in the top 25% of French dividend payers, yet its payments have been volatile over the past decade, lacking growth. Despite this instability, dividends are well-covered by earnings and cash flows with payout ratios of 62.2% and 53.3%, respectively. Recent earnings reports show increased sales but a decline in net income, which may affect future payouts if trends continue. The stock trades significantly below estimated fair value, suggesting potential for capital appreciation.

- Get an in-depth perspective on TF1's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that TF1 is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Navigate through the entire inventory of 32 Top Euronext Paris Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SW

Sodexo

Provides food services and facilities management services worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives