- France

- /

- Consumer Durables

- /

- ENXTPA:KOF

3 European Dividend Stocks Yielding Up To 9.8%

Reviewed by Simply Wall St

Amid concerns about global growth following weak U.S. jobs data and a stronger euro, the pan-European STOXX Europe 600 Index ended slightly lower, reflecting mixed performances across major stock indexes in the region. In this uncertain environment, dividend stocks can offer investors a degree of stability and income potential; selecting those with robust fundamentals and attractive yields is key to navigating the current market landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.21% | ★★★★★☆ |

| Swiss Re (SWX:SREN) | 4.14% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 6.97% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.62% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.97% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.23% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.63% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.75% | ★★★★★☆ |

| Afry (OM:AFRY) | 3.92% | ★★★★★☆ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

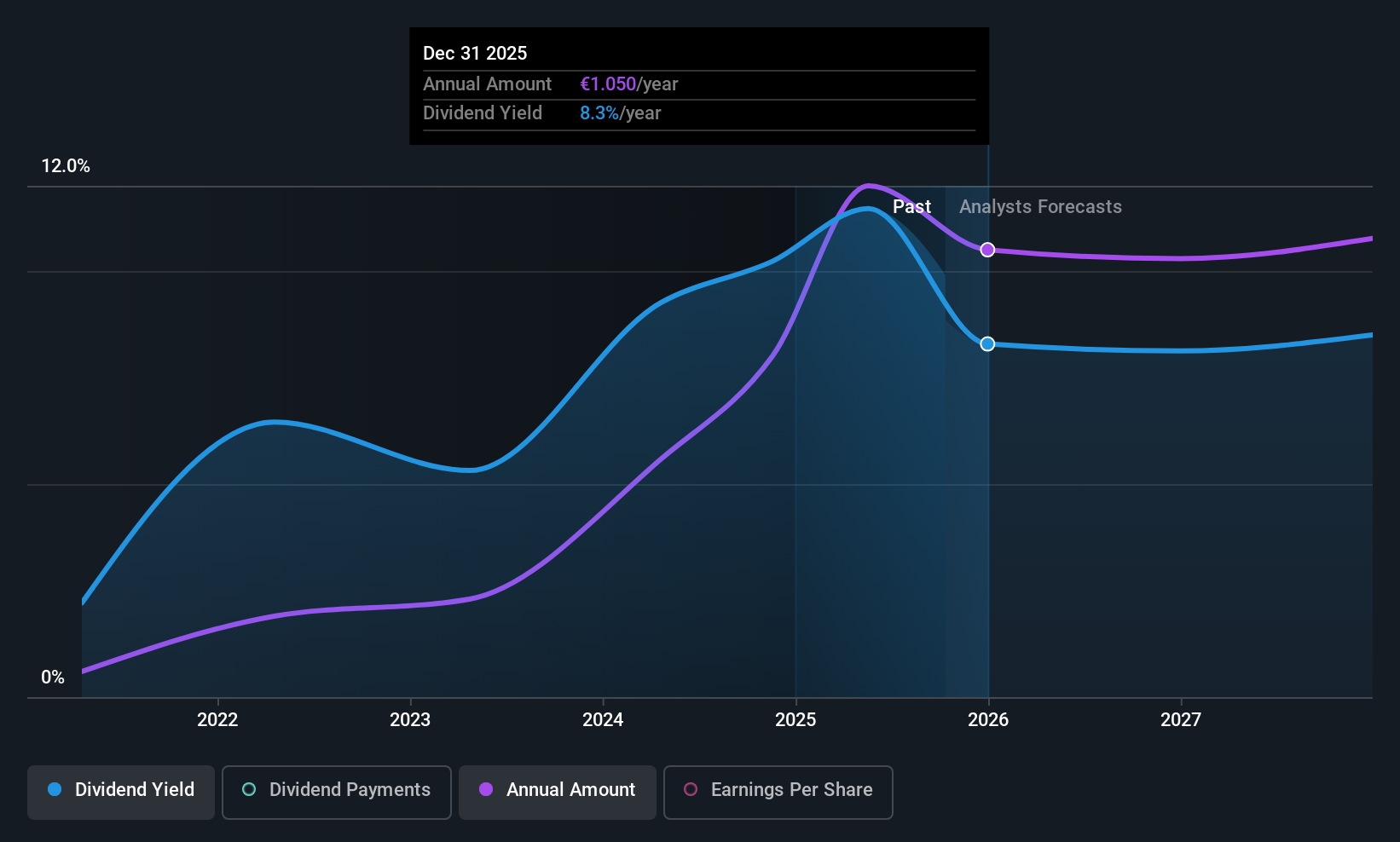

Banco BPM (BIT:BAMI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco BPM S.p.A. is an Italian bank offering a range of banking and financial services to individual, business, and corporate clients, with a market cap of €18.33 billion.

Operations: Banco BPM S.p.A.'s revenue segments include Commercial Management (€3.88 billion), Corporate and Investment Banking (€876.78 million), Finance (€168.84 million), Insurance (€147.19 million), Corporate Center (€151.91 million), and Strategic Partnerships (€126.62 million).

Dividend Yield: 9.8%

Banco BPM is enhancing its appeal to dividend investors with a proposed 17% increase in its 2025 dividend, totaling €700 million. Despite having only five years of dividend history, the payout is well-covered by earnings at a 37.9% ratio. Recent earnings growth of 71.9% supports this sustainability, although the bank faces challenges with high non-performing loans at 2.6%. Banco BPM's strategic debt management and potential M&A activities could influence future dividends and stability.

- Dive into the specifics of Banco BPM here with our thorough dividend report.

- Upon reviewing our latest valuation report, Banco BPM's share price might be too pessimistic.

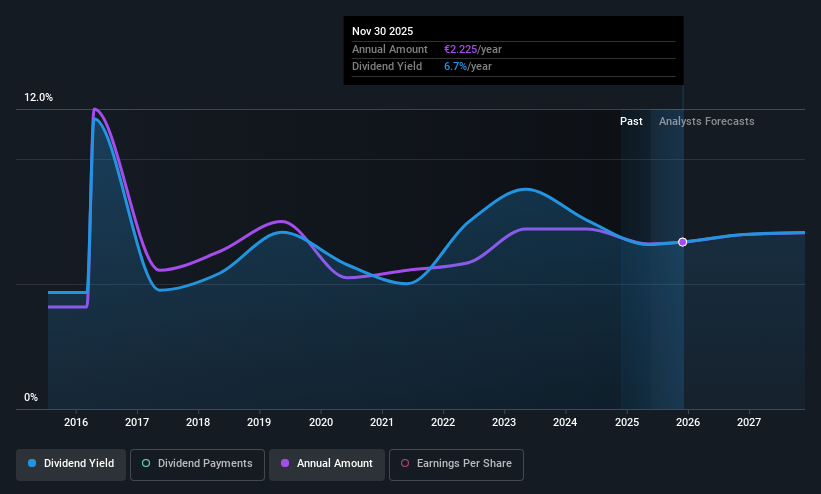

Kaufman & Broad (ENXTPA:KOF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kaufman & Broad S.A. is a property developer and builder operating in France with a market cap of €555.02 million.

Operations: Kaufman & Broad S.A.'s revenue is primarily derived from its operations in East (€281.43 million), West (€251.58 million), Ile-De-France (€354.83 million), and Commercial Real Estate and Logistics (€189.39 million) sectors in France.

Dividend Yield: 7.8%

Kaufman & Broad offers a compelling dividend yield of 7.77%, placing it among the top 25% in France, yet its dividends have been volatile over the past decade. Despite recent earnings growth and a favorable price-to-earnings ratio of 11.8x, concerns arise from its high payout ratio of 91.2%, indicating dividends aren't well covered by earnings. The company's reaffirmed guidance for stable sales growth and EBIT margins suggests potential for future stability in dividend payments.

- Take a closer look at Kaufman & Broad's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Kaufman & Broad is priced lower than what may be justified by its financials.

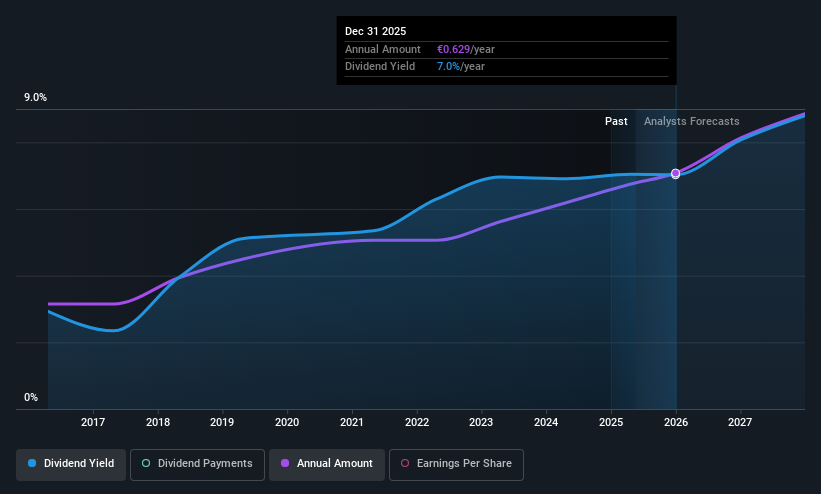

TF1 (ENXTPA:TFI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TF1 SA operates in broadcasting, studios and entertainment, and digital sectors both in France and internationally, with a market cap of €1.87 billion.

Operations: TF1 SA generates its revenue primarily from Media, including Digital, amounting to €2.01 billion, and Studios TF1 contributing €414.80 million.

Dividend Yield: 6.8%

TF1's dividend yield of 6.76% ranks in the top 25% of French payers, although its dividends have been volatile over the past decade. Despite a slight earnings growth and trading at a significant discount to fair value, concerns persist due to its unstable dividend history. However, with payout ratios showing coverage by both earnings (67.4%) and cash flows (64.3%), TF1's dividends are currently sustainable, supported by strategic partnerships like the Netflix content deal in France starting Summer 2026.

- Delve into the full analysis dividend report here for a deeper understanding of TF1.

- Insights from our recent valuation report point to the potential undervaluation of TF1 shares in the market.

Next Steps

- Investigate our full lineup of 223 Top European Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaufman & Broad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:KOF

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.