As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are increasingly seeking stability amidst the volatility. With U.S. job growth cooling and manufacturing showing signs of recovery, dividend stocks offer a compelling option for those looking to balance income with potential capital appreciation in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.04% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

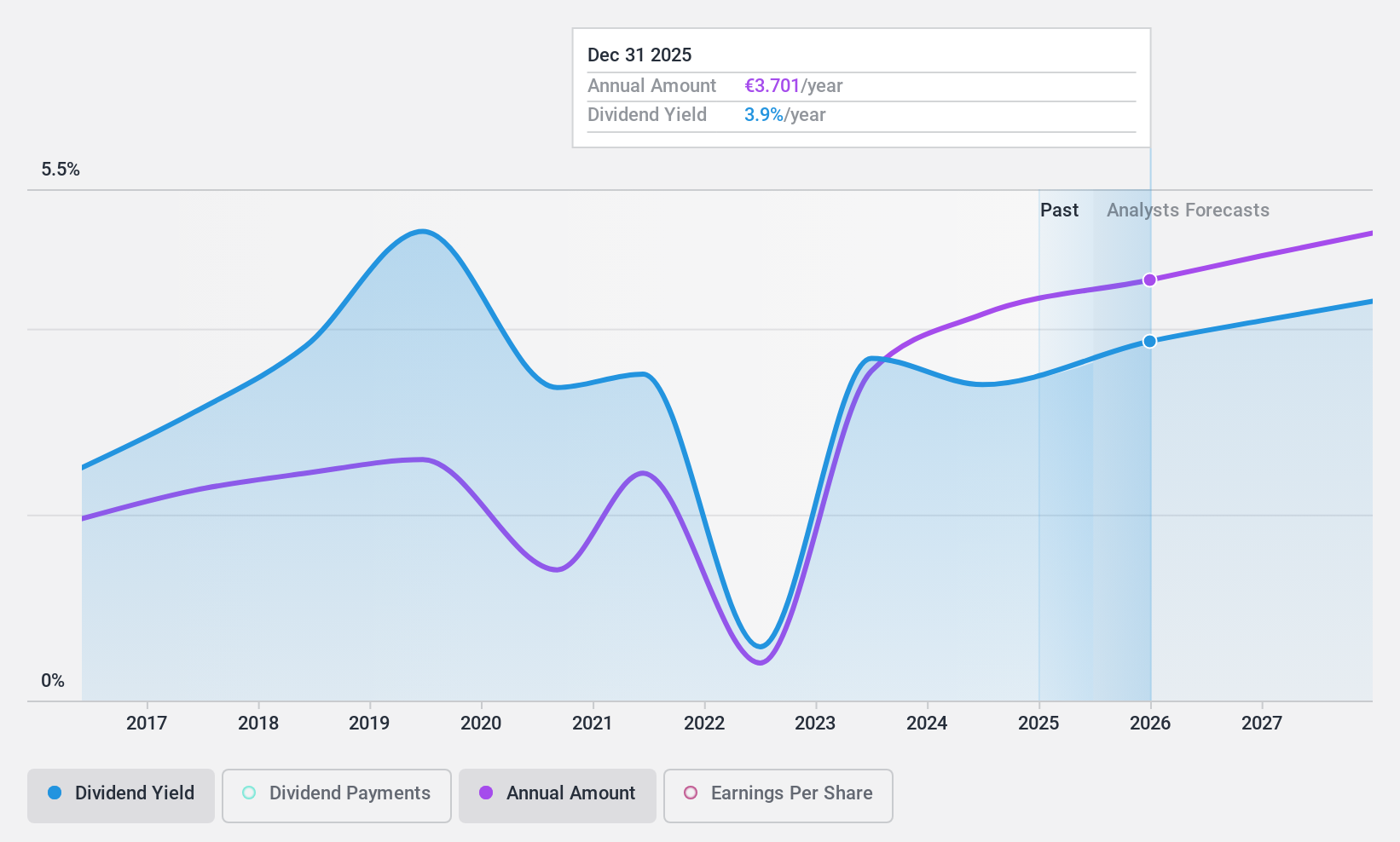

Publicis Groupe (ENXTPA:PUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. offers marketing, communications, and digital business transformation services across various regions including North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East with a market cap of approximately €26.57 billion.

Operations: Publicis Groupe S.A.'s revenue from Advertising and Communication Services amounts to €16.03 billion.

Dividend Yield: 3.4%

Publicis Groupe offers a mixed dividend profile. While its dividend payments have been volatile over the past decade, recent increases show promise, with a proposed €3.60 per share for 2024, marking an 80% rise since 2020. The payout ratio of 49.3% suggests dividends are well-covered by earnings and cash flows. Despite trading below estimated fair value and stable earnings growth, the dividend yield remains lower than top-tier French market payers.

- Click to explore a detailed breakdown of our findings in Publicis Groupe's dividend report.

- The analysis detailed in our Publicis Groupe valuation report hints at an deflated share price compared to its estimated value.

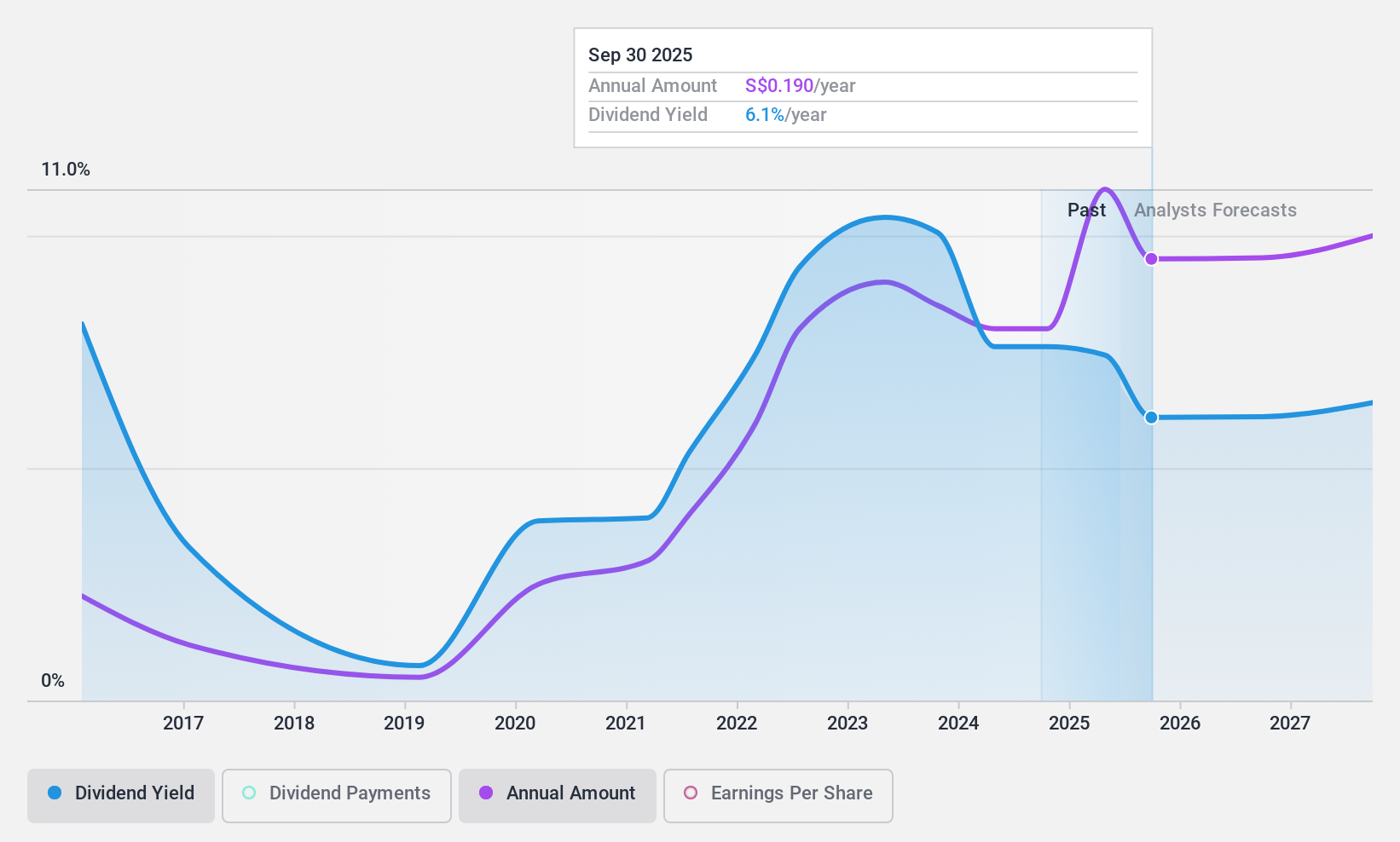

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited, with a market cap of SGD801.10 million, specializes in the prefabrication of steel reinforcement for concrete applications across Singapore and various international markets including Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, and India.

Operations: BRC Asia Limited generates its revenue from two main segments: Trading, which accounts for SGD217.69 million, and Fabrication and Manufacturing, contributing SGD1.26 billion.

Dividend Yield: 7.5%

BRC Asia's dividend profile is marked by a strong yield of 7.53%, placing it among the top 25% in Singapore. Despite its volatile dividend history, recent increases, including a proposed final and special dividend totaling 14 Singapore cents per share for FY2024, indicate growth potential. The dividends are well-covered by earnings (41.1% payout ratio) and cash flows (29.8% payout ratio), though future earnings are forecast to decline slightly over the next three years.

- Navigate through the intricacies of BRC Asia with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of BRC Asia shares in the market.

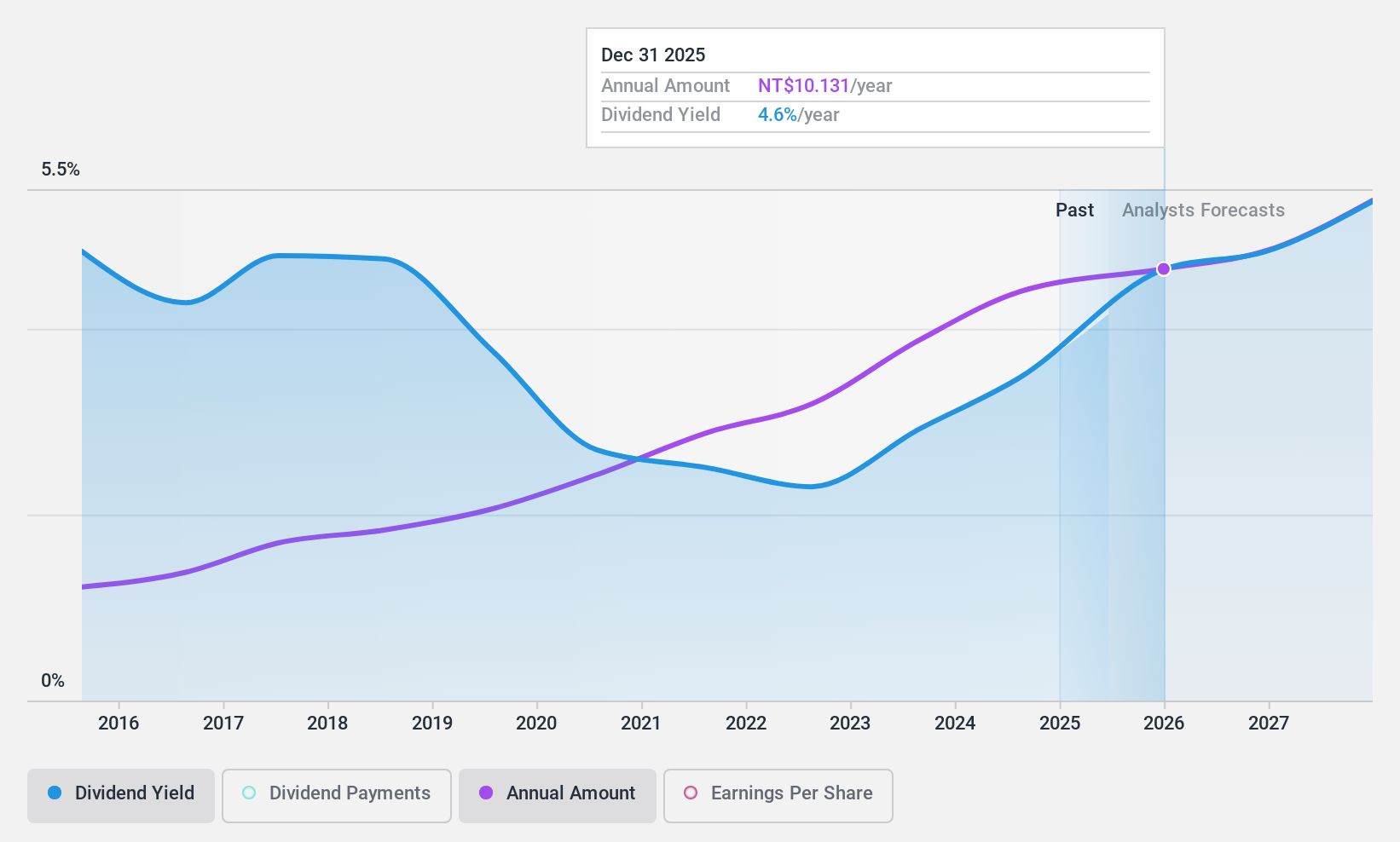

SINBON Electronics (TWSE:3023)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SINBON Electronics Co., Ltd. manufactures and sells computer peripherals, connectors, wires, and other parts across Mainland China, Hong Kong, the United States, Taiwan, and internationally with a market cap of NT$64.34 billion.

Operations: SINBON Electronics Co., Ltd. generates revenue from various segments, including Healthcare (NT$2.92 billion), Green Energy (NT$9.99 billion), Communication (NT$7.57 billion), Industrial Applications (NT$10.25 billion), and Automotive and Aerospace (NT$5.21 billion).

Dividend Yield: 3.6%

SINBON Electronics offers a stable dividend history with consistent growth over the past decade, supported by a reasonable payout ratio of 67.8%. However, its current dividend yield of 3.58% is lower than the top quartile in Taiwan's market and not well covered by free cash flow due to a high cash payout ratio of 104.4%. Despite this, SINBON's earnings have grown significantly at 14.9% annually over five years, suggesting potential for future improvement in coverage.

- Click here to discover the nuances of SINBON Electronics with our detailed analytical dividend report.

- Our valuation report unveils the possibility SINBON Electronics' shares may be trading at a premium.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1959 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PUB

Publicis Groupe

Provides marketing, communications, and digital business transformation services in North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives