- France

- /

- Trade Distributors

- /

- ENXTPA:RXL

Top Dividend Stocks On Euronext Paris For October 2024

Reviewed by Simply Wall St

As the French stock market faces a downturn, with the CAC 40 Index dropping 1.52% amid expectations of slower monetary policy easing by the Federal Reserve, investors are increasingly looking towards stable income sources such as dividend stocks. In these uncertain times, a good dividend stock is often characterized by its ability to provide consistent payouts and maintain financial health despite broader economic challenges.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.83% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.90% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.04% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.33% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.62% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.64% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.65% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.89% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 8.06% | ★★★★★☆ |

| Eiffage (ENXTPA:FGR) | 4.80% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Groupe Guillin (ENXTPA:ALGIL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Groupe Guillin S.A. is a company that produces and sells food packaging products both in France and internationally, with a market capitalization of €525.02 million.

Operations: Groupe Guillin S.A. generates its revenue through the production and sale of food packaging products, serving both domestic and international markets.

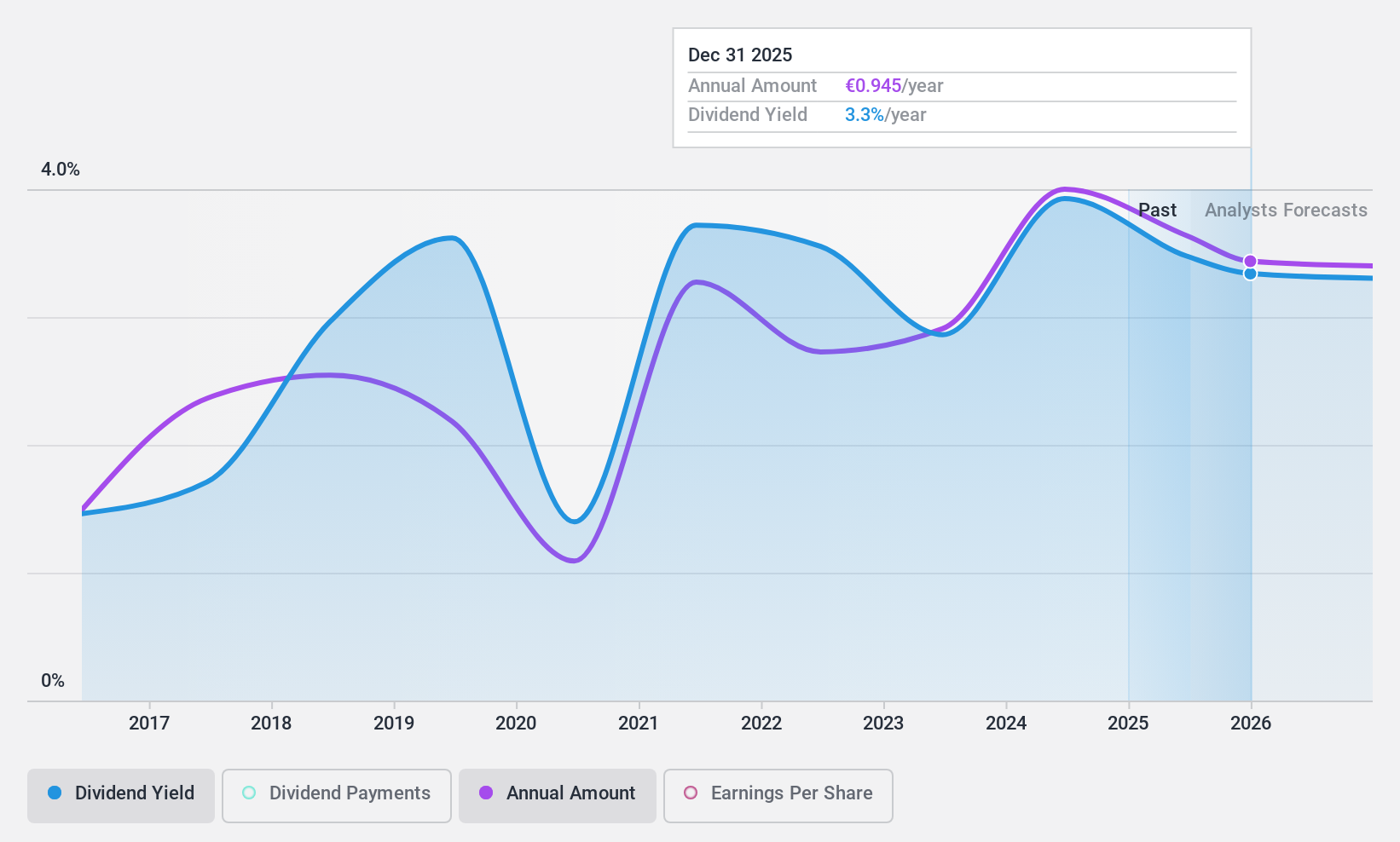

Dividend Yield: 3.9%

Groupe Guillin's recent earnings report shows a decline in both sales and net income compared to the previous year, with sales at €430.27 million and net income at €31.91 million. Despite this, its dividends are well-covered by both earnings and cash flows, with payout ratios of 29.2% and 30.3%, respectively. However, the dividend history is volatile over the past decade despite some growth, making it less reliable for consistent income seekers in France's dividend market.

- Unlock comprehensive insights into our analysis of Groupe Guillin stock in this dividend report.

- According our valuation report, there's an indication that Groupe Guillin's share price might be on the cheaper side.

Publicis Groupe (ENXTPA:PUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. is a global company offering marketing, communications, and digital business transformation services across various regions including North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East with a market cap of €24.94 billion.

Operations: Publicis Groupe S.A. generates its revenue primarily from Advertising and Communication Services, amounting to €15.35 billion.

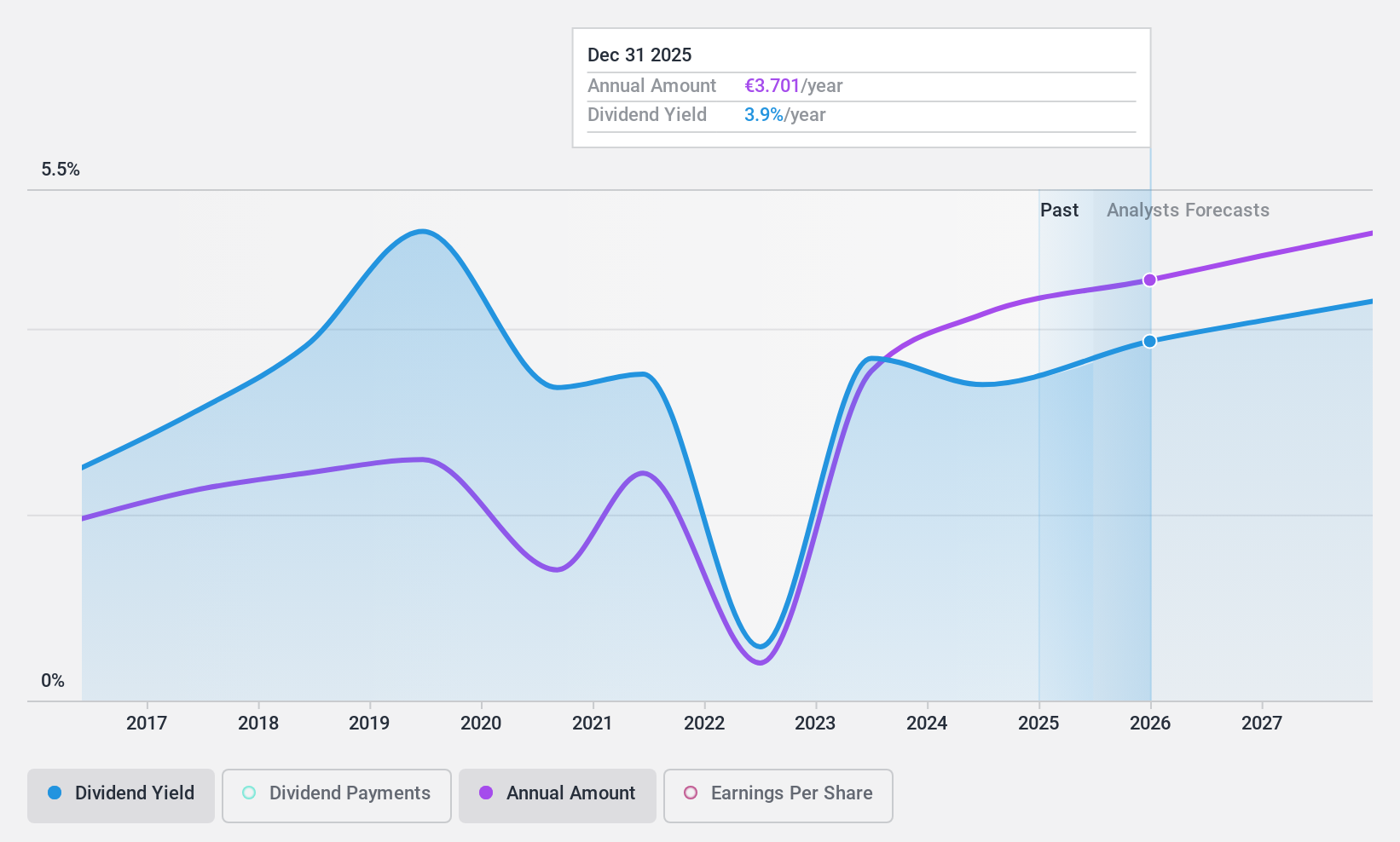

Dividend Yield: 3.4%

Publicis Groupe's dividend payments have been volatile over the past decade, though they have shown growth. The current dividend yield of 3.42% is below the top tier in France, but dividends are covered by earnings and cash flows with payout ratios of 54.7% and 64.2%, respectively. Recent upgrades in earnings guidance and strategic acquisitions signal potential for future growth, although past dividend reliability remains a concern for income-focused investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Publicis Groupe.

- Upon reviewing our latest valuation report, Publicis Groupe's share price might be too pessimistic.

Rexel (ENXTPA:RXL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rexel S.A. is a company that, along with its subsidiaries, distributes low and ultra-low voltage electrical products and services to residential, commercial, and industrial markets across France, Europe, North America, and Asia-Pacific; it has a market cap of €7.69 billion.

Operations: Rexel S.A.'s revenue primarily comes from its wholesale electronics segment, which generated €19.02 billion.

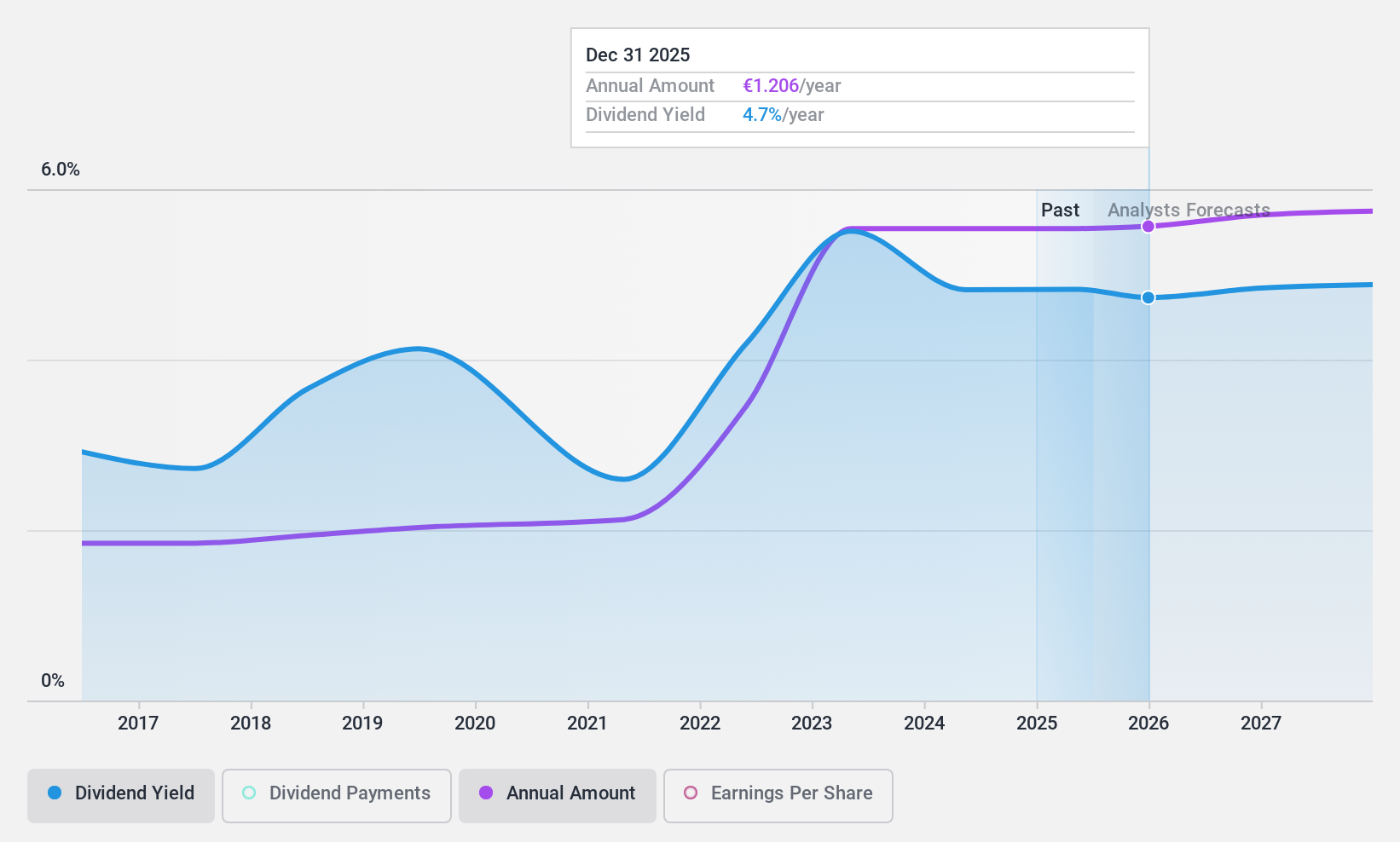

Dividend Yield: 4.7%

Rexel's dividend payments have been inconsistent over the last decade, showing volatility despite some growth. The current yield of 4.65% falls short of the top French dividend payers, yet dividends are supported by earnings and cash flows with payout ratios of 51.6% and 39.9%, respectively. Recent financials indicate a decline in net income, while strategic M&A pursuits and share buybacks suggest a focus on long-term growth amidst a competitive market landscape.

- Navigate through the intricacies of Rexel with our comprehensive dividend report here.

- The analysis detailed in our Rexel valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Click this link to deep-dive into the 32 companies within our Top Euronext Paris Dividend Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RXL

Rexel

Engages in the distribution of low and ultra-low voltage electrical products for the residential, commercial, and industrial markets in France, rest of Europe, North America, and the Asia-Pacific.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives