Shareholders Will Probably Be Cautious Of Increasing Métropole Télévision S.A.'s (EPA:MMT) CEO Compensation At The Moment

CEO Nicolas Bellet de Tavernost Abel has done a decent job of delivering relatively good performance at Métropole Télévision S.A. (EPA:MMT) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 20 April 2021. We present our case of why we think CEO compensation looks fair.

Check out our latest analysis for Métropole Télévision

Comparing Métropole Télévision S.A.'s CEO Compensation With the industry

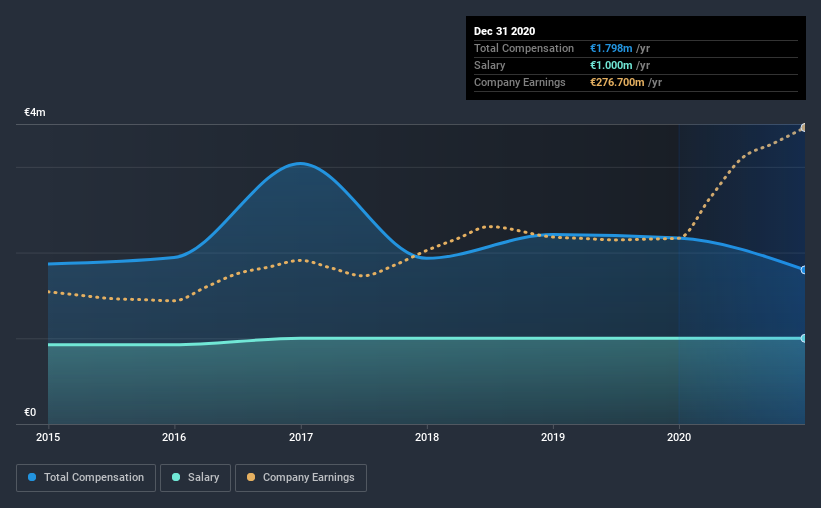

According to our data, Métropole Télévision S.A. has a market capitalization of €2.4b, and paid its CEO total annual compensation worth €1.8m over the year to December 2020. We note that's a decrease of 17% compared to last year. Notably, the salary which is €1.00m, represents a considerable chunk of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between €1.7b and €5.4b had a median total CEO compensation of €2.1m. So it looks like Métropole Télévision compensates Nicolas Bellet de Tavernost Abel in line with the median for the industry. Furthermore, Nicolas Bellet de Tavernost Abel directly owns €7.2m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €1.0m | €1.0m | 56% |

| Other | €798k | €1.2m | 44% |

| Total Compensation | €1.8m | €2.2m | 100% |

Speaking on an industry level, nearly 48% of total compensation represents salary, while the remainder of 52% is other remuneration. According to our research, Métropole Télévision has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Métropole Télévision S.A.'s Growth Numbers

Over the past three years, Métropole Télévision S.A. has seen its earnings per share (EPS) grow by 20% per year. Its revenue is down 12% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Métropole Télévision S.A. Been A Good Investment?

Métropole Télévision S.A. has generated a total shareholder return of 1.3% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 4 warning signs for Métropole Télévision (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Métropole Télévision, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading Métropole Télévision or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:MMT

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion