Eutelsat Group (EPA:ETL) Just Reported Earnings, And Analysts Cut Their Target Price

There's been a major selloff in Eutelsat Group (EPA:ETL) shares in the week since it released its half-yearly report, with the stock down 24% to €1.31. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Check out our latest analysis for Eutelsat Group

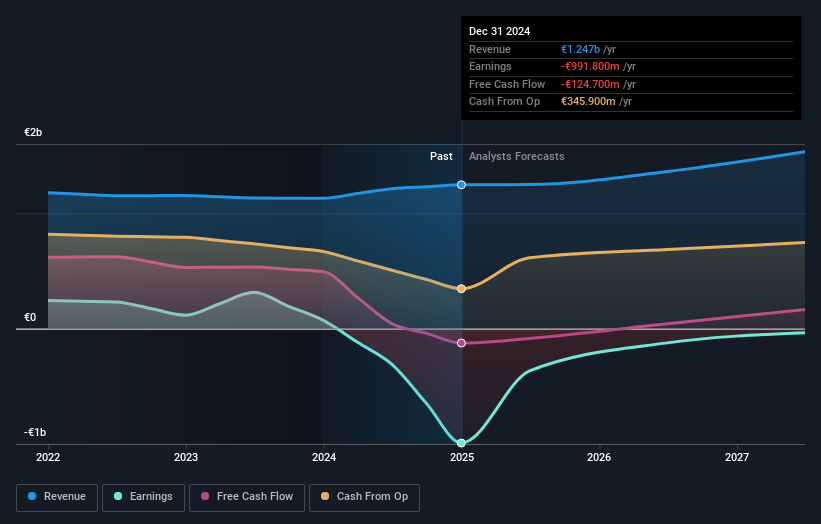

Following last week's earnings report, Eutelsat Group's nine analysts are forecasting 2025 revenues to be €1.25b, approximately in line with the last 12 months. Losses are predicted to fall substantially, shrinking 55% to €0.93. Before this latest report, the consensus had been expecting revenues of €1.27b and €0.36 per share in losses. So it's pretty clear the analysts have mixed opinions on Eutelsat Group even after this update; although they reconfirmed their revenue numbers, it came at the cost of a massive increase in per-share losses.

The consensus price target fell 20% to €2.12per share, with the analysts clearly concerned by ballooning losses. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Eutelsat Group, with the most bullish analyst valuing it at €3.60 and the most bearish at €1.00 per share. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how analysts think this business will perform. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's also worth noting that the years of declining revenue look to have come to an end, with the forecast stauing flat to the end of 2025. Historically, Eutelsat Group's top line has shrunk approximately 1.9% annually over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 2.4% annually. So it's pretty clear that, although revenues are improving, Eutelsat Group is still expected to grow slower than the industry.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Eutelsat Group's revenue is expected to perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Eutelsat Group going out to 2027, and you can see them free on our platform here..

Even so, be aware that Eutelsat Group is showing 2 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

Valuation is complex, but we're here to simplify it.

Discover if Eutelsat Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ETL

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026